Tax breaks to deadlines: Your questions answered on the French tax declaration

Spring in France is tax declaration season - from tax breaks to internet bank accounts, currency conversion to pensions, here are your questions answered.

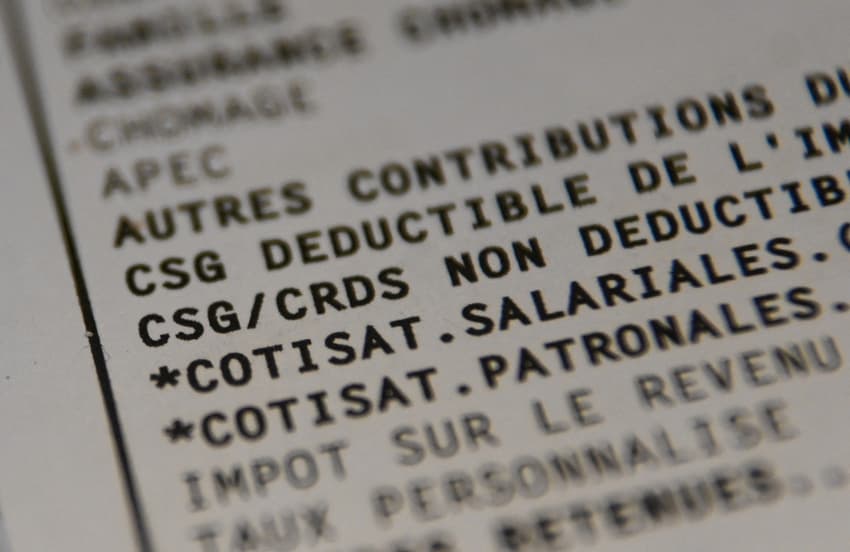

Tax season in France means long complicated forms and plenty of questions from foreigners in France, who understandably find the whole thing quite confusing.

Here we aim to answer some of the most frequently-asked questions;

Do I have to do the tax declaration?

Probably, yes. The annual déclaration des revenues (income tax declaration) has to be completed by almost everyone who lives in France, as well as by those who have income or significant financial activity here.

Even those who have no French income - ie retirees living on an overseas pension - must complete the form if they live in France. Salaried employees in France, whose income is taxed at source, must also complete the declaration.

Find the full breakdown of who has to complete the annual tax declaration HERE.

When do I have to do it?

Declarations open on April 13th and the deadline to have filed is in May or June, depending on where you live and whether you file on paper or online. Find the complete tax calendar HERE.

This year's tax declaration is for the 2023 tax year (January - December 2023), if you moved to France after January 1st 2024 you will not have to do the declaration until next year.

How do I do it?

If this is your first time declaring you will first need to request a numéro fiscal (tax number) - find instructions on how to do that HERE.

In previous years, people declaring for the first time have made their declaration on paper, before moving to online declarations the following year via the government tax site impots.gouv.fr.

This year the tax office says that first-timers can also do the declaration online (although they did also say that in 2020, when it turned out that online services didn't work for first-time declarations).

After getting your numéro fiscal you should be able to set up an account at impots.gouv.fr and then complete your declaration online. If that doesn't work, you can request a paper version of the form from your local tax office.

You can find a guide to filling in the form, and what each section means, HERE.

Do I have to do it online?

Most people do their declarations online because there are several advantages; firstly you get a later deadline and secondly the online form can 'remember' your answers from previous years, making the whole thing a bit easier.

The declaration is supposed to be an online-only process, but if you cannot file online (ie you have no internet access, or you are not confident using online services), your local tax office can continue to send you the paper version of the form.

What do I have to declare?

The short answer here is 'everything' - the French tax declaration is asking about all of your global income, including income from overseas such as a foreign pension, income from a rental property back home or any work that you do outside of France.

Depending on the tax treaty that your home country has with France you probably won't pay tax on overseas income that has already been taxed/is tax exempt in your home country, but you still have to tell the French taxman about it.

Find full details on what you need to declare HERE.

