Working in France: What can you expect to earn?

If you want to work in France, it's helpful to know what you can expect to earn - here's a look at the industry-standard salaries on offer in a range of different jobs.

If you want to work in France one of the key questions is how much can you expect to earn? France is not generally known as a high-wage country, although on the other hand the cost-of-living in some areas is also quite low.

READ ALSO How much money do you need to live in France?

French daily newspaper Le Parisien has put together a 'salary simulator' where you can check the industry standard for your profession, covering a wide range of different types of jobs.

With the obvious caveat that a lot depends on your experience, whether your qualifications are recognised in France and whether (if applicable) you speak French, you can check out the simulator HERE.

Below are five examples of standard rates of pay (annual, before tax) using the salary simulator, for jobs popular with foreigners in France;

Tech

France has been making a big effort to attract tech workers in recent years. It has even launched the 'French Tech Visa' - a type of 'passeport talent' (you can read more about this residency permit HERE) that allows you to work in France for up to four years if you have been offered a job at an eligible French company.

French President Emmanuel Macron also launched the "Choose France" campaign to attract foreign investment in French tech, as well as to make France a more appealing place to work for technology workers. The website Welcome to France (written in English) is also geared toward attracting foreign talent and start-ups, and offers links to tech-specific job boards for English-speakers looking to work in France.

To give an example of this, we picked the average salary expectations for a "Data Scientist or ML Developer"

With 0 to 2 years experience in the field: Between €40,000 and €45,00

With 2 to 5 years experience: Between €45,000 and €60,000

With 5 to 10 years experience: Between €60,000 and €70,000

With 10 to 15 years experience: Between €70,000 and more than €80,000

With 15 years experience or more: Between €70,000 and more than €80,000

Healthcare Assistant/ Worker

A shortage of healthcare workers means there are plenty of jobs in this sector - but many roles require French qualifications.

Foreigners looking to work in French healthcare might consider being a healthcare assistant or aide - more accessible professions which require less country-specific training.

For this field, we chose a 'healthcare assistant' at a care facility for the salary example:

0 to 2 years : Between €21,000 and €24,000

2 to 5 years : Between €24,000 and €28,000

5 to 10 years : Between €28,000 and €32,000

10 to 15 years: Between €32,000 and €36,000

15 years and more : Between €32,000 and €36,000

Marketing and Public Relations

As many French companies and businesses seek to increase their appeal to English-speaking audiences, your status as an anglophone could come in handy. The website Emploi Strategies is focused on jobs in marketing and PR, with many ob postings asking that candidates either be bilingual or speak some level of English in order to apply.

We chose the role of "Product Manager" for the example within this field.

0 to 2 years : Between €30,000 and €35,000

2 to 5 years : Between €35,000 and €45,000

5 to 10 years : Between €45,000 and €55,000

10 to 15 years: Between €45,000 and €55,000

15 years and more : Between €45,000 and €55,000

Tourism

This is a field that is accessible for English-speaking foreigners - France is the world's most-visited tourist destination and the relaxation of Covid-related travel restrictions helped create a huge rebound in tourism in France, particularly on the part of American tourists, who made up around 12.7 percent of foreign tourists in 2022.

With an influx of English-speaking tourists, as well as a minimum level of English often being a stated requirement for those working in France's tourism industry, being a native speaker could be in your favour.

We chose the example of an "Account Manager":

0 to 2 years : Between €28,000 and €35,000.

2 to 5 years : Between €30,000 and €38,000

5 to 10 years : Between €35,000 and €45,000

10 to 15 years: More than €45,000

15 years and more : More than €45,000

Local variations

The data comes from PageGroup, a firm specialising in executive recruitment, who analysed the majority of salaries offered in the first half of 2022 - encompassing over 800 jobs in 24 sectors across France.

Some career fields might not be listed on the simulator, particularly those pertaining to public servants whose salaries are indexed.

