GUIDE: French property grants you might be eligible for

Looking to purchase or renovate a home in France? You might be eligible for assistance from the French government, especially if you're doing work on the heating, windows or insulation.

There are several grants available to people with property in France, but it's not always easy to work out if you are eligible - especially for second-home owners since some grants require French residency. Others are means tested and might require a recent French tax declaration in order to qualify.

Here are some options:

MaPrimeRénov

This scheme is intended to help pay for energy-related renovations. Specifically, the work would need to fit into one of four categories: heating, insulation, ventilation and energy audits. This might include installing a new heat pump, for example, installing new windows or doing work on the roof insulation.

There are some changes to the scheme in 2024, including the introduction of two distinct grant funds: Ma PrimeRénov' Efficiency and Ma PrimeRénov' Performance. . The former is intended for "single-gesture work", such as installing new energy-efficient heating systems - full details here.

According to the Institut national de la statistique et des études économiques (Insee), housing is the fourth biggest emitter of greenhouse gases in France, after road transport, agriculture and industry.

From July 1st, 2024, the insulation of properties classified F or G for energy efficiency, will only be eligible for government aid if it is coupled with the installation of new, low-carbon heating equipment.

For households in the lowest income bracket, there is another option to apply for 'MaPrimeRénov' Sérénité' - which, as of 2023, offered greater financial assistance, but required that households be prepared to carry out large-scale renovations that would achieve energy savings of at least 35 percent.

Who?

Theoretically, all property owners in France, including second-home owners and those who rent out their properties, are eligible for this.

However, the grant is means-tested and in order to prove your income you will need a recent French tax return. As such, non-residents (meaning those who do not submit a yearly income tax declaration) would not be able to apply.

People who are resident in France and have a French second-home can, however, use the grant.

From January 1st, 2024, homeowners who access Ma PrimeRénov' funding to pay for major home improvements will have their works tracked by a representative.

More complex projects will be monitored by a representative of the Mon Accompagnateur Rénov' scheme – at a means-tested cost of up to €2,000 – which will help with administrative formalities, advise on work to be carried out, recommend approved workers, and identify which grants homeowners may be able to access.

How much?

Each household can test the renovation they would like to do using THIS simulator. In 2024, the maximum amount of aid is expected to be increased for the lowest earning households doing large-scale renovation work.

It is expected to go up to €70,000, from €35,000 previously, with up to 90 percent of the cost covered by grants for the most modest households. Keep in mind that the amount of aid awarded will depend on several factors, including the type of project, the household income and the number of people living there.

READ MORE: MaPrimeRenov: How France's property renovation grants will change in 2024

How can I apply?

Before starting work you need to submit an application. In order to do so, you must create an account on the MaPrimeRenov website. You will be asked to provide a number of supporting documents.

If you are deemed eligible, you will receive notification confirming that you have been awarded your grant. At this point, you can start work, but be sure that you request your invoices from RGE (Reconnu Garant de l'Environnement) recognised professionals.

You can send invoices and upload bank details onto your personal account. You will be reimbursed via bank transfer.

Interest-free loans

The Prêt à taux zéro (PTZ) is a supplementary interest-free loan that can be used to finance part of the purchase of a home, usually in addition to a mortgage.

It is aimed at first-time home buyers or those who have not owned their primary residence for at least two years, though there are some exceptions namely for people with disabilities.

It can also be used, in some cases, for the purchase of an outbuilding - such as a garage or parking space.

Who?

The PTZ is awarded on a means-tested basis - meaning a yearly income tax declaration will be required for application.

Additionally, it is not available for all properties. The criteria for which type of property you can use the loan on will depend on whether you live in an area with a housing shortage (zone tendue) or not.

READ MORE: French property: What is a 'zone tendue' in France?

As of 2023, the general goal for the PTZ was to help people with the purchase or construction of a 'new home' (logement neuf). In France, a building is considered a logement neuf if it is less than five years old.