Tax breaks

For plenty of people, the tax bill after the declaration will be €0 - this will include groups such as people living on an overseas pension that is covered by a dual taxation treaty or salaried employees who have already have their income taxed at source.

And for some, tax season is a time when the government gives you money - rather than the other way around. This is because of the large numbers of tax breaks available for everything from employing a cleaner or childminder to giving to charity or contributing income to a private pension plan.

Find more information on tax breaks available HERE.

What about foreign bank accounts?

You must declare all non-French bank accounts on your French declaration, even if they are dormant or have no money in them.

This is important because it is easy to miss on the form, but you can incur fines of several thousand euro for each foreign bank account that you fail to declare.

This can also include internet bank accounts if the provider is not based in France. Find full details on declaring foreign bank accounts HERE.

How do I convert foreign income into euros?

Unlike the US, the French tax authority does not set conversion rates for converting income in pounds, dollars or other currencies into euros.

Most people use online currency converters to make the conversion - it is advised to keep a note of the date that you did the conversion and the method you used, just in case this is queried at a later date.

Is this the same as the property declaration?

No. The déclaration des revenues is an annual task for everyone who lives in France, whether they own property or not. People who own property in France (including second-home owners who live in another country) must also fill in the property tax declaration known as the déclaration d'occupation.

Unlike the déclaration des revenues, this is a one-off task and once you have done it you do not need to do it again until your situation changes (eg you buy or sell a property or change a second-home into a main residence or vice versa, or start to rent out your property).

Full details on the property tax declaration HERE.

What happens if I miss the deadline?

Deadlines to have the income tax declaration completed vary according to where you live. If you miss the deadline by more than a few days you can start to accrue late fees.

The fees gradually increase and if you still fail to file, the tax office can impose a charge that is a percentage of your estimated tax owed - full details on the late fee structure HERE.

What happens if I make a mistake?

In 2017 the French won the legal 'right to make a mistake' in administrative tasks. In addition to the deadline to have completed the declaration there is also a deadline to fix mistakes - usually in December.

This means that between April and December you can correct mistakes on your tax declaration without fear of attracting penalties.

READ ALSO What do do if you make a mistake on your French taxes

How can I get help?

If you're stuck with your French taxes then don't panic - help is available.

The first port of call is usually your local tax office - you can visit the office on a walk-in basis without an appointment and staff are usually happy to help. If you visit the office close to the deadline date it's a good idea to take something good to read in the queue, as they can get very busy.

If it's not practical to visit in person, you can also set up a phone appointment or call the helpline - details HERE. There is also an English-language helpline, although be prepared to wait.

7 top tips for dealing with the French tax office

If your tax affairs are complicated or you just find the whole thing too daunting, you might consider getting professional help from an accountant.

You can find tips on finding English-speaking tax specialists HERE.

If you have more questions about the French tax declaration then feel free to share them in the comments below, or email us at [email protected], and we will do our best to answer them

Comments (1)

See Also

Tax season in France means long complicated forms and plenty of questions from foreigners in France, who understandably find the whole thing quite confusing.

Here we aim to answer some of the most frequently-asked questions;

Do I have to do the tax declaration?

Probably, yes. The annual déclaration des revenues (income tax declaration) has to be completed by almost everyone who lives in France, as well as by those who have income or significant financial activity here.

Even those who have no French income - ie retirees living on an overseas pension - must complete the form if they live in France. Salaried employees in France, whose income is taxed at source, must also complete the declaration.

Find the full breakdown of who has to complete the annual tax declaration HERE.

When do I have to do it?

Declarations open on April 13th and the deadline to have filed is in May or June, depending on where you live and whether you file on paper or online. Find the complete tax calendar HERE.

This year's tax declaration is for the 2023 tax year (January - December 2023), if you moved to France after January 1st 2024 you will not have to do the declaration until next year.

How do I do it?

If this is your first time declaring you will first need to request a numéro fiscal (tax number) - find instructions on how to do that HERE.

In previous years, people declaring for the first time have made their declaration on paper, before moving to online declarations the following year via the government tax site impots.gouv.fr.

