What are your French taxes spent on?

France is a high-tax country, but you also get a lot for your money - using a new government tool, you can see exactly how the French government spends your taxes.

As French tax declaration season opens, you might be focusing on how much you will have to pay in taxes this year. While France is one of the most highely taxed countries in Europe, it also offers many state-funded services that help to give France the enjoyable quality of life that many foreigners move here for.

Now - with the help of a new government tool - you can see exactly where your taxes go in France, and how much those services have an impact on your daily life.

Taking data from 2019 and using the sum of €1,000 as an example, the French tax authorities have created a diagram to help taxpayers visualise where their money is going. You can access it HERE.

The breakdown is based on impôts - income taxes. Most people in France will also pay social charges, which include pension contributions and unemployment insurance. If you own property in France you will also pay property taxes, which are collected by local authorities and spent on local services.

Once you file your tax declaration for 2023 online, you will be given an option to head to this page - which might cheer you up after wrestling with the form.

READ MORE: How to file your 2023 French income tax declaration

Source: economie.gouv.fr

In general, over half of your taxes (impôts) go toward social welfare, representing approximately €572 out of every €1,000.

This can be broken down into a few different segments: retirement (retraites), health (santé), family (famille), unemployment (chômage), housing aid (aide au logement) and other benefits (autre solidarité).

The largest section is pensions - although you also pay contributions to your own pension pot, many French pension schemes - particularly for those which allow early retirement for public sector employees like train drivers - are loss-making and are subsidised by the government.

Source economie.gouv.fr

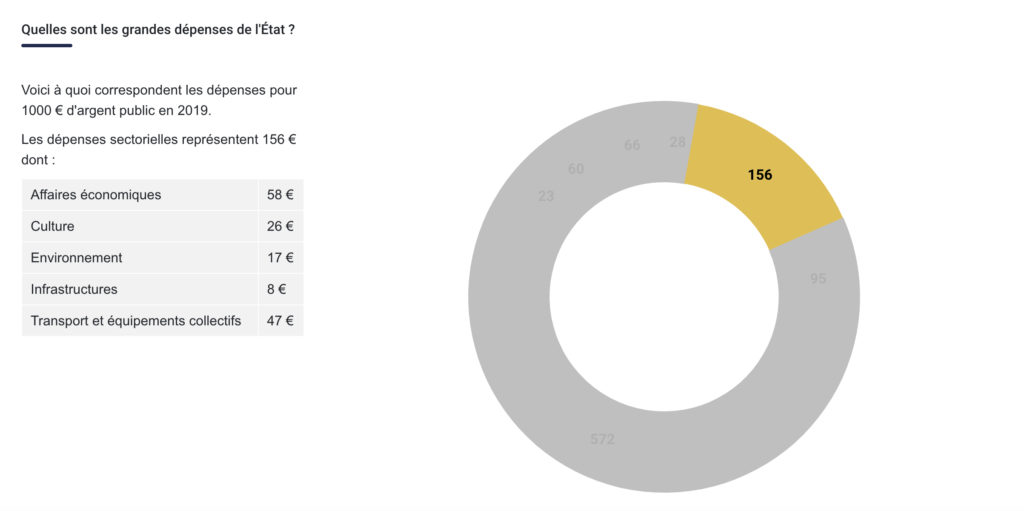

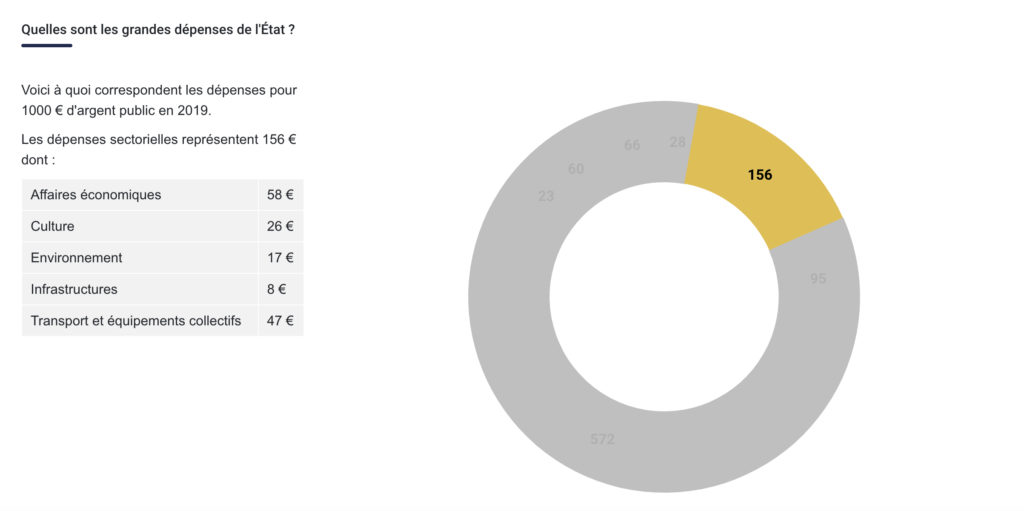

The next largest chunk of your taxable income (€156 out of €1,000) is spent on 'sectoral expenses'. This covers services provided by different government ministries - such as economy, culture, and environment. It also helps to fund infrastructure and transport projects.