The table below shows maximum yearly income for eligibility based on the number of occupants and the zone of the new or to-be-constructed property.

Those wanting to use the loan for an older property would need to be in an area not affected by a housing shortage - meaning located in zone B2 or C (find the zone of your commune here).

For an older home to qualify, it would also need to require work that would enable its annual energy consumption to be limited to a maximum of 331 KWh/m2 per year.

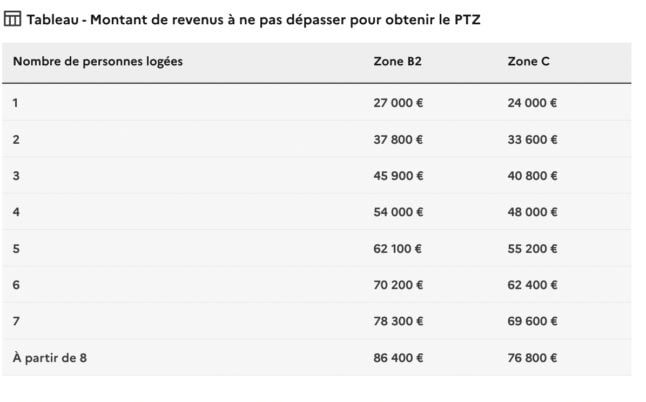

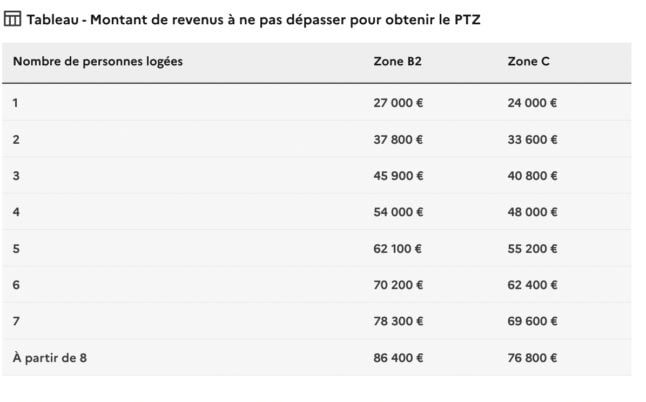

The table below shows income maximums to qualify for a PTZ outside of 'zones tendues'.

How much?

The amount awarded depends on your income, as well as the zone the property is located in and the number of occupants. You can use this simulator, which operates with the standards as of 2023, to see how much your loan might be.

Starting in 2024, the French government announced that, as part of its 2024 budget, it will extend the caps on the interest-free loan scheme and keep it in place until 2027, even though it was intended to end in 2023.

While the scheme will remain means-tested, maximum salaries for eligible parties will also increased making it more available to middle income households. An estimated 6 million more households will become eligible for the interest-free loan in 2024.

Recently, the French government also added hundreds more towns and cities to the 'zones tendues' list, meaning more areas will be eligible for the PTZ.

READ MORE: Electric car grants to second-home taxes: What's in France's 2024 budget

How can I access it?

Only financial institutions that have signed an agreement with the French government can grant a PTZ. Applications should be made directly to the lending institution of your choice.

Interest-free 'eco' loan

This scheme differs from the regular PTZ because it is focused on renovations to improve your home's energy performance.

There are 3 main categories of work covered by the eco-PTZ:

- One-off renovation work to improve your home's energy performance (e.g. roof insulation, changing your windows and/or heating system).

- Overall renovation work to enable your home to achieve a minimum level of energy performance

- Renovation work to replace your on-site sewage system with an energy-efficient system.

Who?

To qualify, in most cases you must be either an owner-occupier or a renter (with permission from the landlord). Your home must also have been built more than 2 years before the start of the work.

All households are eligible, without a means-test, for the eco-PTZ. However, as the home must be your primary residence, second-home owners would be excluded.

How can I access it?

First, choose a professional holding the RGE (recognised environmental guarantor) label (you can start by looking here).

