Reader question: Who is responsible for paying French inheritance tax?

If you have received an inheritance there is a chance you will be required to pay French inheritance tax, even if you don't live in France. Here is how it works.

In some countries taxes are subtracted from the estate before it is distributed, but in France the estate is distributed and then it is the responsibility of the heir to pay taxes on the share they have received.

In terms of the taxation level, the rate can range from 0 to 60 percent based on the person’s relationship with the deceased.

Scenario A: I live outside France, but I received an inheritance from a resident of France

The first thing to verify is whether or not the person who died was indeed a tax resident and fiscally domiciled in France. If you are unsure, you can consult our guide to tax residency. (although ultimately it will be French tax authorities who determine the answer).

Death and taxes: What you need to know about estate planning in France

In some very specific cases, Americans (thanks to the US-France tax treaty) can request to maintain the United States as their fiscal domicile in the first five years of living in France if they can prove they did not intend to move to France permanently and will be moving back to the US, according to tax attorney Jérôme Assouline, who is admitted to the bar in both Paris and New York (and based in Paris).

Oftentimes, this is done by posted workers who have the intention of returning to the US after the end of their contract. The decedent should have taken steps to qualify for this status, so you will need to verify.

However, in most cases, if France was their main home then they would almost certainly be tax resident and fiscally domiciled in France. Keep in mind that this designation can apply to some second-home owners or people who spend long periods in France.

If the person was a French tax resident then their estate - including assets outside France - will be eligible for inheritance taxes in France and by French law.

This means that you, as the heir, would be responsible for paying French inheritance taxes.

Scenario B: I've received an inheritance from someone who didn't live in France, but owned property there

If the person who died was not a French tax resident, but they owned property in France (for example, a second-home owner) then only their assets in France will factor into French inheritance taxes.

So if you have inherited a property or a part share in a property in France, you will be responsible for paying French inheritance tax, even if you don't live in France.

Scenario C: I am a tax resident of France, and I've received an inheritance from someone living outside France

The first question to answer is whether or not the country where the deceased was resident has a tax treaty with France. In the case of the US and UK, there are tax treaties in place to avoid the double taxation of inheritance. For the US, you can find the treaty here. For the UK, you can find the treaty here.

Now, let's say you live in France and your American parent (resident in the US) passes away and leave you an inheritance. In this case, the inheritance, assuming the assets contained are based in the US, ought to be taxed by the United States and not France. If the inheritance comes from a trust, however, the situation may be more complicated.

For those from countries that countries that have no tax treaty in place with France, you may need to declare the inheritance to French tax authorities - even if you don't have to pay tax on it and especially if the inheritance is more than €50,000. In this case you should check with your local tax office.

How much will I have to pay?

So once you have established whether or not you are liable to inheritance tax in France, the next step is how much you will be taxed - and this is on a sliding scale depending on your relationship with the deceased.

The taxable proportion is equal to the taxable assets of the estate minus the tax-free allowance.

The tax-free allowance is determined based on family relationships with the deceased. The surviving spouse or civil union partner is exempt from inheritance tax.

For children and parents of the deceased, up to €100,000 can be given tax-free.

For siblings, the maximum of tax-free inheritance is €15,932. For nephews and nieces, the value is €7,967 and for all other heirs (eg friends or neighbours) the non-taxable maximum is €1,594.

After you have determined how much you can receive tax-free, anything above that amount is taxed on a rate dependent on your relationship.

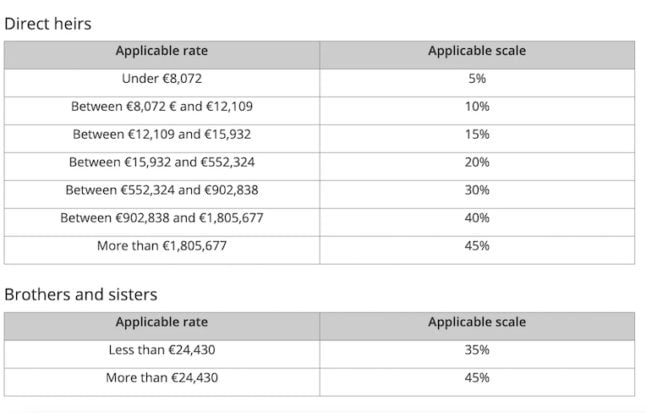

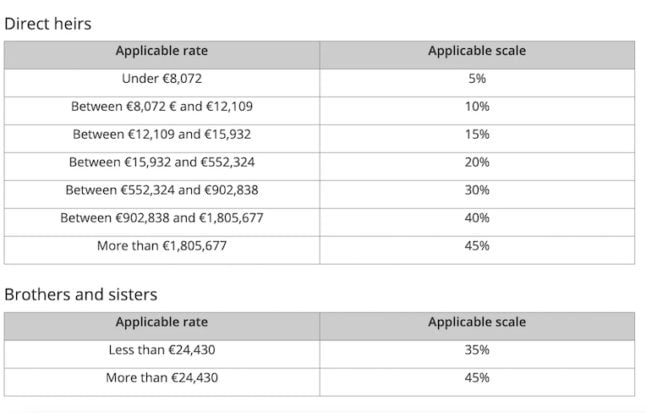

For children and parents – direct heirs – the scale for inheritance after the first €100,000 is shown below, as well as for siblings after €15,932.