Source; economie.gouv.fr

In third place, taking up about €95 out of every €1,000 paid in tax, is education.

To get a better idea of how much it costs the French government to run things, like schools and daycare centres, you can scroll down to see links to different subjects, such as education, health and housing. Each of these links will take you to a government-run page that outlines the average costs for specific services.

When it comes to education, the government broke expenses down by education level - from crèche all the way up to university.

For example, on average it costs the public administration €6,805 to send one child to primary school for one year. Prices increase as the child gets older - with secondary school (collège) the cost is about €8,206 per student per year and for lycée, it is €10,986 per student per year.

The French government also helps to fund back-to-school allowances that are means-tested and paid out to low income families.

As for university, the French government pays a sizeable portion of yearly costs. On average, it costs €11,580 per student per year at university, 66 percent of which is financed by the State, nine percent by local authorities, four percent by other public administrations, 12 percent by companies and finally, nine percent by either the student themselves or their family.

In healthcare, you will be able to see how much the State pays for appointments and visits, as well as emergency services. An ambulance ride, for example, costs an average of €97, with a minimum of 65 percent of that cost being reimbursed by the French government, and often 100 percent for emergency situations.

Finally, €66 out of every €1,000 are spent on "public administration services", €60 are spent in the 'sovereignty' domain, which includes defence spending (€31 out of €1,000), justice (€4 out of €1,000) and general security (€25 out of €1,000).

The remaining funds go toward paying off the public debt (€28) and research (€23).

Comments

See Also

As French tax declaration season opens, you might be focusing on how much you will have to pay in taxes this year. While France is one of the most highely taxed countries in Europe, it also offers many state-funded services that help to give France the enjoyable quality of life that many foreigners move here for.

Now - with the help of a new government tool - you can see exactly where your taxes go in France, and how much those services have an impact on your daily life.

Taking data from 2019 and using the sum of €1,000 as an example, the French tax authorities have created a diagram to help taxpayers visualise where their money is going. You can access it HERE.

The breakdown is based on impôts - income taxes. Most people in France will also pay social charges, which include pension contributions and unemployment insurance. If you own property in France you will also pay property taxes, which are collected by local authorities and spent on local services.

Once you file your tax declaration for 2023 online, you will be given an option to head to this page - which might cheer you up after wrestling with the form.

READ MORE: How to file your 2023 French income tax declaration

In general, over half of your taxes (impôts) go toward social welfare, representing approximately €572 out of every €1,000.

This can be broken down into a few different segments: retirement (retraites), health (santé), family (famille), unemployment (chômage), housing aid (aide au logement) and other benefits (autre solidarité).

The largest section is pensions - although you also pay contributions to your own pension pot, many French pension schemes - particularly for those which allow early retirement for public sector employees like train drivers - are loss-making and are subsidised by the government.

The next largest chunk of your taxable income (€156 out of €1,000) is spent on 'sectoral expenses'. This covers services provided by different government ministries - such as economy, culture, and environment. It also helps to fund infrastructure and transport projects.

In third place, taking up about €95 out of every €1,000 paid in tax, is education.

To get a better idea of how much it costs the French government to run things, like schools and daycare centres, you can scroll down to see links to different subjects, such as education, health and housing. Each of these links will take you to a government-run page that outlines the average costs for specific services.

When it comes to education, the government broke expenses down by education level - from crèche all the way up to university.

For example, on average it costs the public administration €6,805 to send one child to primary school for one year. Prices increase as the child gets older - with secondary school (collège) the cost is about €8,206 per student per year and for lycée, it is €10,986 per student per year.

The French government also helps to fund back-to-school allowances that are means-tested and paid out to low income families.

As for university, the French government pays a sizeable portion of yearly costs. On average, it costs €11,580 per student per year at university, 66 percent of which is financed by the State, nine percent by local authorities, four percent by other public administrations, 12 percent by companies and finally, nine percent by either the student themselves or their family.

In healthcare, you will be able to see how much the State pays for appointments and visits, as well as emergency services. An ambulance ride, for example, costs an average of €97, with a minimum of 65 percent of that cost being reimbursed by the French government, and often 100 percent for emergency situations.

Finally, €66 out of every €1,000 are spent on "public administration services", €60 are spent in the 'sovereignty' domain, which includes defence spending (€31 out of €1,000), justice (€4 out of €1,000) and general security (€25 out of €1,000).

The remaining funds go toward paying off the public debt (€28) and research (€23).

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.