How to write a French 'attestation sur l'honneur'

At some point during your time in France, you will likely have to write an 'attestation sur l'honneur' - here's what this document is for and how to write one properly.

An attestation sur l'honneur - sometimes also referred to as a déclaration sur l'honneur - is a written document that's best translated into English as a 'sworn statement' - they're widely used in France from simple matters like picking up a parcel for a friend to more complex issues like setting up a business.

Some types of official documents - such as tax declarations - are a declaration sur l'honneur, where you have to swear that the information you have provided is true, but you can also create your own.

They're particularly handy for foreigners if you get caught in a bureaucratic loop or your country doesn't issue the exact document that French authorities are asking for - in this case often the offer of making a sworn statement will solve the problem.

This document can either be handwritten or typed, but will need to be signed. Deliberately signing a false declaration can land you in trouble - in the most severe cases leading to three years imprisonment and a €45,000 fine.

When do I need to write an attestation sur l'honneur?

There are many contexts in which you might be asked to write an attestation sur l'honneur in France.

If you're required to provide proof of address for an official function and you don't have the necessary utility bills or rental contract, you can ask your landlord to write an attestation for you.

Likewise if you're trying to complete an administration task and the fonctionnaire is demanding a document that you simply don't possess (because it doesn't exist in your home country) it's sometimes possible to get around this by providing the documents you do have, plus an attestation sur l'honneur swearing to the necessary fact. This doesn't always work though.

For marriages, each partner will need to sign an attestation sur l'honneur declaring their address and that they are not already married. For PACS ceremonies, each partner will need to sign an attestation sur l'honneur listing their shared address and declaring that they are not related by blood.

Other situations in which you could be asked to provide an attestation sur l'honneur include if you want to create a business; open some kinds of bank account; retire from work; access certain types of certain security payments; or even authorise someone to pick up a package on your behalf.

How do I write an attestation sur l'honneur?

Each attestation sur l'honneur looks a little different as the format varies a little depending on what you are using it for, but there are certain things that must be there for it to be a valid document.

In general they begin Je soussigné(e) (I, the undersigned) followed by your name, address and date of birth, atteste sur l'honneur que (swear on my honour that) followed by the fact you are attesting to. The document is then signed with the date and place of signature added.

In good news, official bodies like the ServicePublic website and the La Poste website provide templates for attestations or déclarations - you fill in your details (remembering to tick the male or female box so that your adjectives will agree) and it will create the document for you, in the correct formal French.

You can find the government model letter HERE. Meanwhile La Poste offers tailored documents for specific circumstances such as ending a utilities contract or giving notice to your landlord HERE.

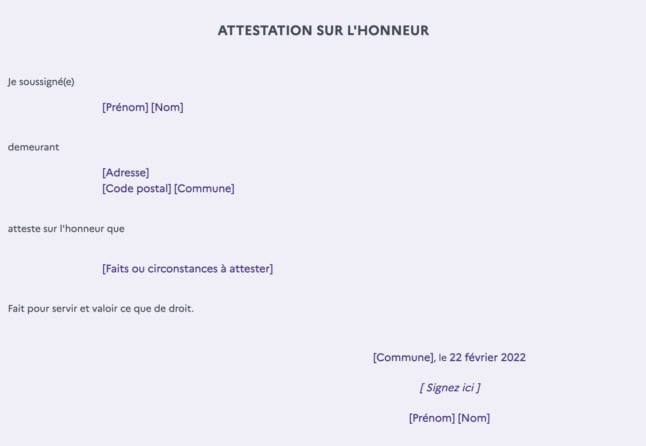

The generic template looks something like this:

This is a template of what a French attestation sur l'honneur might look like. Source: service-public.fr

The areas in squared brackets are details you will need to fill out yourself.

[Prénom] [Nom] - Your first name and surname

[Adresse] - Your address

[Code postal] [Commune] - Your postcode and commune

[Faits ou circonstances à attester] - This is where you actually provide a statement or declaration

[Commune] - When this appears for a second time, you should name the commune where you are actually writing the attestation

[Signez ici] - This is where you sign

In some templates that you find online, you sometimes see the following:

À _________ and le _________

In the first place, you should name the town or village where you are signing the document and in the second you should give the date at which you are signing.

In France a signature is not considered official unless it has both the date and place where it was signed.

Authorising a third party to pick up a letter or parcel

One of the most common uses of an attestation sur l'honneur is giving someone authorisation to pick up a parcel from the post office on your behalf.