Credit: Impots.Gouv.Fr

Credit: Impots.Gouv.Fr

Other relatives, including cousins, are taxed at a flat rate of 55 percent, while all other heirs are taxed at the flat rate of 60 percent.

So for example if your sibling left you €16,932 the first €15,932 would be tax free. You would then pay tax on the remaining €1,000 at the sibling rate of 35 percent, giving you a total tax bill of €350.

However if you were left the same amount by a friend, only the first €1,594 is tax free. You would therefore pay tax on €15,338 at the non-relatives tax rate of 60 percent, giving you a total tax bill of €9,202.

What about gifts?

It's not uncommon for older family members to give gifts to their heirs, but these too may be subject to tax in France.

If as a French resident you want to leave a non-French resident a gift, then French tax rules would apply - similar to inheritance it depends on your relationship with the recipient of the gift, with a sliding scale of how much can be gifted tax-free. See full details here.

If you are in France but are given a gift from someone outside France then, similar to inheritance, you will need to verify whether your country has a tax agreement with France. So for example if you are the child of a UK resident, and they give you a gift, then it would usually be taxed in the UK, but potentially subject to reporting requirements in France (depending on the amount of the gift).

How to avoid problems

So as we've seen things can be complicated when it comes to cross-border inheritance.

For this reason it's a good idea to have a family conversation about inheritance, and to consult specialists - ideally someone with expertise in both the tax and legal aspects of inheritance, who is familiar with both French laws and the laws of your home country - when writing your will.

READ MORE: Wills, estates and notaires - what you need to know about French inheritance law

Notaires (legal experts) are crucial actors in the settlement of an estate. If you live in France and plan on leaving assets to relatives outside France who don't speak French, it's highly recommended to work in advance with a bilingual notaire, who will be able to explain things to your heirs when the time comes.

When someone dies in France, the notaire is responsible for drawing up a notary act which involves listing out all of the people who should be notified to collect their inheritance, as well as what rights apply to them.

The next step will be for the notaire to create a comprehensive inheritance review of the deceased, which involves listing out all of their assets, according to Notaires.Fr.

After this, the notaire will work with the heirs regarding tax formalities, as well as the mortgage if there is one involved. It is at this point that an 'inheritance declaration' for French tax authorities would be drafted. The following forms will need to be filled out and sent to French tax authorities: 2705, 2750-S and 2706 - you can find them here.

The general rule is that French inheritance tax must be paid within six months of the death, but if the death occurred outside of France, then the heirs have up to one year to pay tax. The heirs can work with the French tax authorities to pay in instalments.

The final step of estate settlement in France involves the heirs' deciding whether or not to share property.

This article is intended as a general overview of French law and is not a substitute for legal advice. In all cases, it is best to obtain independent advice that's appropriate to your personal situation, from a financial expert.

Comments

See Also

In some countries taxes are subtracted from the estate before it is distributed, but in France the estate is distributed and then it is the responsibility of the heir to pay taxes on the share they have received.

In terms of the taxation level, the rate can range from 0 to 60 percent based on the person’s relationship with the deceased.

Scenario A: I live outside France, but I received an inheritance from a resident of France

The first thing to verify is whether or not the person who died was indeed a tax resident and fiscally domiciled in France. If you are unsure, you can consult our guide to tax residency. (although ultimately it will be French tax authorities who determine the answer).

Death and taxes: What you need to know about estate planning in France

In some very specific cases, Americans (thanks to the US-France tax treaty) can request to maintain the United States as their fiscal domicile in the first five years of living in France if they can prove they did not intend to move to France permanently and will be moving back to the US, according to tax attorney Jérôme Assouline, who is admitted to the bar in both Paris and New York (and based in Paris).

Oftentimes, this is done by posted workers who have the intention of returning to the US after the end of their contract. The decedent should have taken steps to qualify for this status, so you will need to verify.

However, in most cases, if France was their main home then they would almost certainly be tax resident and fiscally domiciled in France. Keep in mind that this designation can apply to some second-home owners or people who spend long periods in France.

If the person was a French tax resident then their estate - including assets outside France - will be eligible for inheritance taxes in France and by French law.

