Viager: The French property system that can lead to a bargain

It's an unusual type of property transaction, but the French system of 'viager' has benefits for both sellers, who are usually elderly, and for buyers who can snap up a bargain.

Viager is a type of real estate transaction in France, in which you buy a property, but can only move in once the vendor has died. Though seemingly a bit morbid, it is quite popular in France, and has great potential benefits for both the buyer and the seller - as well as some pitfalls.

Hear the team at The Local discussing viager in the latest episode of Talking France. Download here or listen on the link below

In 1997, Jeanne Calment made headlines across the world for breaking records by living until the age of 122. But it was not just her impressively long lifespan that got people talking about her: she also outlived the man who bought her home.

In 1965, at the age of 90, Calment sold her home en viager to then 47-year-old André-François Raffray. From then on, Raffray would pay her 2,500 francs a month, expecting to move in once the elderly woman inevitably passed away. But he never got the chance to live in the home he bought. He died two years before Calment, having paid over double the house’s value over a thirty year period.

Calmet is obviously an exceptional case, but the story illustrates that buying en viager can be a gamble, despite its other benefits.

What is Viager?

A viager agreement involves an elderly person selling their property for a bouquet (down payment) which is usually discounted from its original price.

In most viager arrangements, in return for a cheaper-than-usual price, the buyer agrees to pay a monthly annuity to the seller for the rest of their life. Once the seller (credirentier) dies, the buyer (debirentier) can then take possession of the property.

How does it work?

There are few different types of viager agreement:

Viager Occupé - The Occupied Lifetime Annuity

This is the typical viager scenario - the buyer benefits from a discount on the price of the property and pays a lump-sum (usually 15-30 percent of the property value) for the down-payment.

Then, the buyer will agree upon an indexed monthly rent to be paid for the remainder of the seller’s life. In this scenario, it is also the buyer must pay the property tax and insurance on the property, as well as assume responsibility for any major repairs.

Should the seller take up residence in a retirement home, the buyer will still be required to pay annuity to the seller, but they would be able to occupy or rent out the property.

Viager Sans Rente - The Without Rent Option

This scenario is almost exactly the same as the first, excluding the monthly annuity payment. The buyer simply pays a full lump sum at the beginning of the agreement, and is able to possess the property upon the death of the seller.

Le Viager Libre - The Unoccupied Option

For this scenario, the property is likely unoccupied.

The buyer, therefore, retains the right to live in or rent out the property. Similar to the first arrangement, the buyer must pay both the initial down payment and then an indexed monthly annuity to the seller. Due to free access to the property, the buyer is also required to pay all taxes and charges associated with the property.

La Vente à Terme - The Fixed-Time Sale

Like the occupied lifetime annuity, the buyer pays the initial down payment and a monthly rent. However, the duration of the rent is fixed in advance.

Monthly payments are due until the agreed-upon date, even in the event that the seller dies. This arrangement can go along with both an unoccupied or an occupied property. If the property is occupied, the buyer gains possession after the owner’s death.

La Nue-Propriété - The Bare Property

In this scenario, the buyer still owes a down-payment, but there is also a limit on the amount of time that the buyer owes the monthly rent. The ownership of the property is also split in two: half being the buyer, half being the seller (who retains an usufruct, lifetime use rights, on the property).

So is it a good idea?

There are advantages and drawbacks.

For the buyer, the primary benefit is that the property is reduced in price, which might be especially tempting if it is in an expensive area.

Buying en viager might be a great way to invest, particularly if you are not expecting to live in or make use of the property for an extended period of time. Additionally, notaire fees are typically reduced to only three percent.

The obvious risk is that you don't know how long the seller will live and are therefore unable to plan when you can move into your property.

As with all legal matters, it is crucial to understand the terms of the agreement, as well as the specific real-estate vocabulary that goes along with it.

For this reason, if you are less confident in French, it may be worth going through an English-speaking agency or notaire. You can search for “expert en viager” online, or you can check notaires.fr for English-speaking notaries.

For the seller, the main benefit is being able to stay in your home, while supplementing your income.

The seller is also protected from the risk of the buyer failing to pay their monthly annuity - in the event of non-payment, the seller is able to regain his/her property due to a privilège du vendeur clause.

A key drawback for the seller is that his/her heirs will not be able to benefit should the property increase in value.

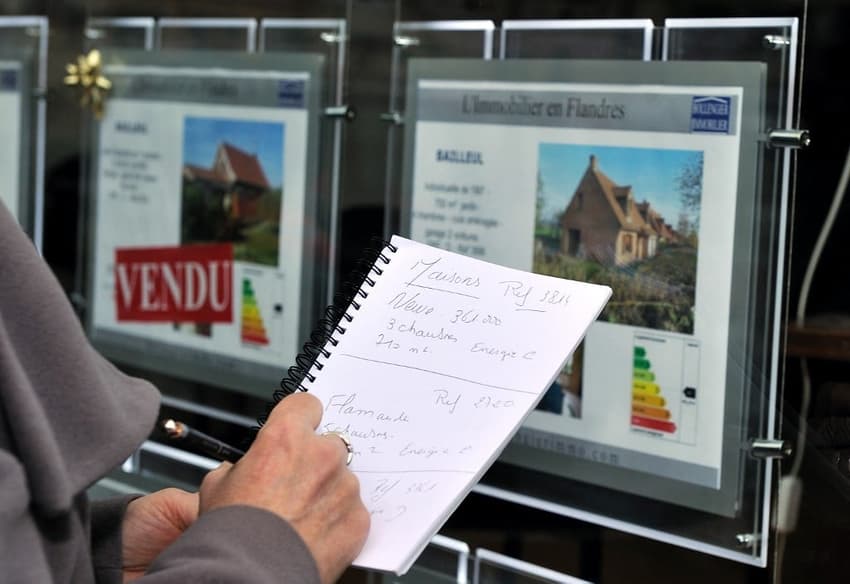

Where can you find a viager property?

