Death and taxes: What you need to know about estate planning in France

Thinking about death is never fun, but it will come to us all and differences in French inheritance laws and tax rules can make things difficult for foreigners.

Estate planning is a notoriously tricky subject, intertwining both inheritance law and complex tax structures. For foreigners - especially those with assets outside of France - there is an added layer of complication.

The Local spoke with US-based attorney G Warren Whitaker, who specialises in estate planning for expats, to help understand what foreigners should think about to ensure that everything goes smoothly for their heirs.

Inheritance law

First of all, you need to think about who you want to leave your estate to, and whether that is allowed under French law.

France applies forced heirship, which means that children are automatically entitled to a certain portion of the deceased person's estate and under French law, you cannot disinherit your children.

This doesn't just apply to French people, it can also cover people who are legal residents in France.

Thanks to EU succession regulations (Brussels IV), foreign nationals living in France can add a clause (codicil) to their will stating that they wish to see their estate handled by the law of their country - in which case you would not be governed by French rules on inheritance for children.

READ MORE: Wills, estates and notaires - what you need to know about French inheritance law

But if you die in France as a resident, without having made a will, then the French Civil Code will apply when your assets are being divided up.

Even if you have added the codicil to your will, this does not take away the requirement to pay inheritance tax in France (more on that below).

Tax obligations and residency

Once you have established a valid will, there's then the question of inheritance tax - and here the thing that is important is whether you have tax residency in France.

The key thing to know here is that 'tax residency' and residency for immigration purposes (ie your visa or carte de séjour) are not the same thing. Tax residency can be an automatic status based on simply being in a country for a certain period of time.

The French government considers you a tax resident if you either: live in France, work in France, or have the centre of your economic interests in France.

By the French government's definition, living in France and having it as your main residence means that you stay here more than six months a year - so for example second-home owners who have a six-month visa and also pay visits under the 90-day rule could find themselves becoming tax residents in France.

EXPLAINED: The rules on tax residency in France

In terms of which country is responsible for taxing your estate after your death, the answer depends on whether you own property in France and whether you are a tax resident.

In France, inheritance taxes can range from 0 to 60 percent based on the person's relationship with the deceased. In contrast to the US and UK, it is the recipient who is responsible for paying tax (based on the amount they receive) rather than entire estate being taxed prior to distribution.

The standard rule is that if you are considered to be a resident of France, then your entire estate, including assets located outside of France, can be subject to inheritance tax by French authorities (subject to international agreements and bilateral tax treaties).

If you are not a resident of France, only your assets located in France (for example a French property) would be subject to French inheritance taxes.

Fiscal domicile

In very specific cases, certain people may be able to maintain a fiscal domicile in their home country rather than France on the basis of the tax treaty between France and their home country.

For Americans specifically, Paris-based tax attorney, Jérôme Assouline, who is admitted to the bar in both Paris and New York, told The Local that it is possible as a result of the tax treaty for Americans who intend to only live in France for a short period of time to maintain the US as their fiscal domicile (meaning their inheritance would be taxed by the United States).

This option is only available for the first five years one lives in France, and "it is only available to those who can prove they are only temporarily in France," Assouline explained. It is used by posted workers or people on a fixed-term contract who plan to return to the US.

To qualify you must be able to show intent to return to the United States, and it is only available for the first five years of residency in France. It is recommended that people in this situation work with a tax professional.

Tax rates

If you are covered by French inheritance taxes, then there is a sliding scale depending on the value of the estate and your relationship to the deceased.

The taxable proportion is equal to the taxable assets of the estate minus the tax-free allowance.

The tax-free allowance is determined based on family relationships with the deceased;

- The surviving spouse or civil partner is exempt from inheritance tax

- For children and parents of the deceased, up to €100,000 can be given tax-free

- For siblings, the maximum of tax-free inheritance is €15,932

- For nephews and nieces, the value is €7,967

- For all other heirs (eg friends or neighbours) the non-taxable maximum is €1,594

After you have determined how much you can receive tax-free, anything above that amount is taxed on a rate dependent on your relationship.

