Working in France: Who needs a work permit?

If you want to work in France and you are not an EU citizen you will need a visa, but you may also need a work permit - known as an 'autorisation du travail' or 'permit du travail' - here's how they work.

Who?

This applies to people who do not have citizenship of an EU country, so for example Brits, Americans, Canadians, Australians.

Most people who have long-term residency permits or cartes de séjour plurianuelle will not need a work permit (full details below) and Brits who are covered by the Withdrawal Agreement - ie those who moved to France before December 31st 2020 - won't need one either.

Where?

There are some exceptions where a work permit is not required:

- work at a sporting, cultural or scientific event

- work at a seminar or trade show

- the production and broadcast of cinematographic and audiovisual works (such as musicians putting on concerts)

- modelling

- personal service workers and domestic workers working in France during their private employers’ stay in the country.

- providing an audit or expertise in IT, management, finance, insurance, architecture and engineering, under the terms of a service agreement or intra-company transfer agreement.

- occasional teaching activities by invited lecturers

Responsibility

The key thing about the work permit is that it is the responsibility of the employer to get the permit, and likewise the employer who will end up in trouble if they are found to be employing people who do not have the correct permit.

This is in contrast to the visa or residency card, which it is up to the employee to sort out (although you will need to have the work permit in order to get certain types of visa).

The process for employers, however, can be pretty complicated and involves them demonstrating that there is a valid reason that they are not employing an EU worker instead - for example they might need to show proof that they have advertised the job and got no responses in France.

It is the administrative complexity and expense (in certain circumstances employers have to pay extra tax for non-EU employees) that make some employers reluctant to recruit non-EU workers who do not already have the right to live and work in France, which can make getting their first job more difficult.

It's not impossible of course, but you are at a disadvantage compared to EU candidates, who can be employed with no extra paperwork or expense.

Short-term work

You will only need a work permit if your period of work is more than 90 days - so for example people on business trips do not need them, neither do contractors or freelancers doing short projects.

Visas

The key thing to know is that a visa and a work permit are two different documents, with different requirements to fulfil to get one.

However, not every non-EU citizen living in France needs a work permit, as certain types of visa or residency card 'act' as a work permit as well.

The basic rule of thumb is that people who already have the right to live and work in France don't need a new work permit for every new job they get - the main categories of people who need them are recently-graduated non-EU students who studied in France, and people arriving in France to take up a new job.