This year the tax office says that first-timers can also do the declaration online (although they did also say that in 2020, when it turned out that online services didn't work for first-time declarations).

After getting your numéro fiscal you should be able to set up an account at impots.gouv.fr and then complete your declaration online. If that doesn't work, you can request a paper version of the form from your local tax office.

You can find a guide to filling in the form, and what each section means, HERE.

Do I have to do it online?

Most people do their declarations online because there are several advantages; firstly you get a later deadline and secondly the online form can 'remember' your answers from previous years, making the whole thing a bit easier.

The declaration is supposed to be an online-only process, but if you cannot file online (ie you have no internet access, or you are not confident using online services), your local tax office can continue to send you the paper version of the form.

What do I have to declare?

The short answer here is 'everything' - the French tax declaration is asking about all of your global income, including income from overseas such as a foreign pension, income from a rental property back home or any work that you do outside of France.

Depending on the tax treaty that your home country has with France you probably won't pay tax on overseas income that has already been taxed/is tax exempt in your home country, but you still have to tell the French taxman about it.

Find full details on what you need to declare HERE.

Tax breaks

For plenty of people, the tax bill after the declaration will be €0 - this will include groups such as people living on an overseas pension that is covered by a dual taxation treaty or salaried employees who have already have their income taxed at source.

And for some, tax season is a time when the government gives you money - rather than the other way around. This is because of the large numbers of tax breaks available for everything from employing a cleaner or childminder to giving to charity or contributing income to a private pension plan.

Find more information on tax breaks available HERE.

What about foreign bank accounts?

You must declare all non-French bank accounts on your French declaration, even if they are dormant or have no money in them.

This is important because it is easy to miss on the form, but you can incur fines of several thousand euro for each foreign bank account that you fail to declare.

This can also include internet bank accounts if the provider is not based in France. Find full details on declaring foreign bank accounts HERE.

How do I convert foreign income into euros?

Unlike the US, the French tax authority does not set conversion rates for converting income in pounds, dollars or other currencies into euros.

Most people use online currency converters to make the conversion - it is advised to keep a note of the date that you did the conversion and the method you used, just in case this is queried at a later date.

Is this the same as the property declaration?

No. The déclaration des revenues is an annual task for everyone who lives in France, whether they own property or not. People who own property in France (including second-home owners who live in another country) must also fill in the property tax declaration known as the déclaration d'occupation.

Unlike the déclaration des revenues, this is a one-off task and once you have done it you do not need to do it again until your situation changes (eg you buy or sell a property or change a second-home into a main residence or vice versa, or start to rent out your property).

Full details on the property tax declaration HERE.

What happens if I miss the deadline?

Deadlines to have the income tax declaration completed vary according to where you live. If you miss the deadline by more than a few days you can start to accrue late fees.

The fees gradually increase and if you still fail to file, the tax office can impose a charge that is a percentage of your estimated tax owed - full details on the late fee structure HERE.

What happens if I make a mistake?

In 2017 the French won the legal 'right to make a mistake' in administrative tasks. In addition to the deadline to have completed the declaration there is also a deadline to fix mistakes - usually in December.

This means that between April and December you can correct mistakes on your tax declaration without fear of attracting penalties.

READ ALSO What do do if you make a mistake on your French taxes

How can I get help?

If you're stuck with your French taxes then don't panic - help is available.

The first port of call is usually your local tax office - you can visit the office on a walk-in basis without an appointment and staff are usually happy to help. If you visit the office close to the deadline date it's a good idea to take something good to read in the queue, as they can get very busy.

If it's not practical to visit in person, you can also set up a phone appointment or call the helpline - details HERE. There is also an English-language helpline, although be prepared to wait.

7 top tips for dealing with the French tax office

If your tax affairs are complicated or you just find the whole thing too daunting, you might consider getting professional help from an accountant.

You can find tips on finding English-speaking tax specialists HERE.

If you have more questions about the French tax declaration then feel free to share them in the comments below, or email us at [email protected], and we will do our best to answer them

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.