French salaries will also depend on region - you can expect to earn more in the Greater Paris area than in other parts of the country. On average, salaries were between five to ten percent lower than Paris in Auvergne-Rhône-Alpes, Pays de la Loire and Provence-Alpes-Côte d'Azur, 15 percent lower in Brittany and Occitania, and up to 20 percent lower in Centre-Val-de-Loire, Nouvelle-Aquitaine, Normandy, the Grand Est and Hauts-de-France.

If you did not see your industry listed above, you can try the job simulator HERE.

Education

This is another common field for foreigners seeking to work in France. Education is one of the ten fields that the French government expects to be hiring the most in the next ten years.

Additionally, English-language instruction has become more of a priority for the French Education Ministry, particularly after launching its Emergency English learning plan for French public schools.

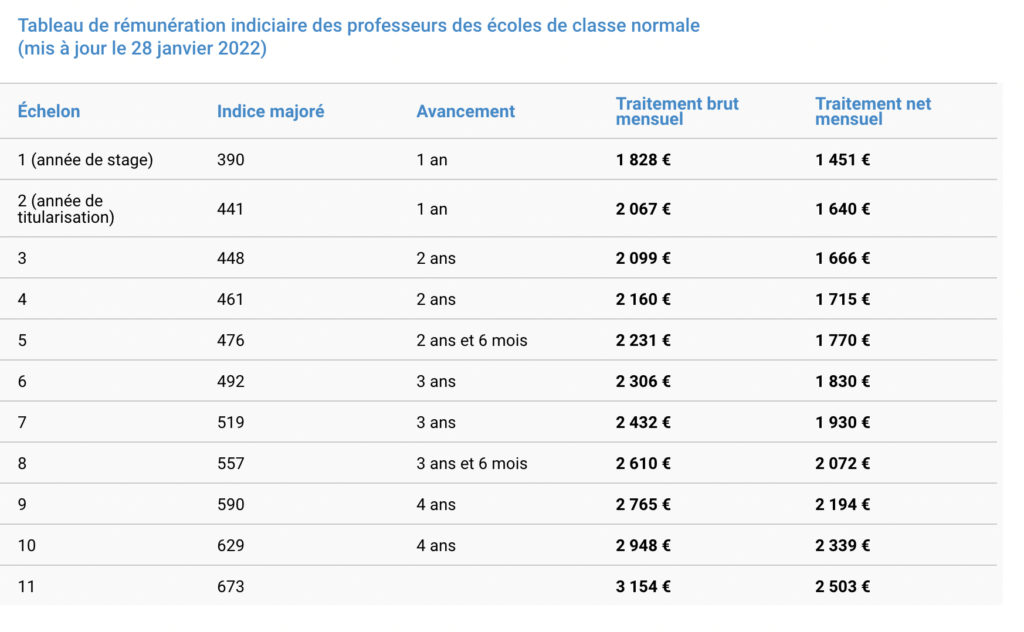

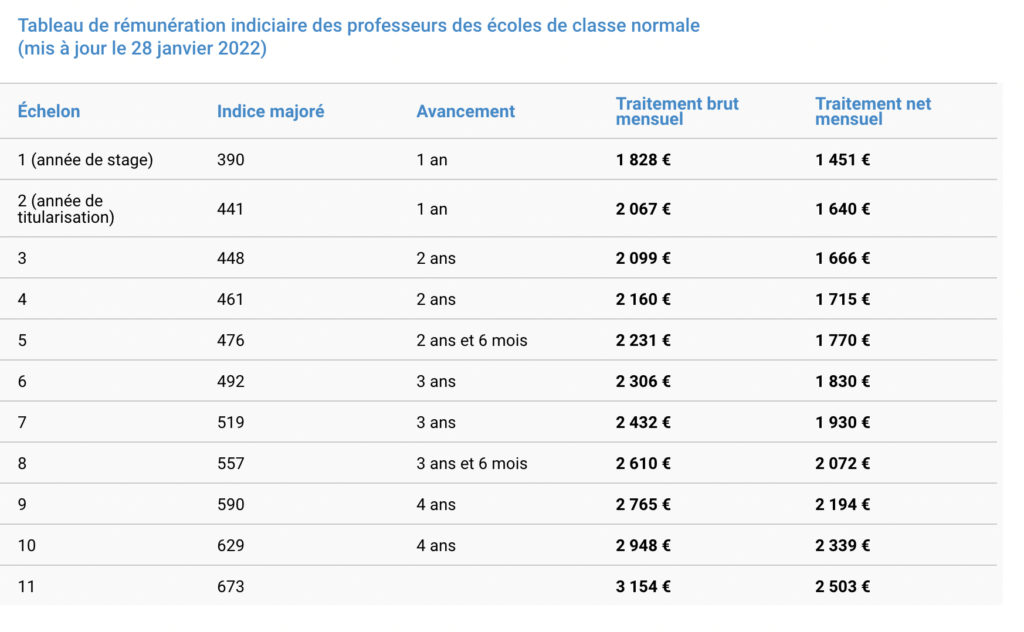

Teaching is not included on Le Parisien's salary simulator as teachers are considered 'fonctionnaires' (civil servants) in France, however the government does publish national pay scales for teachers.

Keep in mind that if you are looking to teach English in France, you will need a TEFL certificate. If you are looking to work as a secondary school teacher generally, you must pass the "Capes" examination (Certificat d'Aptitude au Professorat de l'Enseignement du Second degré).

You can see the table for teacher salaries based on seniority below - unlike the salaries listed above, these are displayed as after-tax.

Education Minister Pap Ndiaye announced in August that starting in September 2023, first year educators will earn €2,000 (post-tax) per month, and that there will also be increases for teachers in the "middle of their career" by the same date.

As of September 2022, a first year teacher earned approximately €19,680 per year after taxes. For a teacher with four years of experience, this amount would be closer to €28,068 after taxes.

The table with salary levels by teacher seniority, as of January 2022, from the education ministry can be seen below:

Table by Education.gouv.fr