Next, you must choose a bank that has signed an agreement with the government to offer the eco-PTZ. You can consult the list of banks here.

Finally you will need to fill out the application form. This will include attaching proof that you use the property as your primary residence, as well as your last tax statement (avis imposition).

Helping Hand Heating Bonus

The 'Prime Coup de pouce Chauffage' or the 'helping-hand heating bonus' in English, is a financial aid intended to help households replace a coal, gas or oil-fired boiler with one of the following systems:

- Efficient biomass boiler, meaning a boiler that uses an organic fuel such as wood and wood by-products (Chaudière biomasse performante in French)

- Air-to-water heat pump (Pompe à chaleur air/eau in French

- Water-to-water heat pump, meaning a geothermal heat pump (Pompe à chaleur eau/eau in French)

- Hybrid heat pump, meaning a system that combines the technology of an air/water heat pump and a condensing boiler (Pompe à chaleur hybride in French)

- Combined solar system, meaning a system combining a solar panel and a storage tank (Système solaire combiné in French)

- Connection to a heating network powered by renewable energies (known as 'Raccordement à un réseau de chaleur alimenté par des énergies renouvelables' in French, or ENR&R)

- High-efficiency wood-fired heating (Chauffage au bois très performant)

Who?

While the amount of aid offered is means-tested, all households are eligible, including second-home owners. As with Ma Prime Renov, a recent French tax declaration is required to complete the means test, which excludes people who are not resident in France.

The home must have been built at least two years ago.

Renters are also eligible, if they rent a single-family home. However, the landlord must authorise the work to be carried out.

How much?

The value of the aid depends on the type of work you want to undergo, as well as whether or not your household is considered low-income.

For example, a hybrid heat pump would be eligible for at least €4,000 in assistance for non low-income households. For low-income households, the minimum aid for a hybrid heat pump would be at least €5,000.

How can I access it?

Accessing the 'helping-hand' scheme involves first contacting an organisation that has signed up to the commitment charter linked to the scheme. Start by going onto the government page for the aid (here), then scroll down and choose which type of device you want to install.

Each device will have a link to click (Recherche une entreprise signataire) that will take you to a pdf listing all participating companies.

After accepting an option with a charter company, you can get an estimate for the work to be done with a professional holding the RGE (recognised environmental guarantor) label. Then, you send invoices for the work back to the signatory company within the specified amount of time.

Ma Prime Logement Décent

Launched on January 1, 2024, Ma Prime Logement Décent (My Decent Housing Bonus) has enabled property owners to obtain financial assistance for renovation work on run-down housing.

Homeowners on a modest income can apply for the Ma Prime Logement Décent financial aid, which is – in certain cases – up to 80 percent of the total spent, up to a maximum of €70,000.

It can only be used for major projects that remedy a proven health and safety risk at a property.

Who?

This one is available to owner-occupiers or people who rent out their property, but not second home owners. It is not limited to French citizens but you must be resident in France, have a French tax number and complete the annual income tax declaration.

It is means-tested and is open to people on 'low' and 'very low' incomes.

This calculation is based on your revenus fiscaux de référence (RFR) - you’ll see the figure on your annual tax assessment – it’s basically an amount calculated by the tax administration from the total income of a tax household intended to reflect the financial resources of that household.

In the greater Paris Île-de-France region, a single person living on their own is considered to be ‘very low income’ if their RFR is €23,541 or less (€17,009 for the rest of the country), and low income if it’s €28,657 or less (€21,805 outside Île-de-France).

The scale rises to €55,427 for a very low income household of five in Île-de-France (€40,002 elsewhere); and €67,473 for a low income household of five (€51,281 elsewhere).

How much?

When you use Ma Prime Logement Décent as an owner-occupier, you'll be reimbursed for :

- 80 percent of the cost of the work if you're part of a ‘very low income’ household (rising to 90 percent if the work also means that your home is no longer a so-called heat sieve);

- 60 percent of the cost of the work if you are part of a ‘low-income’ household ( rising to 70 percent if the work also prevents the home from becoming a so-called heat sieve).

