French celebrate freedom from hungry tax man

French workers can now celebrate being free from the burden of the tax man because for the rest of the year, they won’t pay another cent in taxes, an economic study claims. The Belgians however still have a bit of work to do.

The carefully calculated study published by Brussels-based liberal think tank, the Molinari Economic Institute, this week revealed that Tuesday was the “day of fiscal liberation” meaning effectively any money they earn from now is theirs.

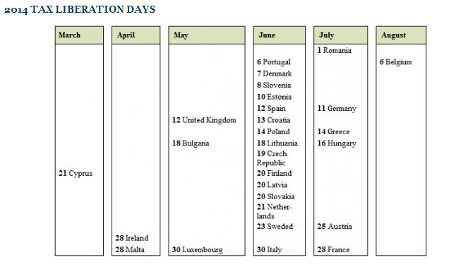

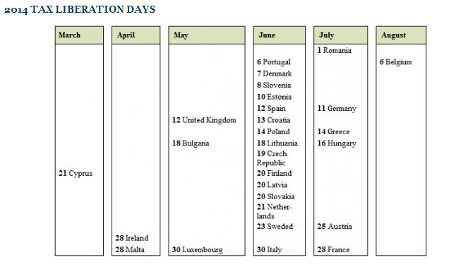

The annual study carried out for the whole of Europe calculates how much tax, social charges and VAT a person must pay to the state compared to what they earn on average. It then works out the equivalent of how many days a year it will take them to pay it.

For French workers the tax liberation day came on Tuesday July 28th – two days later than last year - and long after the British workers became “tax-free” on May 12th.

German workers were able to relax earlier this month (July 11th) knowing their taxes had been paid and in Sweden, which is famous for its high taxes, locals could start saving on June 23rd.

Only the Belgians are still working to satisfy the tax man’s needs. August 6th marks the day when they will finally be free of him.

In 2014, the average worker’s real tax rate reached 45.27% in the EU, but in France it stood at 57.17 percent.

According to the study a French worker must earn €233 to be able to have €100 at his disposal. The institute did acknowledge that "on paper" the French were among the highest paid in Europe, earning on average €55. 314.

The Molinari Institute, which is a liberal economic think-tank "inspired by the teachings of Milton Friedman" as one French news site described it, is highly critical of France’s taxation policies and claims various studies show that French tax payers are not getting value for money.

“France’s situation is very worrying,” says the Institute’s Cecile Philippe, who co-authored the study. “Despite calls for a tax freeze, the tax pressure has been constantly growing. In 2014, the tax burden on the average French worker has increased significantly, in contrast to what happened in Italy, the Netherlands, Belgium, Germany and the United Kingdom.

“And despite a tax grab the like of which we had not seen since 2010, public accounts still record a deficit and government debt is sky-rocketing. Once virtuous France has joined the club of Europe’s most indebted countries,” Philippe says.

In recent months however the French government has pledged to cut taxes for millions of lower income households across the country.

France’s finance minister Michel Sapin said the planned cuts would not just be “a one-off measure”.

“There is a sense of injustice among French people who have had to pay more tax while their incomes have not risen,” Sapin added.

Doubts have been raised in France however about the Institute’s method of calculating the tax freedom days.

Left wing French daily Liberation points to the fact that France’s highest rate of VAT is applied even though it varies across sectors. Certain labour taxes, that are actually paid by employers, were added onto employee’s tax calculations.

To read the study in full CLICK HERE.

Comments

See Also

The carefully calculated study published by Brussels-based liberal think tank, the Molinari Economic Institute, this week revealed that Tuesday was the “day of fiscal liberation” meaning effectively any money they earn from now is theirs.

The annual study carried out for the whole of Europe calculates how much tax, social charges and VAT a person must pay to the state compared to what they earn on average. It then works out the equivalent of how many days a year it will take them to pay it.

For French workers the tax liberation day came on Tuesday July 28th – two days later than last year - and long after the British workers became “tax-free” on May 12th.

German workers were able to relax earlier this month (July 11th) knowing their taxes had been paid and in Sweden, which is famous for its high taxes, locals could start saving on June 23rd.

Only the Belgians are still working to satisfy the tax man’s needs. August 6th marks the day when they will finally be free of him.

In 2014, the average worker’s real tax rate reached 45.27% in the EU, but in France it stood at 57.17 percent.

According to the study a French worker must earn €233 to be able to have €100 at his disposal. The institute did acknowledge that "on paper" the French were among the highest paid in Europe, earning on average €55. 314.

The Molinari Institute, which is a liberal economic think-tank "inspired by the teachings of Milton Friedman" as one French news site described it, is highly critical of France’s taxation policies and claims various studies show that French tax payers are not getting value for money.

“France’s situation is very worrying,” says the Institute’s Cecile Philippe, who co-authored the study. “Despite calls for a tax freeze, the tax pressure has been constantly growing. In 2014, the tax burden on the average French worker has increased significantly, in contrast to what happened in Italy, the Netherlands, Belgium, Germany and the United Kingdom.

“And despite a tax grab the like of which we had not seen since 2010, public accounts still record a deficit and government debt is sky-rocketing. Once virtuous France has joined the club of Europe’s most indebted countries,” Philippe says.

In recent months however the French government has pledged to cut taxes for millions of lower income households across the country.

France’s finance minister Michel Sapin said the planned cuts would not just be “a one-off measure”.

“There is a sense of injustice among French people who have had to pay more tax while their incomes have not risen,” Sapin added.

Doubts have been raised in France however about the Institute’s method of calculating the tax freedom days.

Left wing French daily Liberation points to the fact that France’s highest rate of VAT is applied even though it varies across sectors. Certain labour taxes, that are actually paid by employers, were added onto employee’s tax calculations.

To read the study in full CLICK HERE.

Join the conversation in our comments section below. Share your own views and experience and if you have a question or suggestion for our journalists then email us at [email protected].

Please keep comments civil, constructive and on topic – and make sure to read our terms of use before getting involved.

Please log in here to leave a comment.