Airbnb users in France to pay extra tax

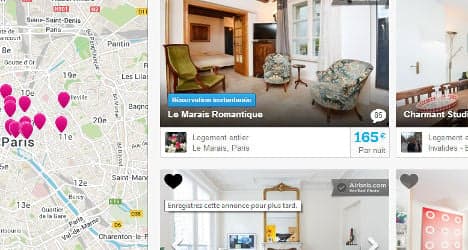

Holiday rental websites in France, such as the popular Airbnb, will soon have to collect a visitors tax – taxe de séjour – from users under new rules set to be passed this week.

Looking to move? Find your next rental apartment here.

Holiday rental websites in France, such as the popular Airbnb, will soon have to collect a lodgings tax – taxe de séjour – from users under new rules set to be passed this week.

Lawmakers will vote in new maximum levels for the taxe de sejour this week and the French government also plans to implement a new set of rules that would require websites to collect the tax from users.

Current rules state that anyone renting out accommodation for short-term stays should impose the taxe de sejour on their guests but the government, as well as the country's leading hotel chains, complain that newer and more informal sites like Airbnb, on which members of the public rent out their own bedrooms or apartments on a short-term basis - are not doing this.

At present the tax varies from 20 centimes to €1.50 per day, depending on the level of luxury. But it will rise to up to €4 for the most prestigious hotels, while Airbnb will come under “unclassified accommodation,” which will have its ceiling raised from 40 centimes to 75.

The move comes after the government had been expected to scrap the planned hike in the taxe de sejour, which had provoked the wrath of the tourism industry and hotels.

Even Prime Minister Manuel Valls said that the proposed tax increase was "much too high".

Tourism chiefs claimed the increase would amount to a blow to the tourist industry in France - the most visited country in the world, with 83 million tourists a year. The tourism sector accounts for seven percent of the country’s GDP, with annual spending by foreign tourists amounting to €36 billion.

It may not be the last time that authorities in France target Airbnb in a bid to bring it into line with more regulated traditional tourist lodgings.

A July report into tourist accommodation in France raised doubts about the legality of Airbnb, after one Frenchman was fined €2,000 for illegally subletting his apartment on the site.

French MPs raised concerns about the popular site in a new report that suggests lawmakers will soon take the US-based company to task.

“It remains difficult to precisely estimate the activity (of websites such as Airbnb) because they are not domiciled in France and not listed on the Paris stock exchange,” the report by MPs Eric Woerth and Monique Rabin said.

“They are also not subject to the annual requirement to disclose their accounts. It seems that their figures remain secret,” said Woerth.

Comments

See Also

Holiday rental websites in France, such as the popular Airbnb, will soon have to collect a lodgings tax – taxe de séjour – from users under new rules set to be passed this week.

Lawmakers will vote in new maximum levels for the taxe de sejour this week and the French government also plans to implement a new set of rules that would require websites to collect the tax from users.

Current rules state that anyone renting out accommodation for short-term stays should impose the taxe de sejour on their guests but the government, as well as the country's leading hotel chains, complain that newer and more informal sites like Airbnb, on which members of the public rent out their own bedrooms or apartments on a short-term basis - are not doing this.

At present the tax varies from 20 centimes to €1.50 per day, depending on the level of luxury. But it will rise to up to €4 for the most prestigious hotels, while Airbnb will come under “unclassified accommodation,” which will have its ceiling raised from 40 centimes to 75.

The move comes after the government had been expected to scrap the planned hike in the taxe de sejour, which had provoked the wrath of the tourism industry and hotels.

Even Prime Minister Manuel Valls said that the proposed tax increase was "much too high".

Tourism chiefs claimed the increase would amount to a blow to the tourist industry in France - the most visited country in the world, with 83 million tourists a year. The tourism sector accounts for seven percent of the country’s GDP, with annual spending by foreign tourists amounting to €36 billion.

It may not be the last time that authorities in France target Airbnb in a bid to bring it into line with more regulated traditional tourist lodgings.

A July report into tourist accommodation in France raised doubts about the legality of Airbnb, after one Frenchman was fined €2,000 for illegally subletting his apartment on the site.

French MPs raised concerns about the popular site in a new report that suggests lawmakers will soon take the US-based company to task.

“It remains difficult to precisely estimate the activity (of websites such as Airbnb) because they are not domiciled in France and not listed on the Paris stock exchange,” the report by MPs Eric Woerth and Monique Rabin said.

“They are also not subject to the annual requirement to disclose their accounts. It seems that their figures remain secret,” said Woerth.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.