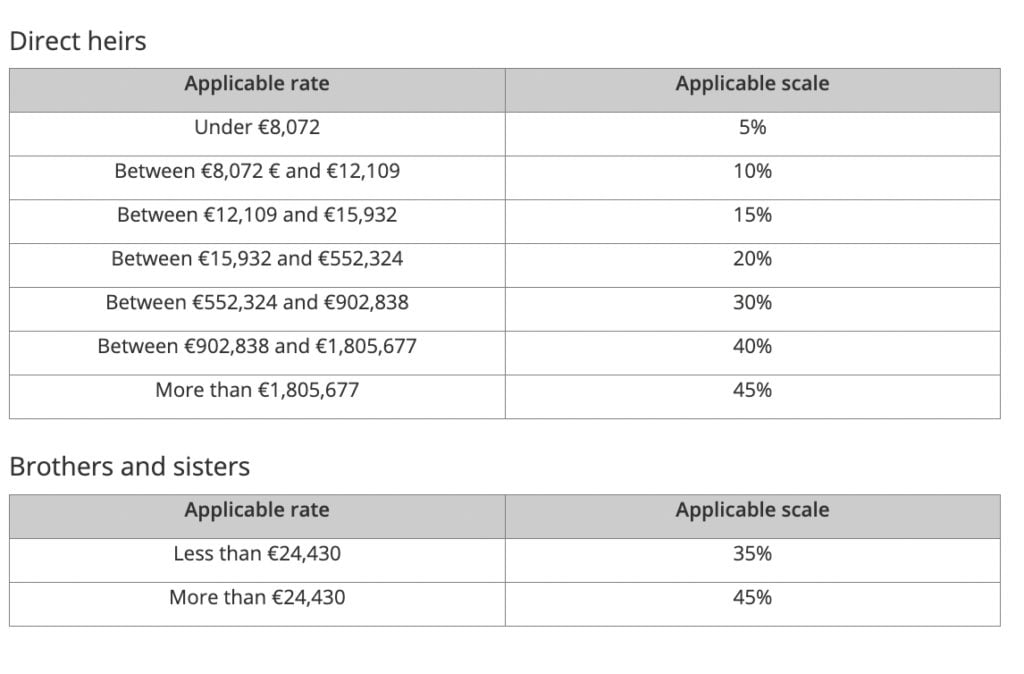

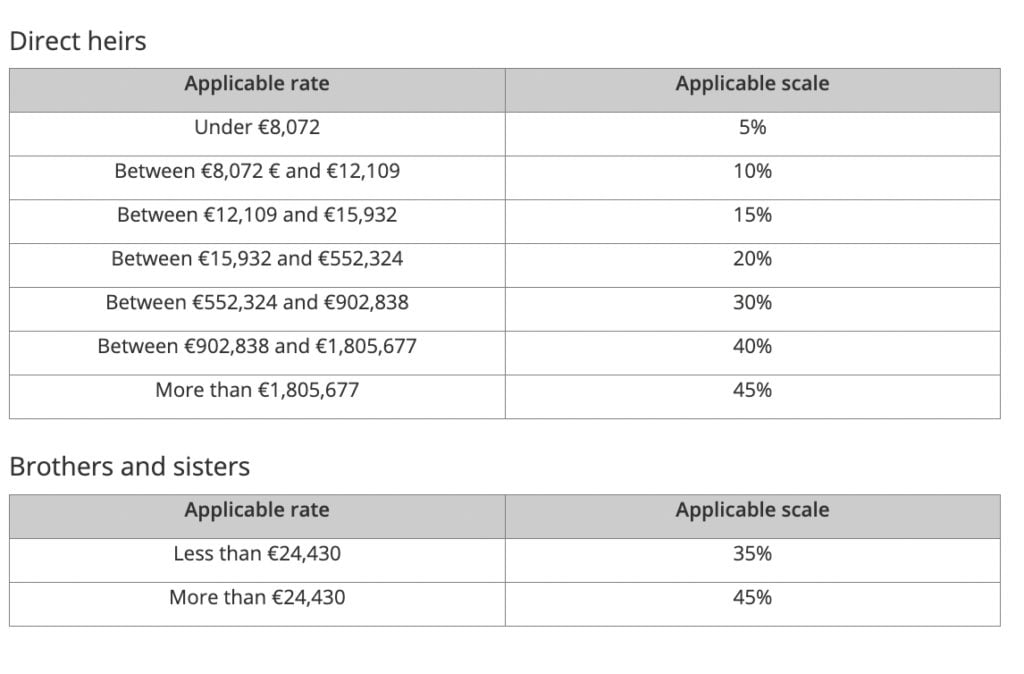

For children and parents - direct heirs - the scale for inheritance after the first €100,000 is shown below, as well as for siblings after €15,932.