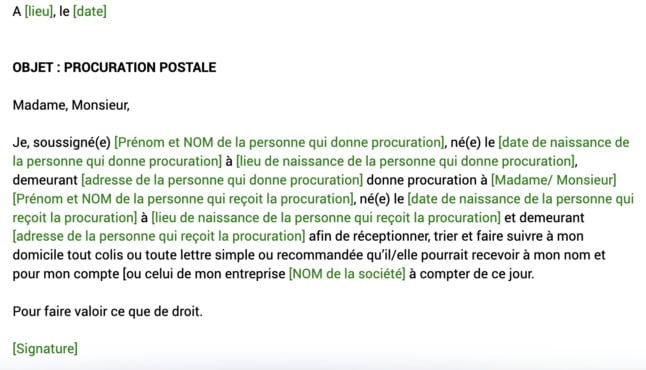

In this instance, you would follow the formula below:

The French attestation sur l'honneur for authorising postal collections in your name. (Source: La Poste)

You will need to fill in the green text with details relevant to you.

[lieu] - place where you are signing the letter

[date] - date at which you sign the letter

[prénom et NOM de la personne qui donne procuration] - your first name and surname (surname should be written all in capitals)

[date de naissance de la personne qui donne procuration] - your birth date

[lieu de naissance de la personne qui donne procuration] - your place of birth

[Madame/Monsieur] - the title of the person who you are giving authorisation to

[Prénom et NOM de la personne qui reçoit la procuration] - first name and SURNAME of the person who you are giving authorisation to

[Date de naissance de la personne qui reçoit procuration] - date of birth of the person who you are giving authorisation to

[Lieu de naissance de la personne qui reçoit procuration] - place of birth of the person who you are giving authorisation to

[Adresse de la personne qui reçoit procuration] - address of the person who you are giving authorisation to

Ou celui de mon enterprise [Nom de la society] - You only need this line if someone is picking up packages on behalf of your business. If this is the case, you can give the name of your business in the squared brackets space.

Will I need supporting documentation?

In some circumstances where you need an attestation sur l'honneur, you may need some additional documents.

For example, if you are using an attestation sur l'honneur to give someone permission to pick up post for you, you will need to provide them with a copy of your ID or your actual ID document. They will need to take a copy of their own ID.

The same goes for if you have signed an attestation d'hébergement, which is a document you can use to indicate that someone is living at your property (if there is no rental contract for example).

Comments

See Also

An attestation sur l'honneur - sometimes also referred to as a déclaration sur l'honneur - is a written document that's best translated into English as a 'sworn statement' - they're widely used in France from simple matters like picking up a parcel for a friend to more complex issues like setting up a business.

Some types of official documents - such as tax declarations - are a declaration sur l'honneur, where you have to swear that the information you have provided is true, but you can also create your own.

They're particularly handy for foreigners if you get caught in a bureaucratic loop or your country doesn't issue the exact document that French authorities are asking for - in this case often the offer of making a sworn statement will solve the problem.

This document can either be handwritten or typed, but will need to be signed. Deliberately signing a false declaration can land you in trouble - in the most severe cases leading to three years imprisonment and a €45,000 fine.

When do I need to write an attestation sur l'honneur?

There are many contexts in which you might be asked to write an attestation sur l'honneur in France.

If you're required to provide proof of address for an official function and you don't have the necessary utility bills or rental contract, you can ask your landlord to write an attestation for you.

Likewise if you're trying to complete an administration task and the fonctionnaire is demanding a document that you simply don't possess (because it doesn't exist in your home country) it's sometimes possible to get around this by providing the documents you do have, plus an attestation sur l'honneur swearing to the necessary fact. This doesn't always work though.

For marriages, each partner will need to sign an attestation sur l'honneur declaring their address and that they are not already married. For PACS ceremonies, each partner will need to sign an attestation sur l'honneur listing their shared address and declaring that they are not related by blood.

Other situations in which you could be asked to provide an attestation sur l'honneur include if you want to create a business; open some kinds of bank account; retire from work; access certain types of certain security payments; or even authorise someone to pick up a package on your behalf.

How do I write an attestation sur l'honneur?

Each attestation sur l'honneur looks a little different as the format varies a little depending on what you are using it for, but there are certain things that must be there for it to be a valid document.

In general they begin Je soussigné(e) (I, the undersigned) followed by your name, address and date of birth, atteste sur l'honneur que (swear on my honour that) followed by the fact you are attesting to. The document is then signed with the date and place of signature added.

