How to save money on your energy bills in France

Gas prices in France have increased by 44 percent since January 2020 and electricity is also set to become more expensive. Here are our tips for cutting down on costs as we head into the colder months.

Gas and electricity bills have been rising in France as prices increase.

According to a report from the French National Energy Poverty Observatory published earlier this year, 18 percent of households faced difficulties paying their energy bills in 2020, and rising prices linked to global markets are likely to make the situation even worse.

As temperatures begin to grow colder, here are a few ways you could reduce your energy bills.

Shop around

The CRE sets the regulated prices of electricity, which are regularly updated, and this is the price you'll pay if you go with EDF's "Tarif Bleu".

But since the energy market was opened up to competition in 2007, you may be able to save money by choosing a different type of contract, or by switching to another provider altogether. If you do choose a competitor, you can either pay a fixed price, which won't change over a period of between one and three years, or a price that is indexed to the regulated tariff, meaning it will evolve at the same rate.

READ ALSO France’s one-off €100 energy grant for low-income households

The same principle applies to gas: Engie's regulated prices are set by the CRE and can change every month, but you also have the option of taking out a subscription at a fixed or indexed market price, with Engie or any other provider.

It's important however to make sure you read the fine print when taking out a contract. As consumer group UFC-Que Choisir warns, if a company promises a 10 percent or more price reduction, this usually "concerns only the pre-tax kilowatt-hour (kWh) price. The subscription is charged at the same price as the regulated tariff."

UFC-Que Choisir's simulator allows you to compare prices between different energy providers to see whether you would be better off with the regulated tariff or following market prices.

Pay attention to the clock

Even if you choose to go with the regulated electricity prices, you could still save money by subscribing to the "off-peak option", which means paying less when you use appliances during eight set hours in the day, but paying more the rest of the time. Those hours could cover the whole night, or some of them may be placed in the middle of the day, depending on your town.

If you go with this option, there are a few things you can do to make sure it's worth your while. Large appliances like washing machines can be programmed to come on at night or during the day, and this is also the best time to charge your devices, as long as they stop charging once full. You can also check that your boiler is set to come on during off-peak hours.

You might be surprised by the results: according to EDF's "Blue tariff", the standard price is €15.58 to €16.05 per kWh, but you would pay €13.06 off peak and €18.21 during peak times if you use this calculation method.

If on the other hand you are working from home more often due to the pandemic, you could find that your peak-hour electricity use has shot up and you are better off switching to a regular contract.

Don't leave appliances on standby

Appliances like your TV, microwave and coffee machine use less electricity on standby than they once did, but turning these machines off completely could still shave 10 percent off your bill, before counting heating costs, according to the French Agency for ecological transition (Ademe).

Using a multi-socket adapter with a switch will make it easier to get into the habit of turning off several appliances at once. This includes your internet router: according to Ademe, a router that's on 24/7 can consume more than 200 kWh per year, as much as a washing machine.

READ ALSO France to bring in new environmental rules on log burners and open fires

Choose your appliances carefully

When it comes time to replace your washing machine, or invest in a new TV for example, you could make significant savings by picking the right model. More energy-efficient appliances might mean spending more money to begin with, but over the life cycle of the machines this could save you up to €3,000 in electricity, according to Ademe.

An energy-efficient fridge-freezer will consume 125 kWh per year, compared to 245 kWh for a less efficient machine. The savings are even more stark for tumble dryers - 170 kWh instead of 560 kWh.

