Reader Question: How long do I have to work to qualify for a French pension?

If you have worked both in France and in another country, you might be curious at what point you become eligible for a French pension. Here is what you need to know.

Many foreigners living in France have had blended careers - meaning they have worked in both France and at least one other country. This can make it complicated for navigating where you fit into the French state pension system, as well as the one for your home country.

The key question most foreigners who have worked in France tend to ask is "How long do I have to work to qualify for a French state pension?" It is difficult to find a direct answer to this question online, and many websites indicate a minimum of ten to 15 years.

Ask the experts: What foreigners living in France need to know about French pensions

In reality, the answer is that you need a minimum of just one trimestre (quarter) of working and paying taxes in France to qualify for a French pension.

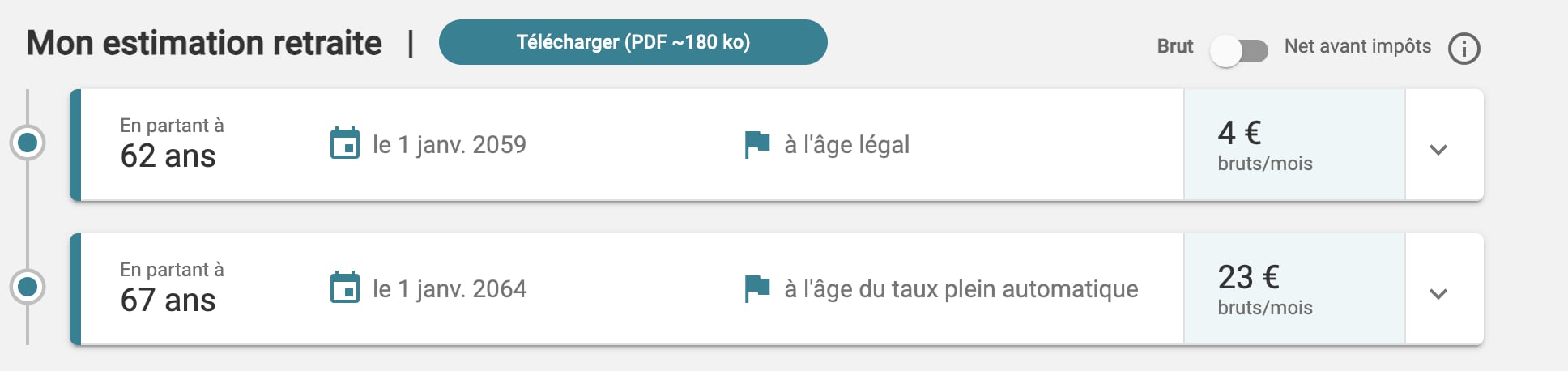

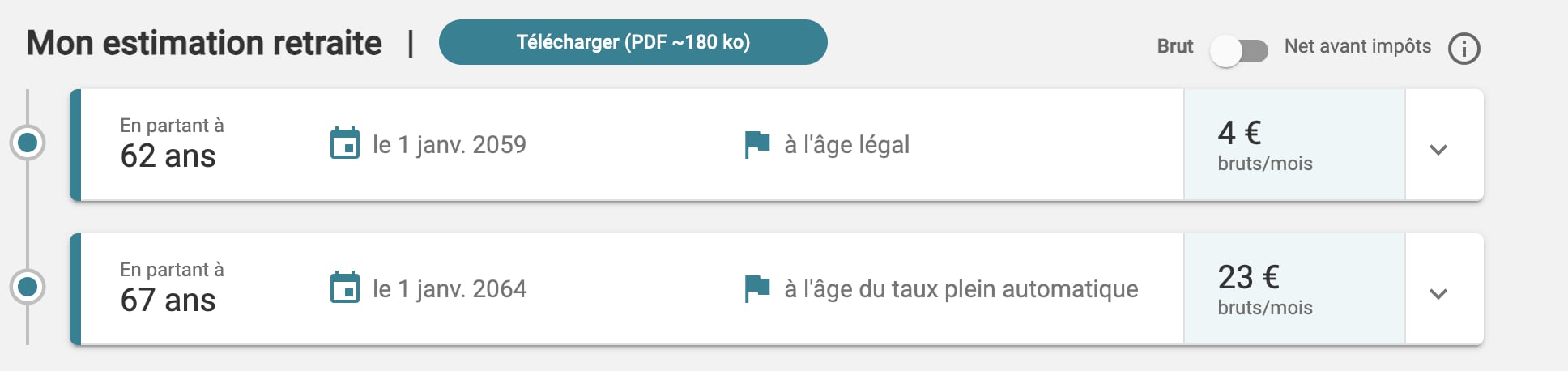

The catch is that French pensions are based on contributions, so although you are eligible after just one trimestre, your pension will be pretty small. The below example is for someone who has worked in France for one year - their French pension is the princely sum of €4 a month.

