How to get help with your 2023 French tax declaration

If you're caught in an admin loop, suffering from IT glitches or just don't understand what that error message about 'box 8SG' means - here's how to find help with your French taxes.

Doing your taxes can be pretty complicated - throw in another language, a tax system that is probably different to the one you are used to and a few IT glitches and it's no wonder that declaration season is often a time for swearing and/or tears.

But don't despair, here are a few tax tips, plus the places to go to get help.

Declarations

If you live in France you will almost certainly have to do the annual déclaration des revenus (income tax declaration) - here's our guide to filling in the 2023 declaration.

If you own property you will also, as a one-off, have to complete the déclaration d'occupation (property tax declaration) - find the guide to that here.

First-timers

If this is your first year completing the income tax declaration, you will likely have to complete the declaration on paper if you don't already have a numéro fiscale (tax number).

You can download the paper declaration here. For most other people online declarations are now compulsory, unless you live in a house that does not have internet access or are not able to complete the declaration online.

Setting up an online account

For most people, both the income tax declaration and the property tax declaration must be done online, via the site impots.gouv.fr. You do this in two stages - if you don't already have one, you first request a numéro fiscale (tax number) and then use this number to set up your espace particulier (personal account).

You can find details on how to get the numéro fiscale HERE.

For the property tax declaration, some people have reported being asked for extra proof of ID when they tried to create the account using their tax number from previous property tax bills - you can find more info on what to do if that happens HERE.

IT glitches

As government websites go, the tax one is fairly good and doesn't suffer from too many bugs and glitches, although as ever it's advisable not to leave your declaration until the last moment, as it's more likely to crash the more people are on it.

When are the tax deadlines for 2023?

One tip for foreigners is to turn off any translation software that you use, as this can sometimes cause problems with the website - it's better to have a translation tool open in a separate window and copy-and-paste any text that you need translating.

How to find help

So what should you do if you have done all that and you're still encountering problems?

Visit your local tax office - one option that people often don't realise is available is to visit your local tax office. You can go on a walk-in basis without an appointment and the staff are generally pretty friendly and helpful - at this time of year they are well used to helping people through the complexities of the declaration form.

To find your local tax office - Google Centre des finances publique plus the name of your commune. It's worth checking opening hours as some offices have limited opening, especially in small towns. Smaller offices may not be able with all aspects of taxes (for example some offices cannot deal with property taxes), but they will be able to direct you to the office that can help.

During declaration season they can get pretty busy, so maybe take a good book to read in the queue.

Don't assume that tax office employees will speak English, so if your French is at beginner level it might be best to take along a French-speaking friend or neighbour.

Helplines - there are also two telephone helplines - the French-language one is 0 809 401 401, open Monday to Friday between 8.30am and 7pm.

There is also an English-language helpline on 0033 1 72 95 20 42, although it doesn't appear to have a huge staff, so expect long waits at peak times like income tax declaration season.

