French tax declaration season opens: Here's how it works

It's time to make that annual declaration of earnings to the French taxman. Here's some important information to remember.

Tax season is here - but don't worry, French authorities are making it easier to declare your taxes.

For now, most taxpayers can choose between filling out a traditional paper declaration or doing it online. And even though we all have to declare our income, it doesn't mean we will all have to pay taxes; in fact, a record low number of people in France will be paying income tax this year.

The declaration deadline by paper forms is May 18th. BUT if you earn more than €40,000 and have an internet connection you can no longer put pen to paper and will have to declare your taxes online. If not you'll pay a fine as well as your taxes.

Declaring online

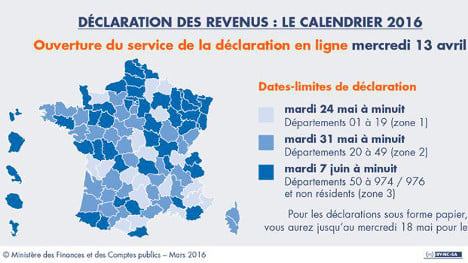

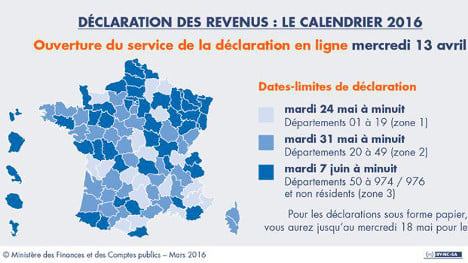

The online declaration portals open on Wednesday, April 13th across France for those who have to pay income tax.

The official site is accessible here. The website allows you to calculate exactly how much you'll have to pay (or how much you'll get back) immediately, rather than having to wait for months to find out.

If you're going to leave it to the last minute, the internet declaration deadlines, which depend on which region of France you are in, are as follows (with map below):

France's 101 départements have been divided into three groups, to ease congestion and the risk of crashes on the official government website - which tends to happen when deadline day approaches.

Départements 0-19 - May 24th

Départements 20-49 - May 31st

Départements 50 plus - June 7th

This year marks the first time online declarations will be mandatory (but only for those earning over €40,000 for the year). There will be a €15 penalty in place for who doesn't declare online for two years running (effectively meaning there is a one-year grace period as people adjust to the new system).

Online declarations will be rolled out as mandatory for everyone earning above €28,000 from next year, and for those earning over €16,000 in 2019. Only those tax payers without an internet connection will be exempt.

A full 40 percent of tax payers used the online option last year.

How much tax will you pay?

Those earning less than €9,700 a year won't be taxed after the government ditched the lowest 5.5 percent tax bracket in 2014.

For revenues between €9,700 and €26,791 the tax rate is 14 percent, while for earnings between €26,791 and €71,826 it is 30 percent.

Anyone (lucky enough to be) earning between €71,826 and €152,108 will be taxed 41 percent on the earnings in that bracket and anyone earning more than €152,108 will pay 45 percent on that revenue.

Important things to remember

This year, as usual, taxpayers have been warned to declare all their bank accounts that are held in foreign countries. This can be done on a separate piece of paper.

So if you have bank accounts and/or ISAs back in the UK, for example you are expected to include evidence of the interest you earned on these accounts, but thanks to an agreement between France and the UK, you won't have to pay taxes on the interest if you already have in the UK.

Foreign bank accounts and income

The same goes for pensions and rental income from properties you have in the UK. The French taxman wants to know your worldwide income.

"There are some people who will think that if their income is taxed in the UK, then they don’t have to declare it here in France, but it’s not true, you have to tell them about your world-wide income,” Siddalls regional manager David Hardy tells The Local.

But this year, with all the scandal over the Panama Papers, it's probably not wise to hide any foreign bank accounts from the French taxman.

Also, taxpayers have been reminded that they don't need to send in proof for costs such as charitable donations or money spent on house cleaners, which can result in a reduction in taxes, but that all evidence of payments must be kept for a minimum of three years in case the taxman decides to inspect you.

This year marks the first time online declarations will be mandatory (but only for those earning over €40,000 for the year). There will be a €15 penalty in place for who doesn't declare online for two years running (effectively meaning there is a one-year grace period as people adjust to the new system).

Online declarations will be rolled out as mandatory for everyone earning above €28,000 from next year, and for those earning over €16,000 in 2019. Only those tax payers without an internet connection will be exempt.

A full 40 percent of tax payers used the online option last year.

How much tax will you pay?

Those earning less than €9,700 a year won't be taxed after the government ditched the lowest 5.5 percent tax bracket in 2014.

For revenues between €9,700 and €26,791 the tax rate is 14 percent, while for earnings between €26,791 and €71,826 it is 30 percent.

Anyone (lucky enough to be) earning between €71,826 and €152,108 will be taxed 41 percent on the earnings in that bracket and anyone earning more than €152,108 will pay 45 percent on that revenue.

Important things to remember

This year, as usual, taxpayers have been warned to declare all their bank accounts that are held in foreign countries. This can be done on a separate piece of paper.