This simulation is based on a person retiring at the (current) legal age of 62, or the maximum age of 67.

In an interview with The Local, French pensioners expert Denis Guertault, who works for the organisation France Retraite, explained that after one quarter of working in France (on a French contract), you will be entered into the state pension system - however, your pension is based on contributions, so although you will be entitled to a pension, it may not be very large.

You can find out what pension you are currently eligible for by using the French government pension calculator website info-retraite.fr

With the passing of the pension reform (after months of strikes and protests) the info-retraite website has now been updated to include the new retirement ages - gradually increasing from 62 to 64 between September 2023 and 2030, with a maximum age of 67 for people who do not have a 'complete' career (ie people who had career breaks such as stay-at-home mums, people who started work late after prolonged study or people who worked in a non-EU country).

READ MORE: EXPLAINED: The website to help you calculate your French pension

"France works on a system of droit acquis (acquired rights)," the Guertault explained. Essentially, this means that the system is set up to be 'pay-as-you-go.'

If you are an employee in France you will already be paying into your pension, since this is compulsory. If you take a look at your French payslip, among the deductions for social charges is the 'retraites' section and this shows your pension contributions. These can be quite high - OECD data shows that the average French worker pays 11 percent of their monthly (gross) salary into their pension.

For self-employed workers, this is part of the deductions set up via URSSAF.

READ MORE: How to understand your French payslip

There are, of course, some exceptions, and the primary one is for people who have 'posted worker' status.

The Local also spoke with Tax Partner Jonathan Hadida, who works for Hadida Tax Advisors, a company specialised in tax consulting and helping Americans living in France to be tax compliant in both countries.

"This does not apply to people on a 'seconded' contract, who can request to stay on US social security for the first five years," Hadida said,

"Generally what happens in a lot of these cases, is that the worker would continue to be paid by the US company, though different companies have different rules," Hadida explained. The tax expert clarified that this is only available for the first five years for American posted workers, however. After five years, they will begin contributing to the French pension system.

When am I eligible for a full French pension?

Prior to September 2023, the minimum retirement age is 62, and to qualify for a full pension (at the maximum rate of 50 percent), you must have worked a certain number of trimestres (quarters). The exact number of trimestres depends on the year you were born. Those born between 1961 and 1963 need 168 trimestres, or 42 years. Those born in 1973 or after currently need 172 trimestres, or 43 years.

The minimum retirement age will gradually increase from September 2023 until 2030, when it will reach 64.

Importantly for foreigners who might be lacking a 'full' career in France, the maximum age remains at 67.

Periods of unemployment, maternity leave or absence because of long-term illness or accidents at work are taken into account and these credits count towards determining your total number of trimestres.

For the average French worker, the calculation for how much one's pension will come out to be will be based on average annual income for the best 25 years of your earning career, and the amount to which you are entitled is based on how long you have paid into the system.

However, for foreigners who have worked in both France and another country, the calculation for the total amount of your pension will depend on whether the other country you worked in is part of the EU/EEA or whether it has an existing social security agreement with France.

READ MORE: Pensions: What should I expect if I worked in both France and a non-EU country?

If the other country you worked in does have an agreement with France (or is part of the EU), then the two will work together to determine how much your pension will be from France, and how much it will be from the other country. This formula will depend on the nature of the social security agreement between the two nations, however.

Once calculated, you will receive one sum from France, and another from the other country you worked in. Keep in mind, that this may mean you will need access to a bank account in the other country to receive your pension payout.

If you have been in France for more than 10 years, you may also be eligible for 'top up benefits' when you retire, if your total pension is below a certain amount.

This article is a general view of the pension system and does not constitute individual financial advice. If you are are unsure about your pension rights, seek independent financial advice.

Comments (1)

See Also

Many foreigners living in France have had blended careers - meaning they have worked in both France and at least one other country. This can make it complicated for navigating where you fit into the French state pension system, as well as the one for your home country.