In good news, official bodies like the ServicePublic website and the La Poste website provide templates for attestations or déclarations - you fill in your details (remembering to tick the male or female box so that your adjectives will agree) and it will create the document for you, in the correct formal French.

You can find the government model letter HERE. Meanwhile La Poste offers tailored documents for specific circumstances such as ending a utilities contract or giving notice to your landlord HERE.

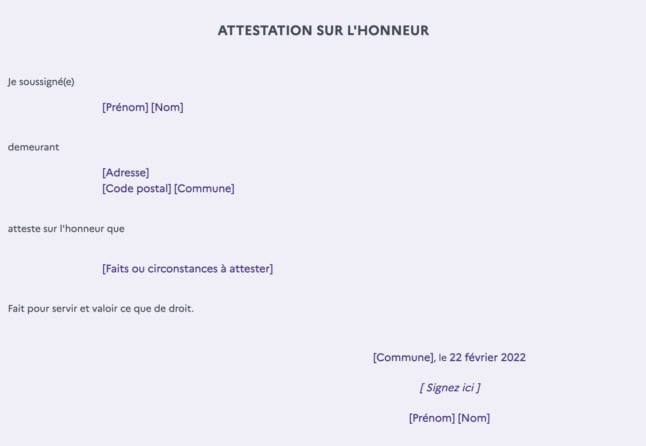

The generic template looks something like this:

The areas in squared brackets are details you will need to fill out yourself.

[Prénom] [Nom] - Your first name and surname

[Adresse] - Your address

[Code postal] [Commune] - Your postcode and commune

[Faits ou circonstances à attester] - This is where you actually provide a statement or declaration

[Commune] - When this appears for a second time, you should name the commune where you are actually writing the attestation

[Signez ici] - This is where you sign

In some templates that you find online, you sometimes see the following:

À _________ and le _________

In the first place, you should name the town or village where you are signing the document and in the second you should give the date at which you are signing.

In France a signature is not considered official unless it has both the date and place where it was signed.

Authorising a third party to pick up a letter or parcel

One of the most common uses of an attestation sur l'honneur is giving someone authorisation to pick up a parcel from the post office on your behalf.

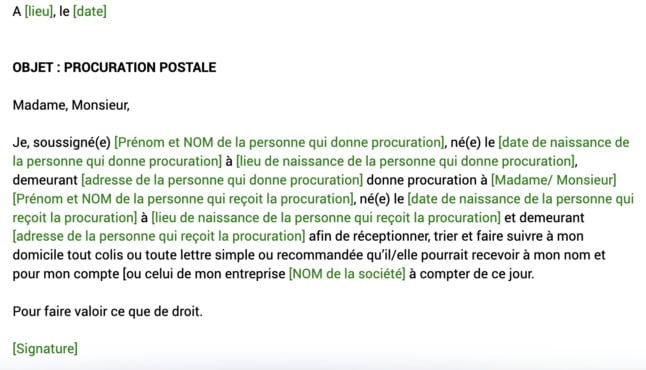

In this instance, you would follow the formula below:

You will need to fill in the green text with details relevant to you.

[lieu] - place where you are signing the letter

[date] - date at which you sign the letter

[prénom et NOM de la personne qui donne procuration] - your first name and surname (surname should be written all in capitals)

[date de naissance de la personne qui donne procuration] - your birth date

[lieu de naissance de la personne qui donne procuration] - your place of birth

[Madame/Monsieur] - the title of the person who you are giving authorisation to

[Prénom et NOM de la personne qui reçoit la procuration] - first name and SURNAME of the person who you are giving authorisation to

[Date de naissance de la personne qui reçoit procuration] - date of birth of the person who you are giving authorisation to

[Lieu de naissance de la personne qui reçoit procuration] - place of birth of the person who you are giving authorisation to

[Adresse de la personne qui reçoit procuration] - address of the person who you are giving authorisation to

Ou celui de mon enterprise [Nom de la society] - You only need this line if someone is picking up packages on behalf of your business. If this is the case, you can give the name of your business in the squared brackets space.

Will I need supporting documentation?

In some circumstances where you need an attestation sur l'honneur, you may need some additional documents.

For example, if you are using an attestation sur l'honneur to give someone permission to pick up post for you, you will need to provide them with a copy of your ID or your actual ID document. They will need to take a copy of their own ID.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.