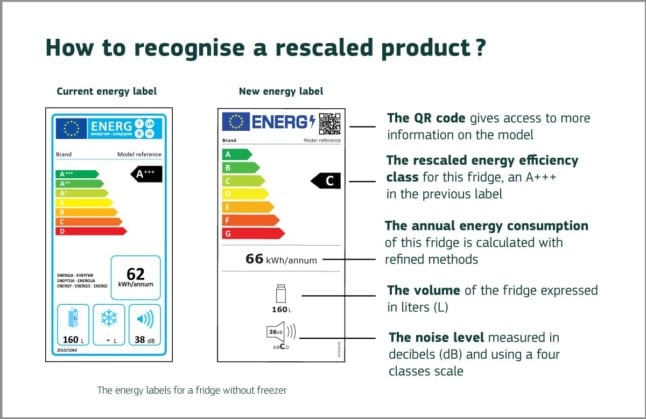

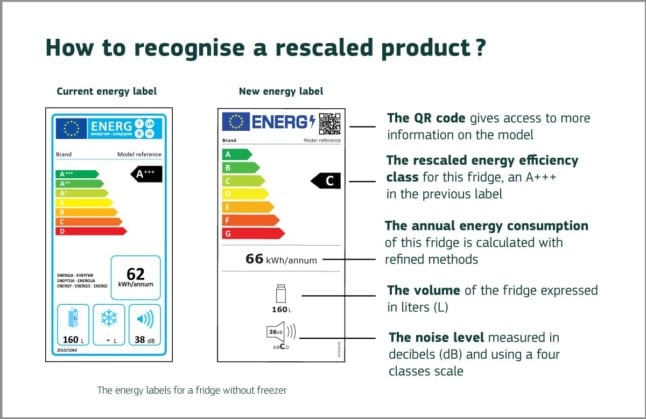

For most appliances, the energy rating goes from A to G, with A being the most efficient. New European rules introduced on March 1st got rid of the A+ to A+++ ratings for most types of appliance, meaning the A is much harder to achieve, and "most energy efficient products currently on the market will typically now be labelled as 'B', 'C' or 'D'."

"Every difference in category represents 15 to 20 percent energy savings," writes Ademe.

Image: European Commission

Cut down on heating

Opening the windows in the morning to ventilate the house, even in the winter, will make your home less humid, meaning it requires less energy to heat.

At night, if your windows have shutters as well as curtains, close them both to keep out the cold air, and when it gets really cold you may also want to close the shutters when you leave the house.

READ ALSO How to access France’s €20k property renovation grants

You can also invest in a programmable thermostat which can be set to come on at particular times in the day, and will automatically adjust to changes in temperature. The thermostat itself will cost €60 to €250, and you could receive a €150 grant to cover up to half of the installation costs. According to Ademe, the investment could save you up to 15 percent in heating costs.

Of course, there are plenty of other ways to save energy every day, including replacing your halogen lights with LED bulbs, using the "Eco" programme on your washing machine, and setting your water heater to between 55C and 60C.

Check whether you are eligible for help

Depending on your income levels, you may also be able to get help from the government towards your energy bills. Around 5.8 million households benefit from the chèques énergie (energy checks) scheme, an annual payment of between €48 and €277 which helps low-income households with their gas and electricity bills. You don't need to do anything - the check should be sent out automatically based on your annual tax declaration. You can find out whether you qualify here.

This year, in response to rising energy prices, the government announced it would send out an additional €100 to households which already qualify for the energy checks. This should also arrive automatically via the post some time in December.

Comments

See Also

Gas and electricity bills have been rising in France as prices increase.

According to a report from the French National Energy Poverty Observatory published earlier this year, 18 percent of households faced difficulties paying their energy bills in 2020, and rising prices linked to global markets are likely to make the situation even worse.

As temperatures begin to grow colder, here are a few ways you could reduce your energy bills.

Shop around

The CRE sets the regulated prices of electricity, which are regularly updated, and this is the price you'll pay if you go with EDF's "Tarif Bleu".

But since the energy market was opened up to competition in 2007, you may be able to save money by choosing a different type of contract, or by switching to another provider altogether. If you do choose a competitor, you can either pay a fixed price, which won't change over a period of between one and three years, or a price that is indexed to the regulated tariff, meaning it will evolve at the same rate.

READ ALSO France’s one-off €100 energy grant for low-income households

The same principle applies to gas: Engie's regulated prices are set by the CRE and can change every month, but you also have the option of taking out a subscription at a fixed or indexed market price, with Engie or any other provider.