If you like the idea, there are several ways to find properties for sale in this way.

If you are looking for an English-language website, CapiFrance” has a dedicated page for Viager purchases.

There are also several French real estate websites that specialise in viager sales, like Costes Viager or Paru Vendu. Otherwise, if you go to most real estate agents' websites, you can look up viager in their search bar to see if they have any listings.

Comments

See Also

Viager is a type of real estate transaction in France, in which you buy a property, but can only move in once the vendor has died. Though seemingly a bit morbid, it is quite popular in France, and has great potential benefits for both the buyer and the seller - as well as some pitfalls.

Hear the team at The Local discussing viager in the latest episode of Talking France. Download here or listen on the link below

In 1997, Jeanne Calment made headlines across the world for breaking records by living until the age of 122. But it was not just her impressively long lifespan that got people talking about her: she also outlived the man who bought her home.

In 1965, at the age of 90, Calment sold her home en viager to then 47-year-old André-François Raffray. From then on, Raffray would pay her 2,500 francs a month, expecting to move in once the elderly woman inevitably passed away. But he never got the chance to live in the home he bought. He died two years before Calment, having paid over double the house’s value over a thirty year period.

Calmet is obviously an exceptional case, but the story illustrates that buying en viager can be a gamble, despite its other benefits.

What is Viager?

A viager agreement involves an elderly person selling their property for a bouquet (down payment) which is usually discounted from its original price.

In most viager arrangements, in return for a cheaper-than-usual price, the buyer agrees to pay a monthly annuity to the seller for the rest of their life. Once the seller (credirentier) dies, the buyer (debirentier) can then take possession of the property.

How does it work?

There are few different types of viager agreement:

Viager Occupé - The Occupied Lifetime Annuity

This is the typical viager scenario - the buyer benefits from a discount on the price of the property and pays a lump-sum (usually 15-30 percent of the property value) for the down-payment.

Then, the buyer will agree upon an indexed monthly rent to be paid for the remainder of the seller’s life. In this scenario, it is also the buyer must pay the property tax and insurance on the property, as well as assume responsibility for any major repairs.

Should the seller take up residence in a retirement home, the buyer will still be required to pay annuity to the seller, but they would be able to occupy or rent out the property.

Viager Sans Rente - The Without Rent Option

This scenario is almost exactly the same as the first, excluding the monthly annuity payment. The buyer simply pays a full lump sum at the beginning of the agreement, and is able to possess the property upon the death of the seller.

Le Viager Libre - The Unoccupied Option

For this scenario, the property is likely unoccupied.

The buyer, therefore, retains the right to live in or rent out the property. Similar to the first arrangement, the buyer must pay both the initial down payment and then an indexed monthly annuity to the seller. Due to free access to the property, the buyer is also required to pay all taxes and charges associated with the property.

La Vente à Terme - The Fixed-Time Sale

Like the occupied lifetime annuity, the buyer pays the initial down payment and a monthly rent. However, the duration of the rent is fixed in advance.

Monthly payments are due until the agreed-upon date, even in the event that the seller dies. This arrangement can go along with both an unoccupied or an occupied property. If the property is occupied, the buyer gains possession after the owner’s death.

La Nue-Propriété - The Bare Property

In this scenario, the buyer still owes a down-payment, but there is also a limit on the amount of time that the buyer owes the monthly rent. The ownership of the property is also split in two: half being the buyer, half being the seller (who retains an usufruct, lifetime use rights, on the property).

So is it a good idea?

There are advantages and drawbacks.

For the buyer, the primary benefit is that the property is reduced in price, which might be especially tempting if it is in an expensive area.

Buying en viager might be a great way to invest, particularly if you are not expecting to live in or make use of the property for an extended period of time. Additionally, notaire fees are typically reduced to only three percent.

The obvious risk is that you don't know how long the seller will live and are therefore unable to plan when you can move into your property.

As with all legal matters, it is crucial to understand the terms of the agreement, as well as the specific real-estate vocabulary that goes along with it.

For this reason, if you are less confident in French, it may be worth going through an English-speaking agency or notaire. You can search for “expert en viager” online, or you can check notaires.fr for English-speaking notaries.

For the seller, the main benefit is being able to stay in your home, while supplementing your income.

The seller is also protected from the risk of the buyer failing to pay their monthly annuity - in the event of non-payment, the seller is able to regain his/her property due to a privilège du vendeur clause.

A key drawback for the seller is that his/her heirs will not be able to benefit should the property increase in value.

Where can you find a viager property?

If you like the idea, there are several ways to find properties for sale in this way.

If you are looking for an English-language website, CapiFrance” has a dedicated page for Viager purchases.

There are also several French real estate websites that specialise in viager sales, like Costes Viager or Paru Vendu. Otherwise, if you go to most real estate agents' websites, you can look up viager in their search bar to see if they have any listings.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.