The French tax calendar for 2021 - which taxes are due when?

The French government has released the tax deadlines for 2021. These are the dates to keep in mind.

Last year, the government decided to push back the tax deadline dates because of the strict Covid-19 lockdown, but this year the normal timeframe remains in place.

People who live in France or own property here generally have to pay at least some tax as - in return for its robust welfare state - France is the most highly taxed country in Europe.

The big one is the annual déclaration des revenues, which this year opened on Thursday, April 8th.

Almost everyone who lives in France has to fill in the annual declaration and non-residents may have to if they have an income in France. Second-home owners usually won't have to do the annual declaration but they are liable for property taxes.

Find out HERE who has to make the declaration, how to do it and some handy vocab to use.

EXPLAINED: Who has to make a tax declaration in France in 2021?

These are the key dates to keep in mind.

May 20th – closing date for the annual tax declarations done on paper. The French government asks everyone who can to declare their taxes online. However first time tax payers and people living in areas with poor internet access may use the paper version of the tax forms.

READ ALSO: How to file your 2021 French tax declaration

May 26th – closing date for online tax declarations for inhabitants of départements 1 to 19, as well as people who live outside France

June 1st – closing date for online tax declarations for inhabitants of départements 20 to 54

June 8th – closing date for online tax declarations for inhabitants of départements 55 to 976

Over the summer you will then receive by mail or email (depending on how you filed the return) a bill telling you how much tax you owe. This bill could be €0 or the government could even give you money.

READ ALSO What the French government doesn't tell you about filing taxes

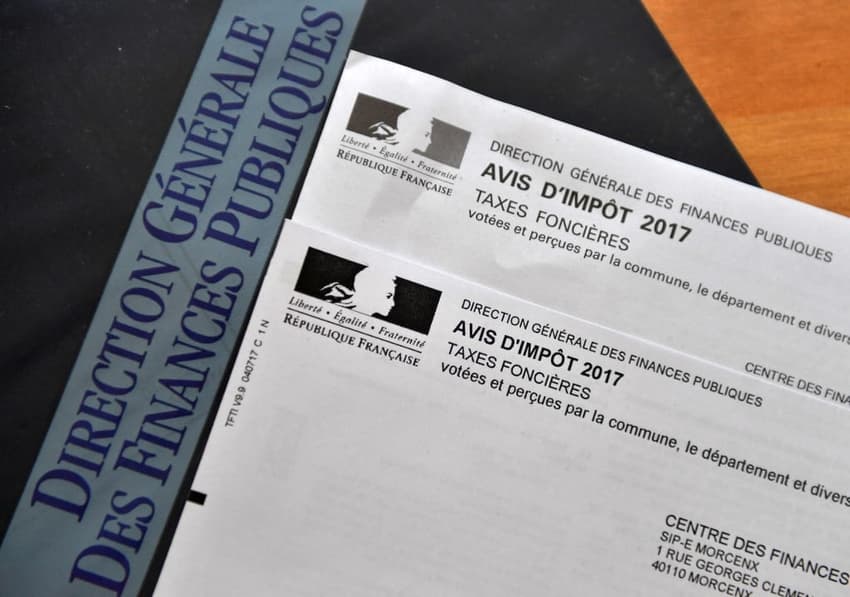

As well as the annual declaration, people who own property in France also pay property taxes, and unfortunately these are still due even for people who have been unable to visit their French properties due to Covid-related travel restrictions.

October 15th – deadline to pay taxe foncière by mail

October 20th – deadline to pay taxe foncière online

October 31st – deadline to register to pay taxe d'habitation and redevance audiovisuelle (the French TV licence) by monthly instalments

November 15th – deadline to pay taxe d'habitation by mail

November 20th – deadline to pay taxe d'habitation online

Mid December – the deadline to correct errors in your online tax declaration. If you have forgotten to add something or made a mistake in your calculations in your declaration you can go online and correct it without attracting a penalty.

So what are all these taxes?

Taxe d'habitation – the housing tax paid by those living in a property, not the owner, is in the process of being phased out and most people won't have to pay it this year. However second home owners are excluded from the phasing out and still have to pay it, bar a few exceptions.

READ ALSO: Can second-home owners in France claim tax rebates for 2020?