Credit: Impots.gouv.fr

Other relatives, including cousins, are taxed at a flat rate of 55 percent, while all other heirs are taxed at the flat rate of 60 percent.

So for example if you left a sibling €16,932 the first €15,932 would be tax free. They would then pay tax on the remaining €1,000 at the sibling rate of 35 percent, giving them a total tax bill of €350.

However if you left the same amount to a friend, only the first €1,594 is tax free. They would therefore pay tax on €15,338 at the non-relatives tax rate of 60 percent, giving them a total tax bill of €9,202.

READ ALSO Who is responsible for paying inheritance tax in France?

Wealth tax

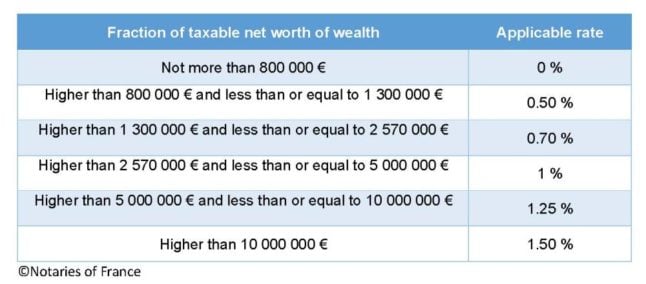

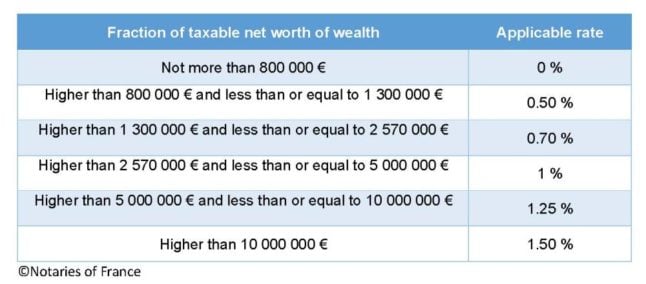

On top of inheritance tax, France has a wealth tax, which can be applied to people with total assets worth more than €1.3 million. However, in this case, the length of residency plays a role.

Credit: Notaires.fr

"If you are resident in France for more than five years, then French wealth taxes can be applied to your global assets" explained Whitaker.

Prior to five years, the French wealth tax considers assets based in France, not abroad.

Beware of alternative structures to avoid inheritance law

Foreigners are often encouraged to seek out alternative options for avoiding French inheritance law, such as purchasing a home under the SCI structure, adding a tontine clause into the deed, or starting an Assurance Vie.

An SCI, or a société civile immobilière, is a non-trading real estate company that allows people to own property such as a second home through shares of a company, rather than under their own name.

However, owning and operating an SCI can be especially complex for foreigners, particularly when picking the correct tax regime. Paris-based notaire, Laure Gaschignard, told The Local in a previous interview that "an SCI is a large commitment. It means you will agree to run a company, and that involves paperwork and meetings."

READ ALSO The advantages and pitfalls of buying property with an SCI

As for purchasing a home with a tontine clause in the deed (contrat de vente), if one partner dies then the surviving partner is considered to be the sole owner of the entire property.

The clause requires agreement of the two partners and must be added when purchasing the home. One primary downside is that the purchasers cannot take legal action later on to divide up the property later on should conflict arise - decisions, including whether to sell, must be made unanimously.

Many foreigners are also encouraged to open an Assurance Vie, which is a life insurance wrapper that holds investments, usually with a minimum deposit - but for Americans living in France an Assurance Vie can lead to lengthy and complicated dealings with the IRS.

READ MORE: 'Death by a thousand cuts': Assurance Vie tax warning for Americans in France

Keep in mind that these methods can have other legal and ramifications, as well as on the inheritance of any children or step-children down the line.

Before opting for these avenues, speak with both law and tax professionals in France to understand possible unintended consequences.

For instance, foreigners often equate French inheritance law and inheritance tax structures, but they are different - you may successfully avoid French forced heirship while still finding yourself still subject to wealth and inheritance taxes.

Take the example of a couple who purchases a home with a tontine clause in the deed. If the couple is not married or in a civil partnership (PACS), then the tontine clause would allow one partner to inherit the entire property. However, they may still be subject to a high inheritance tax (up to 60 percent) as they are not considered to be a family member.