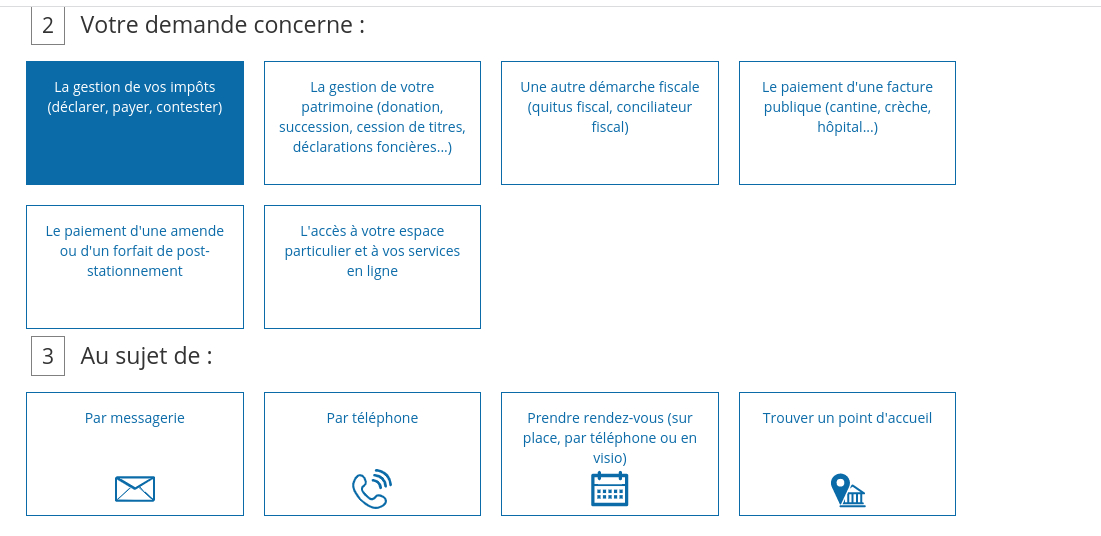

Appointment - you can also schedule a telephone or video call with your local tax office - head to the impots.gouv.fr website (even if you don't have your account set up) and click Contacts et RDV in the top right corner.

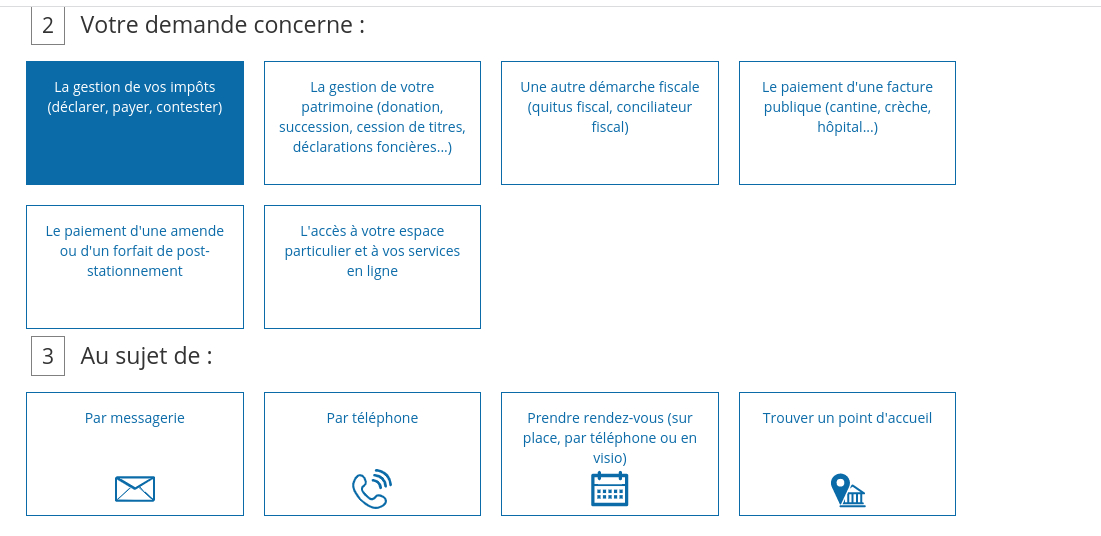

Click particulier and then select La gestion de vos impôts and click on Prendre rendez-vous.

The site then asks for your address in France and then shows the address and phone number of your local tax office, plus an option to make an appointment for a phone or video call.

Email - there is a general email address for the tax office, although anecdotal reports suggest that it's not very responsive. However, many local tax offices are happy to deal with queries via email (although this does vary on a local level). Once you have found your local tax office, head to their website to find the email address.

Professional help

If your tax affairs are complicated, your French is still at beginner level or you just can't face the thought of that form, you might benefit from hiring an accountant to do it for you. The caveat to this is that you will still need to collect all the relevant paperwork yourself, and of course accountants don't work for free.