In both cases, the total cost of the work must not exceed €70,000.

Owners renting out their property can benefit from 35 percent of the cost of your renovation work.

Find full details on how the scheme works HERE

Home adaptation work for the elderly or disabled

The aide Habiter Facile (aid for easy living) existed until the end of 2023. It has been replaced by the more encompassing 'MaPrimeAdapt' which is intended to help those beginning to experience reduced mobility (or already experiencing it) adapt their living environment.

Some of the work might include adding a grab rail or shower seat in the bathroom, installing a toilet adapted to the disability, widening doors to make rooms wheelchair accessible, adding an access ramp or installing an electric stairlift.

You may be eligible for up to 50 to 70 percent of the work, and after sending in an application you will be connected with a project management assistant.

Who?

As of 2023, you must either be an owner-occupier or be a renter (with permission from the landlord) - ie the home must be your primary residence.

You or a member of your household must either be disabled or have lost your mobility/ independence. The scheme is means-tested, and it is only available to low-income households.

How much?

The amount will depend on your household income, but depending on your project and situation, it can finance up to half of the costs.

How can I apply for it?

You will be asked to submit the ANAH form, as well as proof of residence (eg. a property deed). You will also need to include your latest tax statement, as well as proof of disability (eg. carte d’invalidité) or proof of loss of autonomy (via the proof that you receive the 'allocation personnalisée d’autonomie').

The application will also need to include quotes with price estimates, as well as a home assessment from an expert justifying the need for renovations, as well as a project plan or sketch.

Reduced VAT

Any household doing work that improves the home's energy performance might be eligible for VAT (value-added tax) at a reduced rate of 5.5 percent.

You can find the list of works eligible for the reduced VAT here. These are some examples:

- condensing boilers

- gas micro-cogeneration boilers with an electrical output of less than or equal to 3 kilovolt-amperes per dwelling

- thermal insulation materials for opaque or glazed walls, insulating shutters or external doors

- insulation materials for all or part of a heating or hot water production or distribution system

- heating control devices

- energy production equipment using a renewable energy source, with the exception of electricity production equipment using the sun's radiative energy, or heat pumps, other than air/air, whose main purpose is the production of heat or domestic hot water

- underground heat exchangers for geothermal heat pumps

- equipment for connection to a heating network supplied mainly by the sun.

How can I benefit?

To benefit from reduced VAT rates, you must have your work and equipment invoiced by a company.

If you buy your materials yourself, they will be subject to the standard VAT rate of 20 percent. Only the installation work carried out by a contractor will be eligible for a reduced rate.

For all work costing more than €300, including VAT, and in order to benefit from the reduced VAT rates, you must provide your contractor with a specific certificate confirming that the conditions for applying the reduced VAT rates have been met, before invoicing. You can find an example of the certificate here.

Comments

See Also

There are several grants available to people with property in France, but it's not always easy to work out if you are eligible - especially for second-home owners since some grants require French residency. Others are means tested and might require a recent French tax declaration in order to qualify.

Here are some options:

MaPrimeRénov

This scheme is intended to help pay for energy-related renovations. Specifically, the work would need to fit into one of four categories: heating, insulation, ventilation and energy audits. This might include installing a new heat pump, for example, installing new windows or doing work on the roof insulation.

There are some changes to the scheme in 2024, including the introduction of two distinct grant funds: Ma PrimeRénov' Efficiency and Ma PrimeRénov' Performance. . The former is intended for "single-gesture work", such as installing new energy-efficient heating systems - full details here.

According to the Institut national de la statistique et des études économiques (Insee), housing is the fourth biggest emitter of greenhouse gases in France, after road transport, agriculture and industry.

From July 1st, 2024, the insulation of properties classified F or G for energy efficiency, will only be eligible for government aid if it is coupled with the installation of new, low-carbon heating equipment.

