Reader question: Is my non-French Will valid in France?

We don't want to put a downer on anyone's new life in France, but it's time to talk about death.

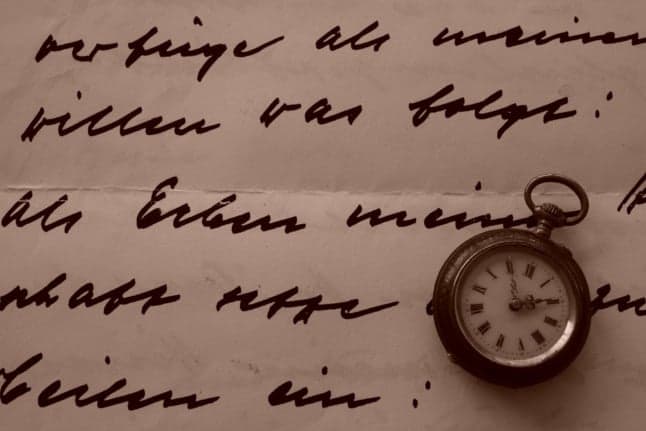

Moving to France and buying property here involves a lot of paperwork, but one piece of paper that is often forgotten in a Will.

So do you need to make a whole new Will when either moving to France or buying property here, or is your old Will valid?

The short answer is that your previous Will can remain valid - but under some conditions.

Long answer: If you make it clear that this is what you want, your non-French Will can apply over your estate, otherwise French inheritance law will take precedence over - at least - any French assets you may hold.

READ ALSO Wills, estates and notaires - what you need to know about inheritance laws in France

All non-French residents in France can opt for the law of the country of their nationality to apply to their estate. This law still applies to Britons, despite Brexit, so it may not be necessary to make an entire new Will.

But this decision has to be clearly expressed, otherwise - under the same EU regulation that allows you to choose under which law your estate shall be administered - the law of the country of the deceased’s last residence will apply to the entire estate.

At a minimum you will need to add a codicil to your Will, stating that you want the law of your home country, not French law, to apply.

Alternatively, a testament olographe stating that you want the Will of your nationality to apply, should be sufficient - though this is best done with the help of a notaire.

If you don't live in France but do have property here then your home country's Will should apply, but for the avoidance of doubt it is better to add that Codicil clearly statting that you do not want French law to apply to your French assets.

If you do decide to make a new Will in France, do seek professional advice from a notaire, since it’s not as simple as just leaving all your worldly possessions to whoever you like. French inheritance rules may be very different to the ones you are used to and include, for example, a ban on disinheriting your children.

You can make two Wills - one for your assets in your home country and one for your assets in France - but this should not be done without professional advice to ensure that the two Wills are not in conflict with each other.

Be aware, too, that under French law there are certain rules on who can inherit what. So, if you make a French Will for your French assets, they will have to comply with these rules.

For more answers to frequently asked questions about Wills and inheritance in France click here

The Notaires de France website also offers useful advice in English, while a list of English-speaking notaires in France is available here.

Comments

See Also

Moving to France and buying property here involves a lot of paperwork, but one piece of paper that is often forgotten in a Will.

So do you need to make a whole new Will when either moving to France or buying property here, or is your old Will valid?

The short answer is that your previous Will can remain valid - but under some conditions.

Long answer: If you make it clear that this is what you want, your non-French Will can apply over your estate, otherwise French inheritance law will take precedence over - at least - any French assets you may hold.

READ ALSO Wills, estates and notaires - what you need to know about inheritance laws in France

All non-French residents in France can opt for the law of the country of their nationality to apply to their estate. This law still applies to Britons, despite Brexit, so it may not be necessary to make an entire new Will.

But this decision has to be clearly expressed, otherwise - under the same EU regulation that allows you to choose under which law your estate shall be administered - the law of the country of the deceased’s last residence will apply to the entire estate.

At a minimum you will need to add a codicil to your Will, stating that you want the law of your home country, not French law, to apply.

Alternatively, a testament olographe stating that you want the Will of your nationality to apply, should be sufficient - though this is best done with the help of a notaire.

If you don't live in France but do have property here then your home country's Will should apply, but for the avoidance of doubt it is better to add that Codicil clearly statting that you do not want French law to apply to your French assets.

If you do decide to make a new Will in France, do seek professional advice from a notaire, since it’s not as simple as just leaving all your worldly possessions to whoever you like. French inheritance rules may be very different to the ones you are used to and include, for example, a ban on disinheriting your children.

You can make two Wills - one for your assets in your home country and one for your assets in France - but this should not be done without professional advice to ensure that the two Wills are not in conflict with each other.

Be aware, too, that under French law there are certain rules on who can inherit what. So, if you make a French Will for your French assets, they will have to comply with these rules.

For more answers to frequently asked questions about Wills and inheritance in France click here

The Notaires de France website also offers useful advice in English, while a list of English-speaking notaires in France is available here.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.