The education ministry also has its own salary simulator, that you can find HERE for more precise estimates based on your situation.

Comments

See Also

If you want to work in France one of the key questions is how much can you expect to earn? France is not generally known as a high-wage country, although on the other hand the cost-of-living in some areas is also quite low.

READ ALSO How much money do you need to live in France?

French daily newspaper Le Parisien has put together a 'salary simulator' where you can check the industry standard for your profession, covering a wide range of different types of jobs.

With the obvious caveat that a lot depends on your experience, whether your qualifications are recognised in France and whether (if applicable) you speak French, you can check out the simulator HERE.

Below are five examples of standard rates of pay (annual, before tax) using the salary simulator, for jobs popular with foreigners in France;

Tech

France has been making a big effort to attract tech workers in recent years. It has even launched the 'French Tech Visa' - a type of 'passeport talent' (you can read more about this residency permit HERE) that allows you to work in France for up to four years if you have been offered a job at an eligible French company.

French President Emmanuel Macron also launched the "Choose France" campaign to attract foreign investment in French tech, as well as to make France a more appealing place to work for technology workers. The website Welcome to France (written in English) is also geared toward attracting foreign talent and start-ups, and offers links to tech-specific job boards for English-speakers looking to work in France.

To give an example of this, we picked the average salary expectations for a "Data Scientist or ML Developer"

With 0 to 2 years experience in the field: Between €40,000 and €45,00

With 2 to 5 years experience: Between €45,000 and €60,000

With 5 to 10 years experience: Between €60,000 and €70,000

With 10 to 15 years experience: Between €70,000 and more than €80,000

With 15 years experience or more: Between €70,000 and more than €80,000

Healthcare Assistant/ Worker

A shortage of healthcare workers means there are plenty of jobs in this sector - but many roles require French qualifications.

