How much Capital Gains Tax will you pay if you sell your French property?

If you're thinking of selling a French property, you should first be aware of the rules around paying Capital Gains Tax in France.

Capital Gains Tax is the one-off tax payable in certain cases if you get an unusual extra addition to your finances - and for most people the most common scenario when this would apply is if you are selling a property.

Most countries have their own versions of Capital Gains Tax (CGT) and France is no exception, here it is called Impôt sur les plus-values.

It applies to all capital gains, the most common scenario is selling a property but you may also be liable for the tax if you sell land, outbuildings or other assets, or receive a lump sum of cash (that is not an inheritance).

But how much you pay, and whether you need to pay at all, varies depending on your personal circumstances.

Do you have to pay Capital Gains Tax?

There are actually quite a few exemptions to this tax.

Is it your main home or a second home? If you are selling your main residence, then there is no CGT to pay. If your property is a second home or holiday home, however, then you may have to pay GCT.

All properties in France need to be registered with the tax office as either résidence primaire (main residence) or résidence sécondaire (second home) or as a holiday rental or property rented out on a long-term lease. Only main residences are exempt from CGT.

If you are selling a property because you are getting divorced or separating, it is sufficient for one partner to live there until the sale date.

Did you sell it for more than you paid for it? If you made a loss on the property, then there is no gain and therefore no tax to pay. The tax is paid only on the part of the sale price that is profit - for example if you bought your home for €100,000 and sold it for €120,000 then you will be taxed on the €20,000.

Have you owned the property for more than 22 years? If you have owned the property for more then 22 years, then you are exempt from CGT.

If you have owned the property for between 22 and 30 years you will be exempt from CGT but may still have to pay social contributions (more on that below). If you have had the property for more than 30 years you are exempt from both CGT and social contributions.

If it is a second home, do you own your main residence? If the property you are selling is the only one you own, you are exempt from CGT even if it is a second home. So for example if you live in Paris in a rented apartment, but you have a property in the country that you use as a second home, you are exempt from CGT if you sell your countryside property. In this case you must have not owned your main residence for at least four years before the sale.

You can also claim an exemption if you intend to use the proceeds from the sale to buy or build yourself a main residence within two years of the date of the sale.

Are you a pensioner/disabled/living in an old age home? If you are a pensioner or in possession of a CMI (disability card) and your income is below a certain level (usually the level of the French minimum wage) then you are exempt. If you have moved into a care home or nursing home, you are usually exempt from CGT if you sell your property within two years.

Did your property sell for less than €15,000? This probably won't apply to many people selling homes, but could apply if you were selling land or outbuildings. If the sale price was less than €15,000 then no CGT is applied.

These are the main exemptions to CGT, but there are some others in specific cases - for example if you are selling a second home in an area that has a housing shortage you could be entitled to a discount or exemption, likewise if you are selling to a social housing project.

Where do you have to pay?

Assuming that none of the above apply to you, the next question is where you pay the tax.

This one is simple - in most cases you would pay in France, even if you are not resident here, because the capital gain was made in France. The conditions under which you are taxed are the same as for French residents.

In this case whether you are a French citizen or foreigner makes no difference.

For non-EU citizens, dual taxation treaties apply so that you would not also be taxed on the income in your home country.

How much?

Once you've established that you are liable for CGT, then it's time to look at how much you have to pay.

Have you done major renovation works? If you bought your property as a renovation project, you may be able to subtract the cost of the works from the taxable amount. For this you will need to have owned it for at least five years. You can then add to the original purchase price either the cost of the works done, or 15 percent of the purchase price. For this you will need to provide detailed documentation of the works done and the cost.

You can also deduct from the sale price the cost of any compulsory certification (for example the energy diagnostic required in order to sell a property) and the notaire fee.

Inherited property - if you inherited the property or were given it as a gift, the purchase price is the figure used to calculate your inheritance tax or gift tax.

Once you have done your sums and worked out the amount that is taxable (sale price minus purchase price minus any deductions as outlined above) you then check the tax rate for your circumstances.

Tax v social security contributions

If you're resident in France you will already be familiar with this concept, but there are two types of deduction - tax (impôts) and social security contributions (prélèvements sociaux).