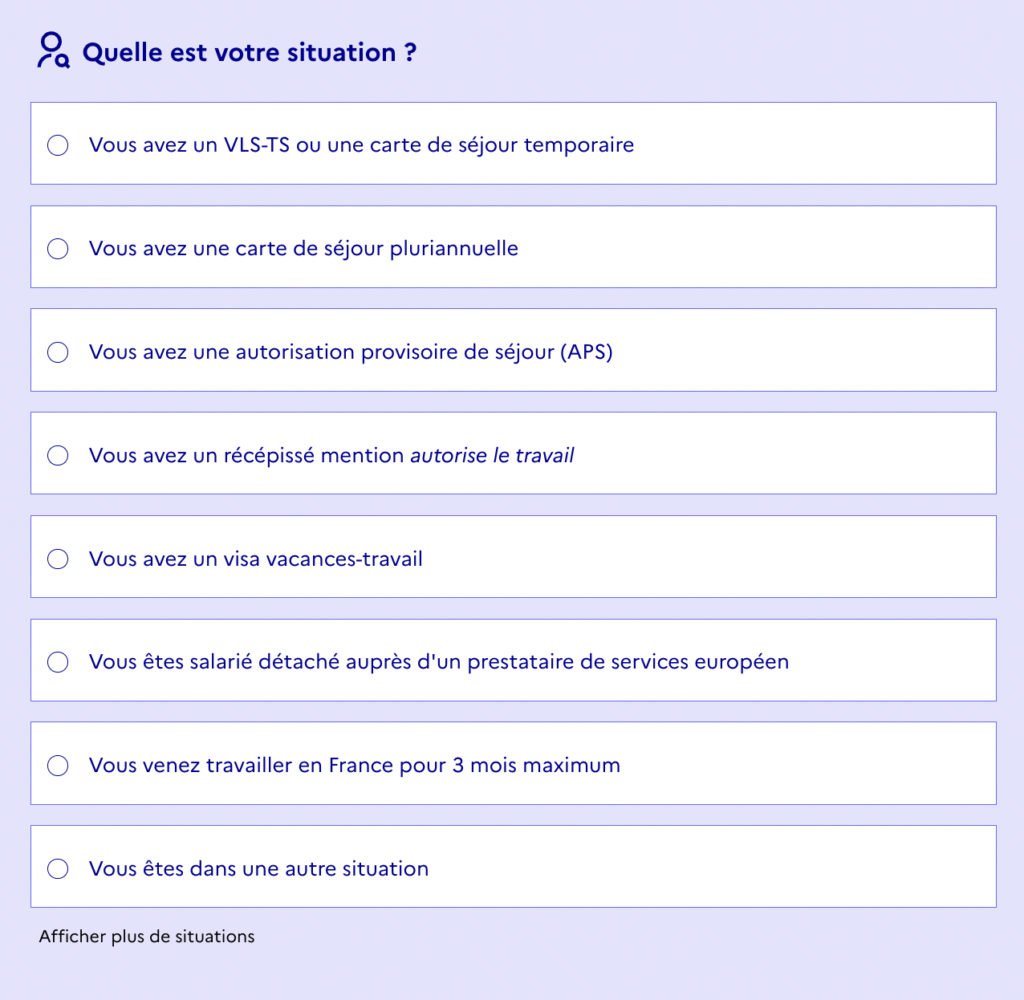

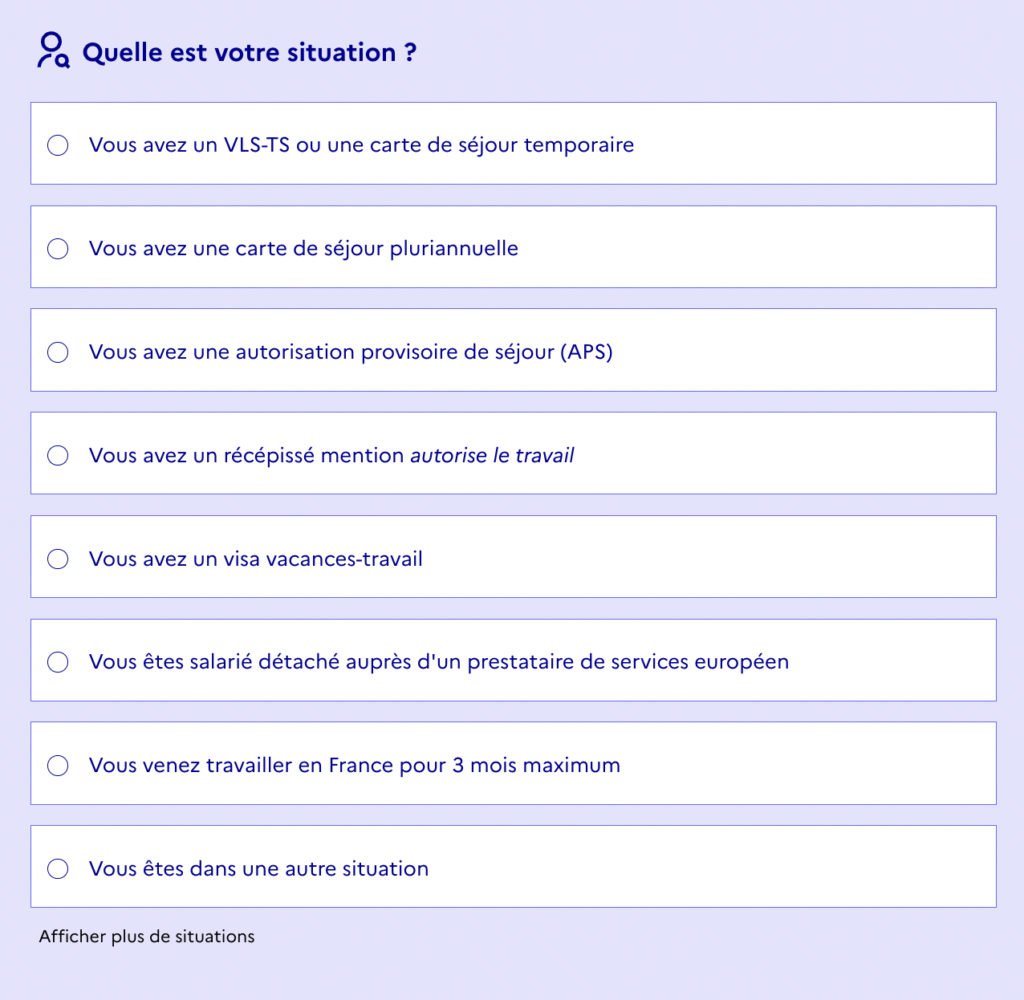

The French visa website HERE gives you a simulator (shown below) that you can click through and find out if you need a work permit, depending on the type of visa or residency card that you have.

Service-public official website

Once you are onto a carte de séjour pluriannuelle - the long-term residency card - you are unlikely to need a work permit.

If you are coming to France on the talent visa (passeport talent) you also won't need a work permit, as the visa also acts as a permit.

Certain types of visa, such as the visitor visa, does not allow you to work at all, so you would need to swap your visa for a work visa, as well as also potentially getting a work permit.

Comments

See Also

Who?

This applies to people who do not have citizenship of an EU country, so for example Brits, Americans, Canadians, Australians.

Most people who have long-term residency permits or cartes de séjour plurianuelle will not need a work permit (full details below) and Brits who are covered by the Withdrawal Agreement - ie those who moved to France before December 31st 2020 - won't need one either.

Where?

There are some exceptions where a work permit is not required:

- work at a sporting, cultural or scientific event

- work at a seminar or trade show

- the production and broadcast of cinematographic and audiovisual works (such as musicians putting on concerts)

- modelling

- personal service workers and domestic workers working in France during their private employers’ stay in the country.

- providing an audit or expertise in IT, management, finance, insurance, architecture and engineering, under the terms of a service agreement or intra-company transfer agreement.

- occasional teaching activities by invited lecturers

Responsibility

The key thing about the work permit is that it is the responsibility of the employer to get the permit, and likewise the employer who will end up in trouble if they are found to be employing people who do not have the correct permit.

This is in contrast to the visa or residency card, which it is up to the employee to sort out (although you will need to have the work permit in order to get certain types of visa).