For households in the lowest income bracket, there is another option to apply for 'MaPrimeRénov' Sérénité' - which, as of 2023, offered greater financial assistance, but required that households be prepared to carry out large-scale renovations that would achieve energy savings of at least 35 percent.

Who?

Theoretically, all property owners in France, including second-home owners and those who rent out their properties, are eligible for this.

However, the grant is means-tested and in order to prove your income you will need a recent French tax return. As such, non-residents (meaning those who do not submit a yearly income tax declaration) would not be able to apply.

People who are resident in France and have a French second-home can, however, use the grant.

From January 1st, 2024, homeowners who access Ma PrimeRénov' funding to pay for major home improvements will have their works tracked by a representative.

More complex projects will be monitored by a representative of the Mon Accompagnateur Rénov' scheme – at a means-tested cost of up to €2,000 – which will help with administrative formalities, advise on work to be carried out, recommend approved workers, and identify which grants homeowners may be able to access.

How much?

Each household can test the renovation they would like to do using THIS simulator. In 2024, the maximum amount of aid is expected to be increased for the lowest earning households doing large-scale renovation work.

It is expected to go up to €70,000, from €35,000 previously, with up to 90 percent of the cost covered by grants for the most modest households. Keep in mind that the amount of aid awarded will depend on several factors, including the type of project, the household income and the number of people living there.

READ MORE: MaPrimeRenov: How France's property renovation grants will change in 2024

How can I apply?

Before starting work you need to submit an application. In order to do so, you must create an account on the MaPrimeRenov website. You will be asked to provide a number of supporting documents.

If you are deemed eligible, you will receive notification confirming that you have been awarded your grant. At this point, you can start work, but be sure that you request your invoices from RGE (Reconnu Garant de l'Environnement) recognised professionals.

You can send invoices and upload bank details onto your personal account. You will be reimbursed via bank transfer.

Interest-free loans

The Prêt à taux zéro (PTZ) is a supplementary interest-free loan that can be used to finance part of the purchase of a home, usually in addition to a mortgage.

It is aimed at first-time home buyers or those who have not owned their primary residence for at least two years, though there are some exceptions namely for people with disabilities.

It can also be used, in some cases, for the purchase of an outbuilding - such as a garage or parking space.

Who?

The PTZ is awarded on a means-tested basis - meaning a yearly income tax declaration will be required for application.

Additionally, it is not available for all properties. The criteria for which type of property you can use the loan on will depend on whether you live in an area with a housing shortage (zone tendue) or not.

READ MORE: French property: What is a 'zone tendue' in France?

As of 2023, the general goal for the PTZ was to help people with the purchase or construction of a 'new home' (logement neuf). In France, a building is considered a logement neuf if it is less than five years old.

The table below shows maximum yearly income for eligibility based on the number of occupants and the zone of the new or to-be-constructed property.

Those wanting to use the loan for an older property would need to be in an area not affected by a housing shortage - meaning located in zone B2 or C (find the zone of your commune here).

For an older home to qualify, it would also need to require work that would enable its annual energy consumption to be limited to a maximum of 331 KWh/m2 per year.

The table below shows income maximums to qualify for a PTZ outside of 'zones tendues'.

How much?

The amount awarded depends on your income, as well as the zone the property is located in and the number of occupants. You can use this simulator, which operates with the standards as of 2023, to see how much your loan might be.

Starting in 2024, the French government announced that, as part of its 2024 budget, it will extend the caps on the interest-free loan scheme and keep it in place until 2027, even though it was intended to end in 2023.

While the scheme will remain means-tested, maximum salaries for eligible parties will also increased making it more available to middle income households. An estimated 6 million more households will become eligible for the interest-free loan in 2024.

Recently, the French government also added hundreds more towns and cities to the 'zones tendues' list, meaning more areas will be eligible for the PTZ.

