France still vice-champion of the world when it comes to high taxes

Only one developed country in the world taxes its population more than France, new figures have revealed.

Ask anyone to list words they associate with France and "taxes" is sure to be one of them.

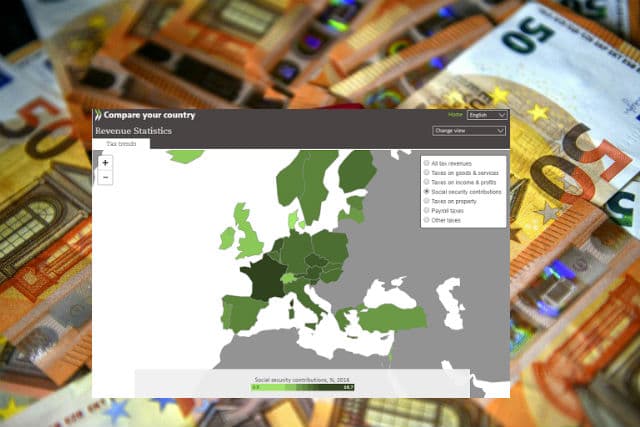

A new survey from the OECD economic think tank reveals why.

Of all the developed countries in the world only Denmark pulls in more in taxes than France.

When income taxes, social security contributions, taxes on property, goods and services are all added together they account for 45.3 percent of France's overall earnings. That's a slight rise of 0.1 percent on 2015, but still below the peak of 45.5 percent reached in 2014.

In podium-topping Denmark, all taxes combined were worth 45.9 percent of the country's wealth. Although the one big difference is Denmark has a budget deficit of 0.6 percent in 2016 while in France it was 3.4 percent.

In third place came Belgium where the tax to GDP ratio was 44.2 percent in 2016.

In the US it was far lower with 26 percent of the country's GDP coming from direct taxes and in the UK it was 33.2 percent.

The OECD average stands at 34.3 percent.

The French do of course get something in return for all these taxes they pay, notably a generous pensions system, a healthcare system that was judge the best in the world (albeit a few years ago now) and generous unemployment and family benefits.

In terms of the breakdown in France, one of the differences to other OECD countries is that income tax plays a much more minor role in revenues (10.6 percent) while social security contributions make up 16.7 percent.

In Denmark for example social contributions make up just 0.1 percent of GDP while income taxes represent 28.7 percent.

In general the tax burden has risen throughout OECD countries but markedly in France with the tax to GDP ratio back in 1965 standing at "just" 33.6 percent.

The French regularly protest against the tax burden and in recent years governments have pledged cuts in a bid to quell voters' concerns.

In July this year the French government announced it will cut taxes on businesses and individuals by roughly €11 billion ($12.6 billion) next year, faster than the it had originally intended.

Key measures will include eliminating a local residence tax - the taxe d'habitation, for 80 percent of French households and reductions in wealth taxes, while corporate taxes will eventually be dropped to 25 percent by 2022.

Nevertheless taxes will rise in other areas, notably via "ecological" levies on diesel and petrol.

So tax payers in France can look forward to retaining the silver medal in the global tax table in 2017, with the finance ministry expecting the GDP to tax ratio to hit 43.6 percent.

Comments

See Also

Ask anyone to list words they associate with France and "taxes" is sure to be one of them.

A new survey from the OECD economic think tank reveals why.

Of all the developed countries in the world only Denmark pulls in more in taxes than France.

When income taxes, social security contributions, taxes on property, goods and services are all added together they account for 45.3 percent of France's overall earnings. That's a slight rise of 0.1 percent on 2015, but still below the peak of 45.5 percent reached in 2014.

In podium-topping Denmark, all taxes combined were worth 45.9 percent of the country's wealth. Although the one big difference is Denmark has a budget deficit of 0.6 percent in 2016 while in France it was 3.4 percent.

In third place came Belgium where the tax to GDP ratio was 44.2 percent in 2016.

In the US it was far lower with 26 percent of the country's GDP coming from direct taxes and in the UK it was 33.2 percent.

The OECD average stands at 34.3 percent.

The French do of course get something in return for all these taxes they pay, notably a generous pensions system, a healthcare system that was judge the best in the world (albeit a few years ago now) and generous unemployment and family benefits.

In terms of the breakdown in France, one of the differences to other OECD countries is that income tax plays a much more minor role in revenues (10.6 percent) while social security contributions make up 16.7 percent.

In Denmark for example social contributions make up just 0.1 percent of GDP while income taxes represent 28.7 percent.

In general the tax burden has risen throughout OECD countries but markedly in France with the tax to GDP ratio back in 1965 standing at "just" 33.6 percent.

The French regularly protest against the tax burden and in recent years governments have pledged cuts in a bid to quell voters' concerns.

In July this year the French government announced it will cut taxes on businesses and individuals by roughly €11 billion ($12.6 billion) next year, faster than the it had originally intended.

Key measures will include eliminating a local residence tax - the taxe d'habitation, for 80 percent of French households and reductions in wealth taxes, while corporate taxes will eventually be dropped to 25 percent by 2022.

Nevertheless taxes will rise in other areas, notably via "ecological" levies on diesel and petrol.

So tax payers in France can look forward to retaining the silver medal in the global tax table in 2017, with the finance ministry expecting the GDP to tax ratio to hit 43.6 percent.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.