The process for employers, however, can be pretty complicated and involves them demonstrating that there is a valid reason that they are not employing an EU worker instead - for example they might need to show proof that they have advertised the job and got no responses in France.

It is the administrative complexity and expense (in certain circumstances employers have to pay extra tax for non-EU employees) that make some employers reluctant to recruit non-EU workers who do not already have the right to live and work in France, which can make getting their first job more difficult.

It's not impossible of course, but you are at a disadvantage compared to EU candidates, who can be employed with no extra paperwork or expense.

Short-term work

You will only need a work permit if your period of work is more than 90 days - so for example people on business trips do not need them, neither do contractors or freelancers doing short projects.

Visas

The key thing to know is that a visa and a work permit are two different documents, with different requirements to fulfil to get one.

However, not every non-EU citizen living in France needs a work permit, as certain types of visa or residency card 'act' as a work permit as well.

The basic rule of thumb is that people who already have the right to live and work in France don't need a new work permit for every new job they get - the main categories of people who need them are recently-graduated non-EU students who studied in France, and people arriving in France to take up a new job.

The French visa website HERE gives you a simulator (shown below) that you can click through and find out if you need a work permit, depending on the type of visa or residency card that you have.

Once you are onto a carte de séjour pluriannuelle - the long-term residency card - you are unlikely to need a work permit.

If you are coming to France on the talent visa (passeport talent) you also won't need a work permit, as the visa also acts as a permit.

Certain types of visa, such as the visitor visa, does not allow you to work at all, so you would need to swap your visa for a work visa, as well as also potentially getting a work permit.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.