How a cross-border train has pushed house prices up in Switzerland and France

A commuter rail link between Switzerland and France has caused property prices on both sides of the border to rise sharply.

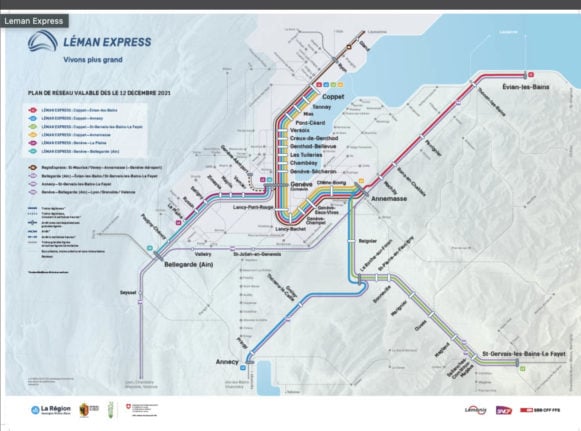

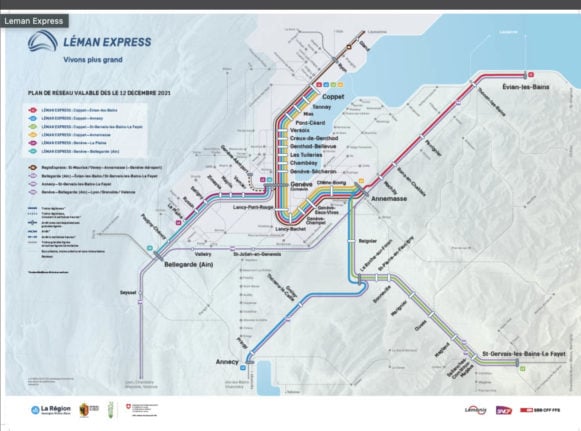

When the Léman Express (LEX) was inaugurated in December 2019, its main goal was to connect the Geneva region with neighbouring French towns and provide a quicker commute for cross-border workers.

Established by the Swiss (SBB) and French (SNCF) railway companies, LEX is Europe’s largest cross-border regional rail network.

Some of the approximately 92,000 employees from France commute to their jobs in the Lake Geneva region by car, while others prefer to take Léman Express, which was launched specifically to reduce journey times and cut traffic in and around Geneva.

But while this goal has been largely achieved – the train carries 52,000 passengers a day — the rail link is also causing rents and property prices in the vicinity of the train’s 45 stations to soar by 8 to 9 percent on average — a sharper increase than elsewhere in the region.

Prices rose in the French departments of Haute-Savoie and Ain, as well as in Swiss cantons of Geneva and Vaud, all of which lie along Léman Express’ 230-km track, according to Tribune de Genève (TDG).

Why has this happened ?

As a general rule, transport infrastructure influences real estate prices, according to Dragana Djurdjevic, statistician at Wüest Partner real estate consultants interviewed by TDG.

Increases vary based on the type of transport —such as trains, buses or trams — as well as the frequency and the distance of the property to the nearest stop.

Typically, prices / rents are the highest within 300 metres around a station.

In general, Swiss and French municipalities with a LEX station have recorded significantly higher rents and sale prices than areas that have no access to the train, Djurdjevic said.

Just how much have prices increased along the LEX line?

On the Swiss side, rents rose by 4.9 percent along the track. In Geneva itself (already the most expensive rental market) , they went up by 1.5 percent, and only slightly less (1.4 percent) in Vaud.

READ MORE: Why is Geneva’s rent the highest in Switzerland?

In terms of properties, prices along the network rose by 17.7 percent; in Geneva the increase is 12.3 percent, and 13 percent in Vaud.

In neighbouring France, rents increased by 6.1 percent along LEX stops. In Haute-Savoie, the increase is 6.3 percent and in Ain 9.1 percent.

Sale prices went up by 15.7 percent along the track, 14.8 percent in Haute-Savoie and 23.7 percent in Ain.

Comments

See Also

When the Léman Express (LEX) was inaugurated in December 2019, its main goal was to connect the Geneva region with neighbouring French towns and provide a quicker commute for cross-border workers.

Established by the Swiss (SBB) and French (SNCF) railway companies, LEX is Europe’s largest cross-border regional rail network.

Some of the approximately 92,000 employees from France commute to their jobs in the Lake Geneva region by car, while others prefer to take Léman Express, which was launched specifically to reduce journey times and cut traffic in and around Geneva.

But while this goal has been largely achieved – the train carries 52,000 passengers a day — the rail link is also causing rents and property prices in the vicinity of the train’s 45 stations to soar by 8 to 9 percent on average — a sharper increase than elsewhere in the region.

Prices rose in the French departments of Haute-Savoie and Ain, as well as in Swiss cantons of Geneva and Vaud, all of which lie along Léman Express’ 230-km track, according to Tribune de Genève (TDG).

Why has this happened ?

As a general rule, transport infrastructure influences real estate prices, according to Dragana Djurdjevic, statistician at Wüest Partner real estate consultants interviewed by TDG.

Increases vary based on the type of transport —such as trains, buses or trams — as well as the frequency and the distance of the property to the nearest stop.

Typically, prices / rents are the highest within 300 metres around a station.

In general, Swiss and French municipalities with a LEX station have recorded significantly higher rents and sale prices than areas that have no access to the train, Djurdjevic said.

Just how much have prices increased along the LEX line?

On the Swiss side, rents rose by 4.9 percent along the track. In Geneva itself (already the most expensive rental market) , they went up by 1.5 percent, and only slightly less (1.4 percent) in Vaud.

READ MORE: Why is Geneva’s rent the highest in Switzerland?

In terms of properties, prices along the network rose by 17.7 percent; in Geneva the increase is 12.3 percent, and 13 percent in Vaud.

In neighbouring France, rents increased by 6.1 percent along LEX stops. In Haute-Savoie, the increase is 6.3 percent and in Ain 9.1 percent.

Sale prices went up by 15.7 percent along the track, 14.8 percent in Haute-Savoie and 23.7 percent in Ain.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.