France changes payslips to make tax declarations easier

The French Government has ordered the modification of payslips from January 1st to make it easier for people to fill out their annual tax declarations. Here's what the changes mean.

Filing a tax return in France can be a complicated procedure - particularly when payslips are peppered with confusing acronyms like CSG, CRDS, APE and NAF.

The French tax system is undergoing a change with the recent introduction of deduction at source (sometimes known as PAYE) for employees.

However, for the moment most employees still have to file the annual tax declaration - even if all their taxes have already been deducted from their payslips and therefore their total tax bill is €0.

Now the French Government has passed a decree to simplify payslips and make it easier to work out how much of your income you need to declare.

READ ALSO How to understand your French payslip

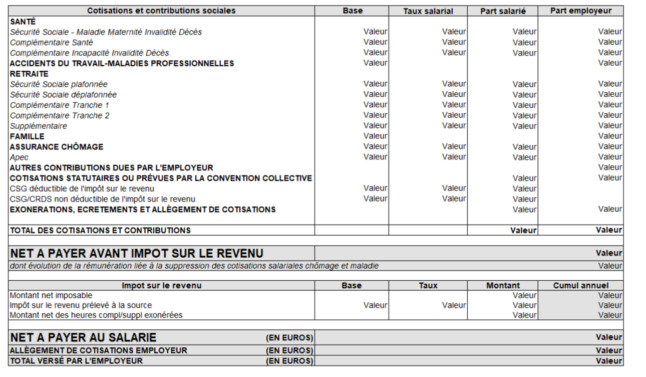

From January 1st, all French payslips must contain the following details in an easily identifiable section:

- The amount deducted from the payment through prélèvement à la source (PAYE, or deduction at source);

- The amount of overtime pay which is exempt from taxation;

- The amount of money you have earned which can still be taxed - or le montant du salaire net imposable

This last point is the most important because if you need to manually enter your earnings onto a tax return (which is the case for people declaring their earnings in France for the first time or filing their return in the post), this is the amount of taxable income you will have to declare.

The new payslips will look something like this:

This is the model for the new payslips introduced in France. The impôt sur revenu box near the bottom describes how much of your work income can be taxed. Credit: legifrance.gouv.fr

When you file your tax return online, many of the fields are filled in automatically, but this new payslip makes it easier to check whether you have been taxed the right amount.

Bear in mind that it is not just work income that is taxed in France. If you own a second home that you rent out in France, you will also need to declare these earnings.

If you live in a French property that you own, you will probably also need to pay the taxe foncière and the taxe d'habitation but these are declared separately from the annual income tax declaration.

We have previously covered who needs to declare their income in France HERE.

READ MORE

- What exactly do I need to tell the French taxman about my assets at home

- The French tax calendar for 2022 – which taxes are due when?

- How to fill out each section of the French tax declaration

The online portal for declaring your 2021 income opens in April.

Comments

See Also

Filing a tax return in France can be a complicated procedure - particularly when payslips are peppered with confusing acronyms like CSG, CRDS, APE and NAF.

The French tax system is undergoing a change with the recent introduction of deduction at source (sometimes known as PAYE) for employees.

However, for the moment most employees still have to file the annual tax declaration - even if all their taxes have already been deducted from their payslips and therefore their total tax bill is €0.

Now the French Government has passed a decree to simplify payslips and make it easier to work out how much of your income you need to declare.

READ ALSO How to understand your French payslip

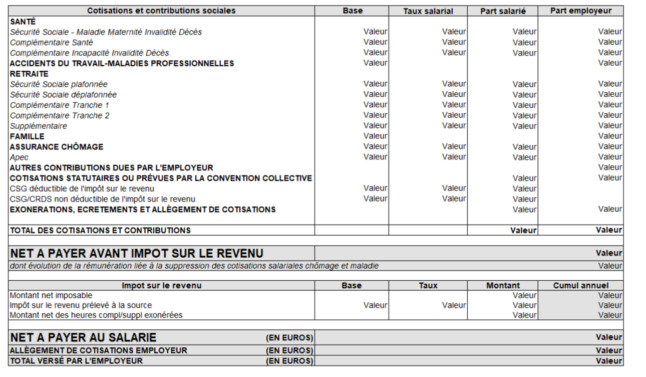

From January 1st, all French payslips must contain the following details in an easily identifiable section:

- The amount deducted from the payment through prélèvement à la source (PAYE, or deduction at source);

- The amount of overtime pay which is exempt from taxation;

- The amount of money you have earned which can still be taxed - or le montant du salaire net imposable

This last point is the most important because if you need to manually enter your earnings onto a tax return (which is the case for people declaring their earnings in France for the first time or filing their return in the post), this is the amount of taxable income you will have to declare.

The new payslips will look something like this:

When you file your tax return online, many of the fields are filled in automatically, but this new payslip makes it easier to check whether you have been taxed the right amount.

Bear in mind that it is not just work income that is taxed in France. If you own a second home that you rent out in France, you will also need to declare these earnings.

If you live in a French property that you own, you will probably also need to pay the taxe foncière and the taxe d'habitation but these are declared separately from the annual income tax declaration.

We have previously covered who needs to declare their income in France HERE.

READ MORE

- What exactly do I need to tell the French taxman about my assets at home

- The French tax calendar for 2022 – which taxes are due when?

- How to fill out each section of the French tax declaration

The online portal for declaring your 2021 income opens in April.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.