Trusts

It is not uncommon for people from the United States to have either set up a trust or to be a beneficiary of one.

However these can cause problems in France.

"Trusts have a negative reputation in France, and for a while the country did not know how to tax them", Whitaker explained.

"10 years ago, France passed a law that cut through any legal concepts that Americans might have about trusts, which in effect makes it so that France views the beneficiary as owning the trust."

Find the full detail on the situation for Americans with trusts HERE.

What to do to plan your estate effectively

As with most things, the key is forward planning. You want to ensure that you are not creating problems for your heirs after you die - and that is especially the case if your heirs don't live in France, don't speak French or don't understand the French legal system.

French estates are administered by notaires, and it would usually be the notaire that you work with who will deal with your estate after you die - if you're leaving your estate to non-French speakers it is therefore a good idea to work with a bilingual notaire, who can explain everything to your heirs once it becomes time to administer the estate.

Whitaker told The Local that it is crucial for foreigners in France to work with a multi-national team of both lawyers and accountants when estate planning - to ensure that there are no surprises for your heirs.

As mentioned above, it is possible to add a clause to your existing will requesting that your estate be handled by the laws of your country of nationality.

"In theory, one will can govern everything", explained Whitaker.

"That being said, sometimes it is simpler when it comes to administration to have two wills.

"It's easier to have a will that is done in French and by a French notaire. For Americans, if they only have one will from the United States, then it must be sent to probate in the US and translated before being applied in France.

"For people with real estate in France especially, we often recommend a separate French will for them," the estate planning expert told The Local.

Once again, before you decide to do so, be sure to work with both tax and legal professionals in your home country and in France to ensure that the information in one Will is not in conflict with the other.

When working with your estate planning team, be sure that you are instructed on whether your country has a dual-taxation agreement with France, and if so, how it works.

This means that the estate planning for your English-speaking friend who has also retired to France, but from a different country, could look very different from your own. One key example is the way the US-France tax treaty approaches US-based pensions.

READ MORE: Reader question: How can I find English-speaking lawyers and accountants in France?

Think about whether it is advantageous to gift assets before death

The threshold for tax-free lifetime gifts in the United Kingdom and United States is different than in France. For Americans, the maximum amount one can give during their lifetime is $13 million in gifts before taxation applies. In the United Kingdom, inheritance tax is only applied to gifts if they are given in the last seven years of the person's life.

But the French fiscal regime has specific maximums for different family members and non-family members. It is most generous for children, allowing parents to give up to €100,000 every 15 years per child before being subject to tax.

As such, Whitaker often recommends that his American clients give away parts of their estate prior to becoming a resident of France.

Ultimately, this will depend on the tax regime of your home country, as well as any existing tax treaties between your home country and France. It is advised to work with professionals before deciding to gift your assets as you will want to ensure sufficient funds to sustain yourself while living in France.

This article is intended as a general overview of French inheritance and tax laws, and is not intended as a substitute for legal advice. In all cases, it is best to obtain independent advice that's appropriate to your personal situation, from a financial or legal expert.

Comments (1)

See Also

Estate planning is a notoriously tricky subject, intertwining both inheritance law and complex tax structures. For foreigners - especially those with assets outside of France - there is an added layer of complication.

The Local spoke with US-based attorney G Warren Whitaker, who specialises in estate planning for expats, to help understand what foreigners should think about to ensure that everything goes smoothly for their heirs.

Inheritance law

First of all, you need to think about who you want to leave your estate to, and whether that is allowed under French law.

France applies forced heirship, which means that children are automatically entitled to a certain portion of the deceased person's estate and under French law, you cannot disinherit your children.

This doesn't just apply to French people, it can also cover people who are legal residents in France.

Thanks to EU succession regulations (Brussels IV), foreign nationals living in France can add a clause (codicil) to their will stating that they wish to see their estate handled by the law of their country - in which case you would not be governed by French rules on inheritance for children.

READ MORE: Wills, estates and notaires - what you need to know about French inheritance law

But if you die in France as a resident, without having made a will, then the French Civil Code will apply when your assets are being divided up.

Even if you have added the codicil to your will, this does not take away the requirement to pay inheritance tax in France (more on that below).

Tax obligations and residency

Once you have established a valid will, there's then the question of inheritance tax - and here the thing that is important is whether you have tax residency in France.

