Why now is the time to buy a house in France

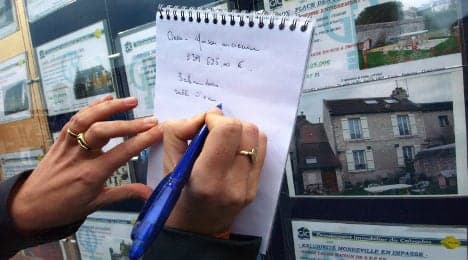

Buying a house in rural France is still the dream for many Anglos, particularly those from Britain and with prices having fallen and exchange rates improved, it seems now is a good time to buy once again. And there's some eye-catching deals out there.

It seem Brits who have been putting off their dream of buying a quaint little cottage in rural France can wait no more.

With a fall in house prices and a property market that looks as accommodating as it has been for a few years, estate agents say there are plenty of bargains out there and international buyers are starting to snap them up again.

“It obviously depends where but you can pick up some extremely good deals on properties in France," Mary Hawkins from Leggett Immobiliere told The Local. "There’s houses going for 400,000 in rural France that would probably cost around 1 million in the UK."

"And there's still a lot of properties for renovation out there that can be snapped up for as little as €50,000.

“Rural France is still a big pull, it’s still their dream and it’s easy to get to from the UK. But it’s not just Brits starting to buy properties again. There’s a lot of international buyers from places like Australia.”

Down in the Dordogne in the south of France, an area that has long been popular for British expats and holiday makers alike, things are also picking up.

10 things you need to think about when buying a house in France

“I think they have just got fed up waiting over the last couple of years and now the exchange rate is a bit better they are starting to but again,” said Cate Carnduff from Hermann de Graff estate agents told The Local.

“People are coming back to the Dordogne with prices having gone down. There are some good deals out there, because there’s a big backlog of property. Those people who really want to sell have got to make their prices really attractive,” said Carnduff.

Although she warned that some expats who bought properties in parts of central France had run into trouble due to the slump in the market.

“Some people bought cheap properties and put a lot of money into them, but there’s no market to resell them,” she said.

The French property market is not proving enticing once again just for international buyers. In France the current lay of the land means it’s seen as an opportune moment to buy a property.

A recent front page headline in the Parisien newspaper simply said: “Now is the moment to buy”.

In the article French mortgage brokers Empruntis gave a clear message: Anyone hoping to buy should not wait.

The reason why potential buyers should not wait is the current low interest rates making it a good time to ask a French bank to stump up some money. But Empruntis’s Maël Bernier says that things will not remain like that throughout the whole of 2014.

Any gains made by a drop in house prices will soon be lost when interest rates rise, Bernier says. For example a 0.5 percent rise in interest rates will cancel out a 4 percent drop in house prices.

So whether you are in France already or you are watching on from abroad, waiting for an opportunity to settle in in "La Belle France", now appears to be as good a time as any to buy.

Comments

See Also

It seem Brits who have been putting off their dream of buying a quaint little cottage in rural France can wait no more.

With a fall in house prices and a property market that looks as accommodating as it has been for a few years, estate agents say there are plenty of bargains out there and international buyers are starting to snap them up again.

“It obviously depends where but you can pick up some extremely good deals on properties in France," Mary Hawkins from Leggett Immobiliere told The Local. "There’s houses going for 400,000 in rural France that would probably cost around 1 million in the UK."

"And there's still a lot of properties for renovation out there that can be snapped up for as little as €50,000.

“Rural France is still a big pull, it’s still their dream and it’s easy to get to from the UK. But it’s not just Brits starting to buy properties again. There’s a lot of international buyers from places like Australia.”

Down in the Dordogne in the south of France, an area that has long been popular for British expats and holiday makers alike, things are also picking up.

10 things you need to think about when buying a house in France

“I think they have just got fed up waiting over the last couple of years and now the exchange rate is a bit better they are starting to but again,” said Cate Carnduff from Hermann de Graff estate agents told The Local.

“People are coming back to the Dordogne with prices having gone down. There are some good deals out there, because there’s a big backlog of property. Those people who really want to sell have got to make their prices really attractive,” said Carnduff.

Although she warned that some expats who bought properties in parts of central France had run into trouble due to the slump in the market.

“Some people bought cheap properties and put a lot of money into them, but there’s no market to resell them,” she said.

The French property market is not proving enticing once again just for international buyers. In France the current lay of the land means it’s seen as an opportune moment to buy a property.

A recent front page headline in the Parisien newspaper simply said: “Now is the moment to buy”.

In the article French mortgage brokers Empruntis gave a clear message: Anyone hoping to buy should not wait.

The reason why potential buyers should not wait is the current low interest rates making it a good time to ask a French bank to stump up some money. But Empruntis’s Maël Bernier says that things will not remain like that throughout the whole of 2014.

Any gains made by a drop in house prices will soon be lost when interest rates rise, Bernier says. For example a 0.5 percent rise in interest rates will cancel out a 4 percent drop in house prices.

So whether you are in France already or you are watching on from abroad, waiting for an opportunity to settle in in "La Belle France", now appears to be as good a time as any to buy.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.