READ MORE: Electric car grants to second-home taxes: What's in France's 2024 budget

How can I access it?

Only financial institutions that have signed an agreement with the French government can grant a PTZ. Applications should be made directly to the lending institution of your choice.

Interest-free 'eco' loan

This scheme differs from the regular PTZ because it is focused on renovations to improve your home's energy performance.

There are 3 main categories of work covered by the eco-PTZ:

- One-off renovation work to improve your home's energy performance (e.g. roof insulation, changing your windows and/or heating system).

- Overall renovation work to enable your home to achieve a minimum level of energy performance

- Renovation work to replace your on-site sewage system with an energy-efficient system.

Who?

To qualify, in most cases you must be either an owner-occupier or a renter (with permission from the landlord). Your home must also have been built more than 2 years before the start of the work.

All households are eligible, without a means-test, for the eco-PTZ. However, as the home must be your primary residence, second-home owners would be excluded.

How can I access it?

First, choose a professional holding the RGE (recognised environmental guarantor) label (you can start by looking here).

Next, you must choose a bank that has signed an agreement with the government to offer the eco-PTZ. You can consult the list of banks here.

Finally you will need to fill out the application form. This will include attaching proof that you use the property as your primary residence, as well as your last tax statement (avis imposition).

Helping Hand Heating Bonus

The 'Prime Coup de pouce Chauffage' or the 'helping-hand heating bonus' in English, is a financial aid intended to help households replace a coal, gas or oil-fired boiler with one of the following systems:

- Efficient biomass boiler, meaning a boiler that uses an organic fuel such as wood and wood by-products (Chaudière biomasse performante in French)

- Air-to-water heat pump (Pompe à chaleur air/eau in French

- Water-to-water heat pump, meaning a geothermal heat pump (Pompe à chaleur eau/eau in French)

- Hybrid heat pump, meaning a system that combines the technology of an air/water heat pump and a condensing boiler (Pompe à chaleur hybride in French)

- Combined solar system, meaning a system combining a solar panel and a storage tank (Système solaire combiné in French)

- Connection to a heating network powered by renewable energies (known as 'Raccordement à un réseau de chaleur alimenté par des énergies renouvelables' in French, or ENR&R)

- High-efficiency wood-fired heating (Chauffage au bois très performant)

Who?

While the amount of aid offered is means-tested, all households are eligible, including second-home owners. As with Ma Prime Renov, a recent French tax declaration is required to complete the means test, which excludes people who are not resident in France.

The home must have been built at least two years ago.

Renters are also eligible, if they rent a single-family home. However, the landlord must authorise the work to be carried out.

How much?

The value of the aid depends on the type of work you want to undergo, as well as whether or not your household is considered low-income.

For example, a hybrid heat pump would be eligible for at least €4,000 in assistance for non low-income households. For low-income households, the minimum aid for a hybrid heat pump would be at least €5,000.

How can I access it?

Accessing the 'helping-hand' scheme involves first contacting an organisation that has signed up to the commitment charter linked to the scheme. Start by going onto the government page for the aid (here), then scroll down and choose which type of device you want to install.

Each device will have a link to click (Recherche une entreprise signataire) that will take you to a pdf listing all participating companies.

After accepting an option with a charter company, you can get an estimate for the work to be done with a professional holding the RGE (recognised environmental guarantor) label. Then, you send invoices for the work back to the signatory company within the specified amount of time.

Ma Prime Logement Décent

Launched on January 1, 2024, Ma Prime Logement Décent (My Decent Housing Bonus) has enabled property owners to obtain financial assistance for renovation work on run-down housing.

Homeowners on a modest income can apply for the Ma Prime Logement Décent financial aid, which is – in certain cases – up to 80 percent of the total spent, up to a maximum of €70,000.

It can only be used for major projects that remedy a proven health and safety risk at a property.

Who?

This one is available to owner-occupiers or people who rent out their property, but not second home owners. It is not limited to French citizens but you must be resident in France, have a French tax number and complete the annual income tax declaration.