Foreigners looking to work in French healthcare might consider being a healthcare assistant or aide - more accessible professions which require less country-specific training.

For this field, we chose a 'healthcare assistant' at a care facility for the salary example:

0 to 2 years : Between €21,000 and €24,000

2 to 5 years : Between €24,000 and €28,000

5 to 10 years : Between €28,000 and €32,000

10 to 15 years: Between €32,000 and €36,000

15 years and more : Between €32,000 and €36,000

Marketing and Public Relations

As many French companies and businesses seek to increase their appeal to English-speaking audiences, your status as an anglophone could come in handy. The website Emploi Strategies is focused on jobs in marketing and PR, with many ob postings asking that candidates either be bilingual or speak some level of English in order to apply.

We chose the role of "Product Manager" for the example within this field.

0 to 2 years : Between €30,000 and €35,000

2 to 5 years : Between €35,000 and €45,000

5 to 10 years : Between €45,000 and €55,000

10 to 15 years: Between €45,000 and €55,000

15 years and more : Between €45,000 and €55,000

Tourism

This is a field that is accessible for English-speaking foreigners - France is the world's most-visited tourist destination and the relaxation of Covid-related travel restrictions helped create a huge rebound in tourism in France, particularly on the part of American tourists, who made up around 12.7 percent of foreign tourists in 2022.

With an influx of English-speaking tourists, as well as a minimum level of English often being a stated requirement for those working in France's tourism industry, being a native speaker could be in your favour.

We chose the example of an "Account Manager":

0 to 2 years : Between €28,000 and €35,000.

2 to 5 years : Between €30,000 and €38,000

5 to 10 years : Between €35,000 and €45,000

10 to 15 years: More than €45,000

15 years and more : More than €45,000

Local variations

The data comes from PageGroup, a firm specialising in executive recruitment, who analysed the majority of salaries offered in the first half of 2022 - encompassing over 800 jobs in 24 sectors across France.

Some career fields might not be listed on the simulator, particularly those pertaining to public servants whose salaries are indexed.

French salaries will also depend on region - you can expect to earn more in the Greater Paris area than in other parts of the country. On average, salaries were between five to ten percent lower than Paris in Auvergne-Rhône-Alpes, Pays de la Loire and Provence-Alpes-Côte d'Azur, 15 percent lower in Brittany and Occitania, and up to 20 percent lower in Centre-Val-de-Loire, Nouvelle-Aquitaine, Normandy, the Grand Est and Hauts-de-France.

If you did not see your industry listed above, you can try the job simulator HERE.

Education

This is another common field for foreigners seeking to work in France. Education is one of the ten fields that the French government expects to be hiring the most in the next ten years.

Additionally, English-language instruction has become more of a priority for the French Education Ministry, particularly after launching its Emergency English learning plan for French public schools.

Teaching is not included on Le Parisien's salary simulator as teachers are considered 'fonctionnaires' (civil servants) in France, however the government does publish national pay scales for teachers.

Keep in mind that if you are looking to teach English in France, you will need a TEFL certificate. If you are looking to work as a secondary school teacher generally, you must pass the "Capes" examination (Certificat d'Aptitude au Professorat de l'Enseignement du Second degré).

You can see the table for teacher salaries based on seniority below - unlike the salaries listed above, these are displayed as after-tax.

Education Minister Pap Ndiaye announced in August that starting in September 2023, first year educators will earn €2,000 (post-tax) per month, and that there will also be increases for teachers in the "middle of their career" by the same date.

As of September 2022, a first year teacher earned approximately €19,680 per year after taxes. For a teacher with four years of experience, this amount would be closer to €28,068 after taxes.

The table with salary levels by teacher seniority, as of January 2022, from the education ministry can be seen below:

The education ministry also has its own salary simulator, that you can find HERE for more precise estimates based on your situation.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.