The key thing to know here is that 'tax residency' and residency for immigration purposes (ie your visa or carte de séjour) are not the same thing. Tax residency can be an automatic status based on simply being in a country for a certain period of time.

The French government considers you a tax resident if you either: live in France, work in France, or have the centre of your economic interests in France.

By the French government's definition, living in France and having it as your main residence means that you stay here more than six months a year - so for example second-home owners who have a six-month visa and also pay visits under the 90-day rule could find themselves becoming tax residents in France.

EXPLAINED: The rules on tax residency in France

In terms of which country is responsible for taxing your estate after your death, the answer depends on whether you own property in France and whether you are a tax resident.

In France, inheritance taxes can range from 0 to 60 percent based on the person's relationship with the deceased. In contrast to the US and UK, it is the recipient who is responsible for paying tax (based on the amount they receive) rather than entire estate being taxed prior to distribution.

The standard rule is that if you are considered to be a resident of France, then your entire estate, including assets located outside of France, can be subject to inheritance tax by French authorities (subject to international agreements and bilateral tax treaties).

If you are not a resident of France, only your assets located in France (for example a French property) would be subject to French inheritance taxes.

Fiscal domicile

In very specific cases, certain people may be able to maintain a fiscal domicile in their home country rather than France on the basis of the tax treaty between France and their home country.

For Americans specifically, Paris-based tax attorney, Jérôme Assouline, who is admitted to the bar in both Paris and New York, told The Local that it is possible as a result of the tax treaty for Americans who intend to only live in France for a short period of time to maintain the US as their fiscal domicile (meaning their inheritance would be taxed by the United States).

This option is only available for the first five years one lives in France, and "it is only available to those who can prove they are only temporarily in France," Assouline explained. It is used by posted workers or people on a fixed-term contract who plan to return to the US.

To qualify you must be able to show intent to return to the United States, and it is only available for the first five years of residency in France. It is recommended that people in this situation work with a tax professional.

Tax rates

If you are covered by French inheritance taxes, then there is a sliding scale depending on the value of the estate and your relationship to the deceased.

The taxable proportion is equal to the taxable assets of the estate minus the tax-free allowance.

The tax-free allowance is determined based on family relationships with the deceased;

- The surviving spouse or civil partner is exempt from inheritance tax

- For children and parents of the deceased, up to €100,000 can be given tax-free

- For siblings, the maximum of tax-free inheritance is €15,932

- For nephews and nieces, the value is €7,967

- For all other heirs (eg friends or neighbours) the non-taxable maximum is €1,594

After you have determined how much you can receive tax-free, anything above that amount is taxed on a rate dependent on your relationship.

For children and parents - direct heirs - the scale for inheritance after the first €100,000 is shown below, as well as for siblings after €15,932.

Other relatives, including cousins, are taxed at a flat rate of 55 percent, while all other heirs are taxed at the flat rate of 60 percent.

So for example if you left a sibling €16,932 the first €15,932 would be tax free. They would then pay tax on the remaining €1,000 at the sibling rate of 35 percent, giving them a total tax bill of €350.

However if you left the same amount to a friend, only the first €1,594 is tax free. They would therefore pay tax on €15,338 at the non-relatives tax rate of 60 percent, giving them a total tax bill of €9,202.

READ ALSO Who is responsible for paying inheritance tax in France?

Wealth tax

On top of inheritance tax, France has a wealth tax, which can be applied to people with total assets worth more than €1.3 million. However, in this case, the length of residency plays a role.

"If you are resident in France for more than five years, then French wealth taxes can be applied to your global assets" explained Whitaker.

Prior to five years, the French wealth tax considers assets based in France, not abroad.

Beware of alternative structures to avoid inheritance law

Foreigners are often encouraged to seek out alternative options for avoiding French inheritance law, such as purchasing a home under the SCI structure, adding a tontine clause into the deed, or starting an Assurance Vie.

An SCI, or a société civile immobilière, is a non-trading real estate company that allows people to own property such as a second home through shares of a company, rather than under their own name.

However, owning and operating an SCI can be especially complex for foreigners, particularly when picking the correct tax regime. Paris-based notaire, Laure Gaschignard, told The Local in a previous interview that "an SCI is a large commitment. It means you will agree to run a company, and that involves paperwork and meetings."