It's important however to make sure you read the fine print when taking out a contract. As consumer group UFC-Que Choisir warns, if a company promises a 10 percent or more price reduction, this usually "concerns only the pre-tax kilowatt-hour (kWh) price. The subscription is charged at the same price as the regulated tariff."

UFC-Que Choisir's simulator allows you to compare prices between different energy providers to see whether you would be better off with the regulated tariff or following market prices.

Pay attention to the clock

Even if you choose to go with the regulated electricity prices, you could still save money by subscribing to the "off-peak option", which means paying less when you use appliances during eight set hours in the day, but paying more the rest of the time. Those hours could cover the whole night, or some of them may be placed in the middle of the day, depending on your town.

If you go with this option, there are a few things you can do to make sure it's worth your while. Large appliances like washing machines can be programmed to come on at night or during the day, and this is also the best time to charge your devices, as long as they stop charging once full. You can also check that your boiler is set to come on during off-peak hours.

You might be surprised by the results: according to EDF's "Blue tariff", the standard price is €15.58 to €16.05 per kWh, but you would pay €13.06 off peak and €18.21 during peak times if you use this calculation method.

If on the other hand you are working from home more often due to the pandemic, you could find that your peak-hour electricity use has shot up and you are better off switching to a regular contract.

Don't leave appliances on standby

Appliances like your TV, microwave and coffee machine use less electricity on standby than they once did, but turning these machines off completely could still shave 10 percent off your bill, before counting heating costs, according to the French Agency for ecological transition (Ademe).

Using a multi-socket adapter with a switch will make it easier to get into the habit of turning off several appliances at once. This includes your internet router: according to Ademe, a router that's on 24/7 can consume more than 200 kWh per year, as much as a washing machine.

READ ALSO France to bring in new environmental rules on log burners and open fires

Choose your appliances carefully

When it comes time to replace your washing machine, or invest in a new TV for example, you could make significant savings by picking the right model. More energy-efficient appliances might mean spending more money to begin with, but over the life cycle of the machines this could save you up to €3,000 in electricity, according to Ademe.

An energy-efficient fridge-freezer will consume 125 kWh per year, compared to 245 kWh for a less efficient machine. The savings are even more stark for tumble dryers - 170 kWh instead of 560 kWh.

For most appliances, the energy rating goes from A to G, with A being the most efficient. New European rules introduced on March 1st got rid of the A+ to A+++ ratings for most types of appliance, meaning the A is much harder to achieve, and "most energy efficient products currently on the market will typically now be labelled as 'B', 'C' or 'D'."

"Every difference in category represents 15 to 20 percent energy savings," writes Ademe.

Image: European Commission

Cut down on heating

Opening the windows in the morning to ventilate the house, even in the winter, will make your home less humid, meaning it requires less energy to heat.

At night, if your windows have shutters as well as curtains, close them both to keep out the cold air, and when it gets really cold you may also want to close the shutters when you leave the house.

READ ALSO How to access France’s €20k property renovation grants

You can also invest in a programmable thermostat which can be set to come on at particular times in the day, and will automatically adjust to changes in temperature. The thermostat itself will cost €60 to €250, and you could receive a €150 grant to cover up to half of the installation costs. According to Ademe, the investment could save you up to 15 percent in heating costs.

Of course, there are plenty of other ways to save energy every day, including replacing your halogen lights with LED bulbs, using the "Eco" programme on your washing machine, and setting your water heater to between 55C and 60C.

Check whether you are eligible for help

Depending on your income levels, you may also be able to get help from the government towards your energy bills. Around 5.8 million households benefit from the chèques énergie (energy checks) scheme, an annual payment of between €48 and €277 which helps low-income households with their gas and electricity bills. You don't need to do anything - the check should be sent out automatically based on your annual tax declaration. You can find out whether you qualify here.

This year, in response to rising energy prices, the government announced it would send out an additional €100 to households which already qualify for the energy checks. This should also arrive automatically via the post some time in December.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.