The key question most foreigners who have worked in France tend to ask is "How long do I have to work to qualify for a French state pension?" It is difficult to find a direct answer to this question online, and many websites indicate a minimum of ten to 15 years.

Ask the experts: What foreigners living in France need to know about French pensions

In reality, the answer is that you need a minimum of just one trimestre (quarter) of working and paying taxes in France to qualify for a French pension.

The catch is that French pensions are based on contributions, so although you are eligible after just one trimestre, your pension will be pretty small. The below example is for someone who has worked in France for one year - their French pension is the princely sum of €4 a month.

This simulation is based on a person retiring at the (current) legal age of 62, or the maximum age of 67.

In an interview with The Local, French pensioners expert Denis Guertault, who works for the organisation France Retraite, explained that after one quarter of working in France (on a French contract), you will be entered into the state pension system - however, your pension is based on contributions, so although you will be entitled to a pension, it may not be very large.

You can find out what pension you are currently eligible for by using the French government pension calculator website info-retraite.fr

With the passing of the pension reform (after months of strikes and protests) the info-retraite website has now been updated to include the new retirement ages - gradually increasing from 62 to 64 between September 2023 and 2030, with a maximum age of 67 for people who do not have a 'complete' career (ie people who had career breaks such as stay-at-home mums, people who started work late after prolonged study or people who worked in a non-EU country).

READ MORE: EXPLAINED: The website to help you calculate your French pension

"France works on a system of droit acquis (acquired rights)," the Guertault explained. Essentially, this means that the system is set up to be 'pay-as-you-go.'

If you are an employee in France you will already be paying into your pension, since this is compulsory. If you take a look at your French payslip, among the deductions for social charges is the 'retraites' section and this shows your pension contributions. These can be quite high - OECD data shows that the average French worker pays 11 percent of their monthly (gross) salary into their pension.

For self-employed workers, this is part of the deductions set up via URSSAF.

READ MORE: How to understand your French payslip

There are, of course, some exceptions, and the primary one is for people who have 'posted worker' status.

The Local also spoke with Tax Partner Jonathan Hadida, who works for Hadida Tax Advisors, a company specialised in tax consulting and helping Americans living in France to be tax compliant in both countries.

"This does not apply to people on a 'seconded' contract, who can request to stay on US social security for the first five years," Hadida said,

"Generally what happens in a lot of these cases, is that the worker would continue to be paid by the US company, though different companies have different rules," Hadida explained. The tax expert clarified that this is only available for the first five years for American posted workers, however. After five years, they will begin contributing to the French pension system.

When am I eligible for a full French pension?

Prior to September 2023, the minimum retirement age is 62, and to qualify for a full pension (at the maximum rate of 50 percent), you must have worked a certain number of trimestres (quarters). The exact number of trimestres depends on the year you were born. Those born between 1961 and 1963 need 168 trimestres, or 42 years. Those born in 1973 or after currently need 172 trimestres, or 43 years.

The minimum retirement age will gradually increase from September 2023 until 2030, when it will reach 64.

Importantly for foreigners who might be lacking a 'full' career in France, the maximum age remains at 67.

Periods of unemployment, maternity leave or absence because of long-term illness or accidents at work are taken into account and these credits count towards determining your total number of trimestres.

For the average French worker, the calculation for how much one's pension will come out to be will be based on average annual income for the best 25 years of your earning career, and the amount to which you are entitled is based on how long you have paid into the system.

However, for foreigners who have worked in both France and another country, the calculation for the total amount of your pension will depend on whether the other country you worked in is part of the EU/EEA or whether it has an existing social security agreement with France.

READ MORE: Pensions: What should I expect if I worked in both France and a non-EU country?

If the other country you worked in does have an agreement with France (or is part of the EU), then the two will work together to determine how much your pension will be from France, and how much it will be from the other country. This formula will depend on the nature of the social security agreement between the two nations, however.

Once calculated, you will receive one sum from France, and another from the other country you worked in. Keep in mind, that this may mean you will need access to a bank account in the other country to receive your pension payout.

If you have been in France for more than 10 years, you may also be eligible for 'top up benefits' when you retire, if your total pension is below a certain amount.

This article is a general view of the pension system and does not constitute individual financial advice. If you are are unsure about your pension rights, seek independent financial advice.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.