READ ALSO The advantages and pitfalls of buying property with an SCI

As for purchasing a home with a tontine clause in the deed (contrat de vente), if one partner dies then the surviving partner is considered to be the sole owner of the entire property.

The clause requires agreement of the two partners and must be added when purchasing the home. One primary downside is that the purchasers cannot take legal action later on to divide up the property later on should conflict arise - decisions, including whether to sell, must be made unanimously.

Many foreigners are also encouraged to open an Assurance Vie, which is a life insurance wrapper that holds investments, usually with a minimum deposit - but for Americans living in France an Assurance Vie can lead to lengthy and complicated dealings with the IRS.

READ MORE: 'Death by a thousand cuts': Assurance Vie tax warning for Americans in France

Keep in mind that these methods can have other legal and ramifications, as well as on the inheritance of any children or step-children down the line.

Before opting for these avenues, speak with both law and tax professionals in France to understand possible unintended consequences.

For instance, foreigners often equate French inheritance law and inheritance tax structures, but they are different - you may successfully avoid French forced heirship while still finding yourself still subject to wealth and inheritance taxes.

Take the example of a couple who purchases a home with a tontine clause in the deed. If the couple is not married or in a civil partnership (PACS), then the tontine clause would allow one partner to inherit the entire property. However, they may still be subject to a high inheritance tax (up to 60 percent) as they are not considered to be a family member.

Trusts

It is not uncommon for people from the United States to have either set up a trust or to be a beneficiary of one.

However these can cause problems in France.

"Trusts have a negative reputation in France, and for a while the country did not know how to tax them", Whitaker explained.

"10 years ago, France passed a law that cut through any legal concepts that Americans might have about trusts, which in effect makes it so that France views the beneficiary as owning the trust."

Find the full detail on the situation for Americans with trusts HERE.

What to do to plan your estate effectively

As with most things, the key is forward planning. You want to ensure that you are not creating problems for your heirs after you die - and that is especially the case if your heirs don't live in France, don't speak French or don't understand the French legal system.

French estates are administered by notaires, and it would usually be the notaire that you work with who will deal with your estate after you die - if you're leaving your estate to non-French speakers it is therefore a good idea to work with a bilingual notaire, who can explain everything to your heirs once it becomes time to administer the estate.

Whitaker told The Local that it is crucial for foreigners in France to work with a multi-national team of both lawyers and accountants when estate planning - to ensure that there are no surprises for your heirs.

As mentioned above, it is possible to add a clause to your existing will requesting that your estate be handled by the laws of your country of nationality.

"In theory, one will can govern everything", explained Whitaker.

"That being said, sometimes it is simpler when it comes to administration to have two wills.

"It's easier to have a will that is done in French and by a French notaire. For Americans, if they only have one will from the United States, then it must be sent to probate in the US and translated before being applied in France.

"For people with real estate in France especially, we often recommend a separate French will for them," the estate planning expert told The Local.

Once again, before you decide to do so, be sure to work with both tax and legal professionals in your home country and in France to ensure that the information in one Will is not in conflict with the other.

When working with your estate planning team, be sure that you are instructed on whether your country has a dual-taxation agreement with France, and if so, how it works.

This means that the estate planning for your English-speaking friend who has also retired to France, but from a different country, could look very different from your own. One key example is the way the US-France tax treaty approaches US-based pensions.

READ MORE: Reader question: How can I find English-speaking lawyers and accountants in France?

Think about whether it is advantageous to gift assets before death

The threshold for tax-free lifetime gifts in the United Kingdom and United States is different than in France. For Americans, the maximum amount one can give during their lifetime is $13 million in gifts before taxation applies. In the United Kingdom, inheritance tax is only applied to gifts if they are given in the last seven years of the person's life.

But the French fiscal regime has specific maximums for different family members and non-family members. It is most generous for children, allowing parents to give up to €100,000 every 15 years per child before being subject to tax.

As such, Whitaker often recommends that his American clients give away parts of their estate prior to becoming a resident of France.

Ultimately, this will depend on the tax regime of your home country, as well as any existing tax treaties between your home country and France. It is advised to work with professionals before deciding to gift your assets as you will want to ensure sufficient funds to sustain yourself while living in France.

This article is intended as a general overview of French inheritance and tax laws, and is not intended as a substitute for legal advice. In all cases, it is best to obtain independent advice that's appropriate to your personal situation, from a financial or legal expert.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.