It is means-tested and is open to people on 'low' and 'very low' incomes.

This calculation is based on your revenus fiscaux de référence (RFR) - you’ll see the figure on your annual tax assessment – it’s basically an amount calculated by the tax administration from the total income of a tax household intended to reflect the financial resources of that household.

In the greater Paris Île-de-France region, a single person living on their own is considered to be ‘very low income’ if their RFR is €23,541 or less (€17,009 for the rest of the country), and low income if it’s €28,657 or less (€21,805 outside Île-de-France).

The scale rises to €55,427 for a very low income household of five in Île-de-France (€40,002 elsewhere); and €67,473 for a low income household of five (€51,281 elsewhere).

How much?

When you use Ma Prime Logement Décent as an owner-occupier, you'll be reimbursed for :

- 80 percent of the cost of the work if you're part of a ‘very low income’ household (rising to 90 percent if the work also means that your home is no longer a so-called heat sieve);

- 60 percent of the cost of the work if you are part of a ‘low-income’ household ( rising to 70 percent if the work also prevents the home from becoming a so-called heat sieve).

In both cases, the total cost of the work must not exceed €70,000.

Owners renting out their property can benefit from 35 percent of the cost of your renovation work.

Find full details on how the scheme works HERE

Home adaptation work for the elderly or disabled

The aide Habiter Facile (aid for easy living) existed until the end of 2023. It has been replaced by the more encompassing 'MaPrimeAdapt' which is intended to help those beginning to experience reduced mobility (or already experiencing it) adapt their living environment.

Some of the work might include adding a grab rail or shower seat in the bathroom, installing a toilet adapted to the disability, widening doors to make rooms wheelchair accessible, adding an access ramp or installing an electric stairlift.

You may be eligible for up to 50 to 70 percent of the work, and after sending in an application you will be connected with a project management assistant.

Who?

As of 2023, you must either be an owner-occupier or be a renter (with permission from the landlord) - ie the home must be your primary residence.

You or a member of your household must either be disabled or have lost your mobility/ independence. The scheme is means-tested, and it is only available to low-income households.

How much?

The amount will depend on your household income, but depending on your project and situation, it can finance up to half of the costs.

How can I apply for it?

You will be asked to submit the ANAH form, as well as proof of residence (eg. a property deed). You will also need to include your latest tax statement, as well as proof of disability (eg. carte d’invalidité) or proof of loss of autonomy (via the proof that you receive the 'allocation personnalisée d’autonomie').

The application will also need to include quotes with price estimates, as well as a home assessment from an expert justifying the need for renovations, as well as a project plan or sketch.

Reduced VAT

Any household doing work that improves the home's energy performance might be eligible for VAT (value-added tax) at a reduced rate of 5.5 percent.

You can find the list of works eligible for the reduced VAT here. These are some examples:

- condensing boilers

- gas micro-cogeneration boilers with an electrical output of less than or equal to 3 kilovolt-amperes per dwelling

- thermal insulation materials for opaque or glazed walls, insulating shutters or external doors

- insulation materials for all or part of a heating or hot water production or distribution system

- heating control devices

- energy production equipment using a renewable energy source, with the exception of electricity production equipment using the sun's radiative energy, or heat pumps, other than air/air, whose main purpose is the production of heat or domestic hot water

- underground heat exchangers for geothermal heat pumps

- equipment for connection to a heating network supplied mainly by the sun.

How can I benefit?

To benefit from reduced VAT rates, you must have your work and equipment invoiced by a company.

If you buy your materials yourself, they will be subject to the standard VAT rate of 20 percent. Only the installation work carried out by a contractor will be eligible for a reduced rate.

For all work costing more than €300, including VAT, and in order to benefit from the reduced VAT rates, you must provide your contractor with a specific certificate confirming that the conditions for applying the reduced VAT rates have been met, before invoicing. You can find an example of the certificate here.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.