The government insists that social security contributions are not a tax, and in a sense they're right as deductions like this cover things like health cover (similar to National Insurance in the UK) and pension contributions - but they're still money taken from you by the government on a non-voluntary basis, so most people see them as tax.

So how much?

The basic rate of Capital Gains Tax is 19 percent.

So if you bought your house for €100,000 and sold it for €120,000 (once the deductions are taken into account) then you would pay €3,800 in CGT (which is 19 percent of the €20,000 profit).

You also pay social security contributions and these are charged at the basic rate of 17.2 percent. So taking the same example that would be €3,400 of your €20,000 profit - bringing your total tax bill to €7,200.

If you made more than €50,000 profit then the CGT rate rises by between two and six percent, depending on the amount. The social security contribution amount remains the same.

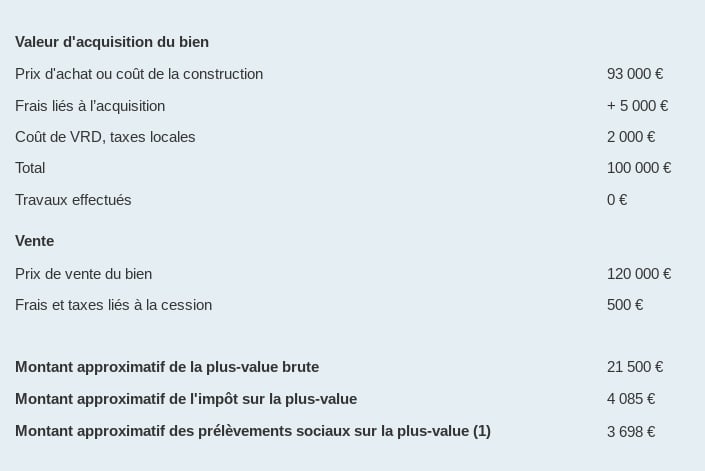

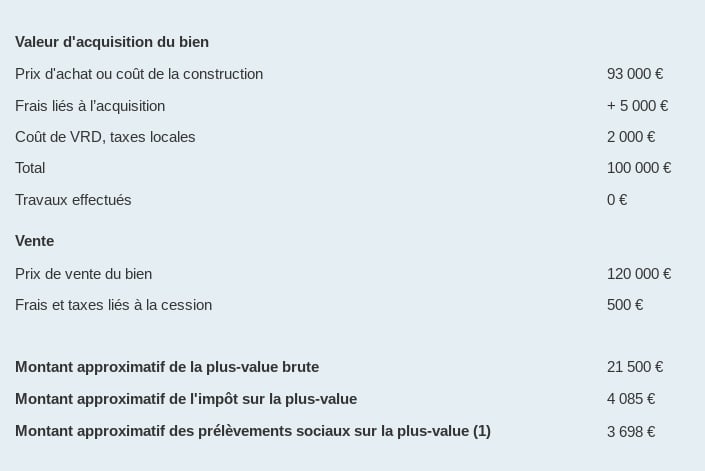

If your head is bursting from too much maths, head to the French government simulator which will work out your tax and social security contributions HERE.

From impots.gouv.fr

If you're confused about the various exemptions, the simulator also asks you a series of questions about your personal circumstances to help you ascertain whether you are liable for CGT.

You can find the full explanation of how the system works (in French) of the government Public Service website here.

Comments

See Also

Capital Gains Tax is the one-off tax payable in certain cases if you get an unusual extra addition to your finances - and for most people the most common scenario when this would apply is if you are selling a property.

Most countries have their own versions of Capital Gains Tax (CGT) and France is no exception, here it is called Impôt sur les plus-values.

It applies to all capital gains, the most common scenario is selling a property but you may also be liable for the tax if you sell land, outbuildings or other assets, or receive a lump sum of cash (that is not an inheritance).

But how much you pay, and whether you need to pay at all, varies depending on your personal circumstances.

Do you have to pay Capital Gains Tax?

There are actually quite a few exemptions to this tax.

Is it your main home or a second home? If you are selling your main residence, then there is no CGT to pay. If your property is a second home or holiday home, however, then you may have to pay GCT.

All properties in France need to be registered with the tax office as either résidence primaire (main residence) or résidence sécondaire (second home) or as a holiday rental or property rented out on a long-term lease. Only main residences are exempt from CGT.