For foreigners it is highly recommended to pick someone with a specialism in international tax affairs, as there can be a few things that catch out foreigners in France (such as the requirement to declare all non-French bank accounts) - you can find some tips on finding an English-speaking professional HERE.

Comments

See Also

Doing your taxes can be pretty complicated - throw in another language, a tax system that is probably different to the one you are used to and a few IT glitches and it's no wonder that declaration season is often a time for swearing and/or tears.

But don't despair, here are a few tax tips, plus the places to go to get help.

Declarations

If you live in France you will almost certainly have to do the annual déclaration des revenus (income tax declaration) - here's our guide to filling in the 2023 declaration.

If you own property you will also, as a one-off, have to complete the déclaration d'occupation (property tax declaration) - find the guide to that here.

First-timers

If this is your first year completing the income tax declaration, you will likely have to complete the declaration on paper if you don't already have a numéro fiscale (tax number).

You can download the paper declaration here. For most other people online declarations are now compulsory, unless you live in a house that does not have internet access or are not able to complete the declaration online.

Setting up an online account

For most people, both the income tax declaration and the property tax declaration must be done online, via the site impots.gouv.fr. You do this in two stages - if you don't already have one, you first request a numéro fiscale (tax number) and then use this number to set up your espace particulier (personal account).

You can find details on how to get the numéro fiscale HERE.

For the property tax declaration, some people have reported being asked for extra proof of ID when they tried to create the account using their tax number from previous property tax bills - you can find more info on what to do if that happens HERE.

IT glitches

As government websites go, the tax one is fairly good and doesn't suffer from too many bugs and glitches, although as ever it's advisable not to leave your declaration until the last moment, as it's more likely to crash the more people are on it.

When are the tax deadlines for 2023?

One tip for foreigners is to turn off any translation software that you use, as this can sometimes cause problems with the website - it's better to have a translation tool open in a separate window and copy-and-paste any text that you need translating.

How to find help

So what should you do if you have done all that and you're still encountering problems?

Visit your local tax office - one option that people often don't realise is available is to visit your local tax office. You can go on a walk-in basis without an appointment and the staff are generally pretty friendly and helpful - at this time of year they are well used to helping people through the complexities of the declaration form.

To find your local tax office - Google Centre des finances publique plus the name of your commune. It's worth checking opening hours as some offices have limited opening, especially in small towns. Smaller offices may not be able with all aspects of taxes (for example some offices cannot deal with property taxes), but they will be able to direct you to the office that can help.

During declaration season they can get pretty busy, so maybe take a good book to read in the queue.

Don't assume that tax office employees will speak English, so if your French is at beginner level it might be best to take along a French-speaking friend or neighbour.

Helplines - there are also two telephone helplines - the French-language one is 0 809 401 401, open Monday to Friday between 8.30am and 7pm.

There is also an English-language helpline on 0033 1 72 95 20 42, although it doesn't appear to have a huge staff, so expect long waits at peak times like income tax declaration season.

Appointment - you can also schedule a telephone or video call with your local tax office - head to the impots.gouv.fr website (even if you don't have your account set up) and click Contacts et RDV in the top right corner.

Click particulier and then select La gestion de vos impôts and click on Prendre rendez-vous.

The site then asks for your address in France and then shows the address and phone number of your local tax office, plus an option to make an appointment for a phone or video call.

Email - there is a general email address for the tax office, although anecdotal reports suggest that it's not very responsive. However, many local tax offices are happy to deal with queries via email (although this does vary on a local level). Once you have found your local tax office, head to their website to find the email address.

Professional help

If your tax affairs are complicated, your French is still at beginner level or you just can't face the thought of that form, you might benefit from hiring an accountant to do it for you. The caveat to this is that you will still need to collect all the relevant paperwork yourself, and of course accountants don't work for free.

For foreigners it is highly recommended to pick someone with a specialism in international tax affairs, as there can be a few things that catch out foreigners in France (such as the requirement to declare all non-French bank accounts) - you can find some tips on finding an English-speaking professional HERE.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.