Taxe foncière – this is the tax for property owners, second home owners pay both this and the taxe d'habitation. The tax on property owners has risen in many areas over the past couple of years.

READ ALSO What is taxe foncière and do I have to pay it?

Redevance audiovisuelle – this is the French equivalent of a TV licence and is paid by almost everyone. You pay it if you have a TV in your property, even if you don't watch French TV.

Avis d'impôt/déclaration des revenues – this is your yearly tax return and is the cause of quite a lot of confusion among foreign residents but in fact the rule is simple – if your main residence is in France you must fill in a tax return.

Many people assume that if their income all comes from another country then they don't need to file a tax return but this is not the case. France has double taxation agreements with most countries, so if you have already paid tax on – for example – income from a rental property in the UK you will not be liable for more tax in France on the same income, but you must still tell the French taxman about it.

READ ALSO What exactly do I need to tell the French taxman about?

All income must be declared, as well as all bank accounts in other countries even if they are dormant.

Comments

See Also

Last year, the government decided to push back the tax deadline dates because of the strict Covid-19 lockdown, but this year the normal timeframe remains in place.

People who live in France or own property here generally have to pay at least some tax as - in return for its robust welfare state - France is the most highly taxed country in Europe.

The big one is the annual déclaration des revenues, which this year opened on Thursday, April 8th.

Almost everyone who lives in France has to fill in the annual declaration and non-residents may have to if they have an income in France. Second-home owners usually won't have to do the annual declaration but they are liable for property taxes.

Find out HERE who has to make the declaration, how to do it and some handy vocab to use.

EXPLAINED: Who has to make a tax declaration in France in 2021?

These are the key dates to keep in mind.

May 20th – closing date for the annual tax declarations done on paper. The French government asks everyone who can to declare their taxes online. However first time tax payers and people living in areas with poor internet access may use the paper version of the tax forms.

READ ALSO: How to file your 2021 French tax declaration

May 26th – closing date for online tax declarations for inhabitants of départements 1 to 19, as well as people who live outside France

June 1st – closing date for online tax declarations for inhabitants of départements 20 to 54

June 8th – closing date for online tax declarations for inhabitants of départements 55 to 976

Over the summer you will then receive by mail or email (depending on how you filed the return) a bill telling you how much tax you owe. This bill could be €0 or the government could even give you money.

READ ALSO What the French government doesn't tell you about filing taxes

As well as the annual declaration, people who own property in France also pay property taxes, and unfortunately these are still due even for people who have been unable to visit their French properties due to Covid-related travel restrictions.

October 15th – deadline to pay taxe foncière by mail

October 20th – deadline to pay taxe foncière online

October 31st – deadline to register to pay taxe d'habitation and redevance audiovisuelle (the French TV licence) by monthly instalments

November 15th – deadline to pay taxe d'habitation by mail

November 20th – deadline to pay taxe d'habitation online

Mid December – the deadline to correct errors in your online tax declaration. If you have forgotten to add something or made a mistake in your calculations in your declaration you can go online and correct it without attracting a penalty.

So what are all these taxes?

Taxe d'habitation – the housing tax paid by those living in a property, not the owner, is in the process of being phased out and most people won't have to pay it this year. However second home owners are excluded from the phasing out and still have to pay it, bar a few exceptions.

READ ALSO: Can second-home owners in France claim tax rebates for 2020?

Taxe foncière – this is the tax for property owners, second home owners pay both this and the taxe d'habitation. The tax on property owners has risen in many areas over the past couple of years.

READ ALSO What is taxe foncière and do I have to pay it?

Redevance audiovisuelle – this is the French equivalent of a TV licence and is paid by almost everyone. You pay it if you have a TV in your property, even if you don't watch French TV.

Avis d'impôt/déclaration des revenues – this is your yearly tax return and is the cause of quite a lot of confusion among foreign residents but in fact the rule is simple – if your main residence is in France you must fill in a tax return.

Many people assume that if their income all comes from another country then they don't need to file a tax return but this is not the case. France has double taxation agreements with most countries, so if you have already paid tax on – for example – income from a rental property in the UK you will not be liable for more tax in France on the same income, but you must still tell the French taxman about it.

READ ALSO What exactly do I need to tell the French taxman about?

All income must be declared, as well as all bank accounts in other countries even if they are dormant.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.