This means that you, as the heir, would be responsible for paying French inheritance taxes.

Scenario B: I've received an inheritance from someone who didn't live in France, but owned property there

If the person who died was not a French tax resident, but they owned property in France (for example, a second-home owner) then only their assets in France will factor into French inheritance taxes.

So if you have inherited a property or a part share in a property in France, you will be responsible for paying French inheritance tax, even if you don't live in France.

Scenario C: I am a tax resident of France, and I've received an inheritance from someone living outside France

The first question to answer is whether or not the country where the deceased was resident has a tax treaty with France. In the case of the US and UK, there are tax treaties in place to avoid the double taxation of inheritance. For the US, you can find the treaty here. For the UK, you can find the treaty here.

Now, let's say you live in France and your American parent (resident in the US) passes away and leave you an inheritance. In this case, the inheritance, assuming the assets contained are based in the US, ought to be taxed by the United States and not France. If the inheritance comes from a trust, however, the situation may be more complicated.

For those from countries that countries that have no tax treaty in place with France, you may need to declare the inheritance to French tax authorities - even if you don't have to pay tax on it and especially if the inheritance is more than €50,000. In this case you should check with your local tax office.

How much will I have to pay?

So once you have established whether or not you are liable to inheritance tax in France, the next step is how much you will be taxed - and this is on a sliding scale depending on your relationship with the deceased.

The taxable proportion is equal to the taxable assets of the estate minus the tax-free allowance.

The tax-free allowance is determined based on family relationships with the deceased. The surviving spouse or civil union partner is exempt from inheritance tax.

For children and parents of the deceased, up to €100,000 can be given tax-free.

For siblings, the maximum of tax-free inheritance is €15,932. For nephews and nieces, the value is €7,967 and for all other heirs (eg friends or neighbours) the non-taxable maximum is €1,594.

After you have determined how much you can receive tax-free, anything above that amount is taxed on a rate dependent on your relationship.

For children and parents – direct heirs – the scale for inheritance after the first €100,000 is shown below, as well as for siblings after €15,932.

Other relatives, including cousins, are taxed at a flat rate of 55 percent, while all other heirs are taxed at the flat rate of 60 percent.

So for example if your sibling left you €16,932 the first €15,932 would be tax free. You would then pay tax on the remaining €1,000 at the sibling rate of 35 percent, giving you a total tax bill of €350.

However if you were left the same amount by a friend, only the first €1,594 is tax free. You would therefore pay tax on €15,338 at the non-relatives tax rate of 60 percent, giving you a total tax bill of €9,202.

What about gifts?

It's not uncommon for older family members to give gifts to their heirs, but these too may be subject to tax in France.

If as a French resident you want to leave a non-French resident a gift, then French tax rules would apply - similar to inheritance it depends on your relationship with the recipient of the gift, with a sliding scale of how much can be gifted tax-free. See full details here.

If you are in France but are given a gift from someone outside France then, similar to inheritance, you will need to verify whether your country has a tax agreement with France. So for example if you are the child of a UK resident, and they give you a gift, then it would usually be taxed in the UK, but potentially subject to reporting requirements in France (depending on the amount of the gift).

How to avoid problems

So as we've seen things can be complicated when it comes to cross-border inheritance.

For this reason it's a good idea to have a family conversation about inheritance, and to consult specialists - ideally someone with expertise in both the tax and legal aspects of inheritance, who is familiar with both French laws and the laws of your home country - when writing your will.

READ MORE: Wills, estates and notaires - what you need to know about French inheritance law

Notaires (legal experts) are crucial actors in the settlement of an estate. If you live in France and plan on leaving assets to relatives outside France who don't speak French, it's highly recommended to work in advance with a bilingual notaire, who will be able to explain things to your heirs when the time comes.

When someone dies in France, the notaire is responsible for drawing up a notary act which involves listing out all of the people who should be notified to collect their inheritance, as well as what rights apply to them.

The next step will be for the notaire to create a comprehensive inheritance review of the deceased, which involves listing out all of their assets, according to Notaires.Fr.

After this, the notaire will work with the heirs regarding tax formalities, as well as the mortgage if there is one involved. It is at this point that an 'inheritance declaration' for French tax authorities would be drafted. The following forms will need to be filled out and sent to French tax authorities: 2705, 2750-S and 2706 - you can find them here.

The general rule is that French inheritance tax must be paid within six months of the death, but if the death occurred outside of France, then the heirs have up to one year to pay tax. The heirs can work with the French tax authorities to pay in instalments.

The final step of estate settlement in France involves the heirs' deciding whether or not to share property.

This article is intended as a general overview of French law and is not a substitute for legal advice. In all cases, it is best to obtain independent advice that's appropriate to your personal situation, from a financial expert.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.