If you are selling a property because you are getting divorced or separating, it is sufficient for one partner to live there until the sale date.

Did you sell it for more than you paid for it? If you made a loss on the property, then there is no gain and therefore no tax to pay. The tax is paid only on the part of the sale price that is profit - for example if you bought your home for €100,000 and sold it for €120,000 then you will be taxed on the €20,000.

Have you owned the property for more than 22 years? If you have owned the property for more then 22 years, then you are exempt from CGT.

If you have owned the property for between 22 and 30 years you will be exempt from CGT but may still have to pay social contributions (more on that below). If you have had the property for more than 30 years you are exempt from both CGT and social contributions.

If it is a second home, do you own your main residence? If the property you are selling is the only one you own, you are exempt from CGT even if it is a second home. So for example if you live in Paris in a rented apartment, but you have a property in the country that you use as a second home, you are exempt from CGT if you sell your countryside property. In this case you must have not owned your main residence for at least four years before the sale.

You can also claim an exemption if you intend to use the proceeds from the sale to buy or build yourself a main residence within two years of the date of the sale.

Are you a pensioner/disabled/living in an old age home? If you are a pensioner or in possession of a CMI (disability card) and your income is below a certain level (usually the level of the French minimum wage) then you are exempt. If you have moved into a care home or nursing home, you are usually exempt from CGT if you sell your property within two years.

Did your property sell for less than €15,000? This probably won't apply to many people selling homes, but could apply if you were selling land or outbuildings. If the sale price was less than €15,000 then no CGT is applied.

These are the main exemptions to CGT, but there are some others in specific cases - for example if you are selling a second home in an area that has a housing shortage you could be entitled to a discount or exemption, likewise if you are selling to a social housing project.

Where do you have to pay?

Assuming that none of the above apply to you, the next question is where you pay the tax.

This one is simple - in most cases you would pay in France, even if you are not resident here, because the capital gain was made in France. The conditions under which you are taxed are the same as for French residents.

In this case whether you are a French citizen or foreigner makes no difference.

For non-EU citizens, dual taxation treaties apply so that you would not also be taxed on the income in your home country.

How much?

Once you've established that you are liable for CGT, then it's time to look at how much you have to pay.

Have you done major renovation works? If you bought your property as a renovation project, you may be able to subtract the cost of the works from the taxable amount. For this you will need to have owned it for at least five years. You can then add to the original purchase price either the cost of the works done, or 15 percent of the purchase price. For this you will need to provide detailed documentation of the works done and the cost.

You can also deduct from the sale price the cost of any compulsory certification (for example the energy diagnostic required in order to sell a property) and the notaire fee.

Inherited property - if you inherited the property or were given it as a gift, the purchase price is the figure used to calculate your inheritance tax or gift tax.

Once you have done your sums and worked out the amount that is taxable (sale price minus purchase price minus any deductions as outlined above) you then check the tax rate for your circumstances.

Tax v social security contributions

If you're resident in France you will already be familiar with this concept, but there are two types of deduction - tax (impôts) and social security contributions (prélèvements sociaux).

The government insists that social security contributions are not a tax, and in a sense they're right as deductions like this cover things like health cover (similar to National Insurance in the UK) and pension contributions - but they're still money taken from you by the government on a non-voluntary basis, so most people see them as tax.

So how much?

The basic rate of Capital Gains Tax is 19 percent.

So if you bought your house for €100,000 and sold it for €120,000 (once the deductions are taken into account) then you would pay €3,800 in CGT (which is 19 percent of the €20,000 profit).

You also pay social security contributions and these are charged at the basic rate of 17.2 percent. So taking the same example that would be €3,400 of your €20,000 profit - bringing your total tax bill to €7,200.

If you made more than €50,000 profit then the CGT rate rises by between two and six percent, depending on the amount. The social security contribution amount remains the same.

If your head is bursting from too much maths, head to the French government simulator which will work out your tax and social security contributions HERE.

If you're confused about the various exemptions, the simulator also asks you a series of questions about your personal circumstances to help you ascertain whether you are liable for CGT.

You can find the full explanation of how the system works (in French) of the government Public Service website here.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.