So if you have bank accounts and/or ISAs back in the UK, for example you are expected to include evidence of the interest you earned on these accounts, but thanks to an agreement between France and the UK, you won't have to pay taxes on the interest if you already have in the UK.

Foreign bank accounts and income

The same goes for pensions and rental income from properties you have in the UK. The French taxman wants to know your worldwide income.

"There are some people who will think that if their income is taxed in the UK, then they don’t have to declare it here in France, but it’s not true, you have to tell them about your world-wide income,” Siddalls regional manager David Hardy tells The Local.

But this year, with all the scandal over the Panama Papers, it's probably not wise to hide any foreign bank accounts from the French taxman.

Also, taxpayers have been reminded that they don't need to send in proof for costs such as charitable donations or money spent on house cleaners, which can result in a reduction in taxes, but that all evidence of payments must be kept for a minimum of three years in case the taxman decides to inspect you.

Remember it's household income:

Whereas in the UK you pay tax as an individual, in France you are taxed by household. So if you are a married couple or if you are “pacsed” (in a civil partnership) then you should make one joint declaration rather than two. If you got married half way through the year you can now declare one common declaration (instead of three, which was previously the case) for the whole year.

And if you have any children living with you that are earning then you’ll need to declare their earnings too.

Things will change

There will be more changes (and hopefully fewer headaches) when it comes to paying taxes in the future, with income taxes to be deducted at source from January 1st 2018.

That means workers will see the taxes deducted straight out of their wages at the end of each month in real time, similar to the Pay As You Earn system in the UK.

Comments

See Also

Tax season is here - but don't worry, French authorities are making it easier to declare your taxes.

For now, most taxpayers can choose between filling out a traditional paper declaration or doing it online. And even though we all have to declare our income, it doesn't mean we will all have to pay taxes; in fact, a record low number of people in France will be paying income tax this year.

The declaration deadline by paper forms is May 18th. BUT if you earn more than €40,000 and have an internet connection you can no longer put pen to paper and will have to declare your taxes online. If not you'll pay a fine as well as your taxes.

Declaring online

The online declaration portals open on Wednesday, April 13th across France for those who have to pay income tax.

The official site is accessible here. The website allows you to calculate exactly how much you'll have to pay (or how much you'll get back) immediately, rather than having to wait for months to find out.

If you're going to leave it to the last minute, the internet declaration deadlines, which depend on which region of France you are in, are as follows (with map below):

France's 101 départements have been divided into three groups, to ease congestion and the risk of crashes on the official government website - which tends to happen when deadline day approaches.

Départements 0-19 - May 24th

Départements 20-49 - May 31st

Départements 50 plus - June 7th

This year marks the first time online declarations will be mandatory (but only for those earning over €40,000 for the year). There will be a €15 penalty in place for who doesn't declare online for two years running (effectively meaning there is a one-year grace period as people adjust to the new system).

Online declarations will be rolled out as mandatory for everyone earning above €28,000 from next year, and for those earning over €16,000 in 2019. Only those tax payers without an internet connection will be exempt.

A full 40 percent of tax payers used the online option last year.

How much tax will you pay?

Those earning less than €9,700 a year won't be taxed after the government ditched the lowest 5.5 percent tax bracket in 2014.

For revenues between €9,700 and €26,791 the tax rate is 14 percent, while for earnings between €26,791 and €71,826 it is 30 percent.

Anyone (lucky enough to be) earning between €71,826 and €152,108 will be taxed 41 percent on the earnings in that bracket and anyone earning more than €152,108 will pay 45 percent on that revenue.

Important things to remember

This year, as usual, taxpayers have been warned to declare all their bank accounts that are held in foreign countries. This can be done on a separate piece of paper.

So if you have bank accounts and/or ISAs back in the UK, for example you are expected to include evidence of the interest you earned on these accounts, but thanks to an agreement between France and the UK, you won't have to pay taxes on the interest if you already have in the UK.

Foreign bank accounts and income

The same goes for pensions and rental income from properties you have in the UK. The French taxman wants to know your worldwide income.

"There are some people who will think that if their income is taxed in the UK, then they don’t have to declare it here in France, but it’s not true, you have to tell them about your world-wide income,” Siddalls regional manager David Hardy tells The Local.

But this year, with all the scandal over the Panama Papers, it's probably not wise to hide any foreign bank accounts from the French taxman.

Also, taxpayers have been reminded that they don't need to send in proof for costs such as charitable donations or money spent on house cleaners, which can result in a reduction in taxes, but that all evidence of payments must be kept for a minimum of three years in case the taxman decides to inspect you.

Remember it's household income:

Whereas in the UK you pay tax as an individual, in France you are taxed by household. So if you are a married couple or if you are “pacsed” (in a civil partnership) then you should make one joint declaration rather than two. If you got married half way through the year you can now declare one common declaration (instead of three, which was previously the case) for the whole year.

And if you have any children living with you that are earning then you’ll need to declare their earnings too.

Things will change

There will be more changes (and hopefully fewer headaches) when it comes to paying taxes in the future, with income taxes to be deducted at source from January 1st 2018.

That means workers will see the taxes deducted straight out of their wages at the end of each month in real time, similar to the Pay As You Earn system in the UK.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.